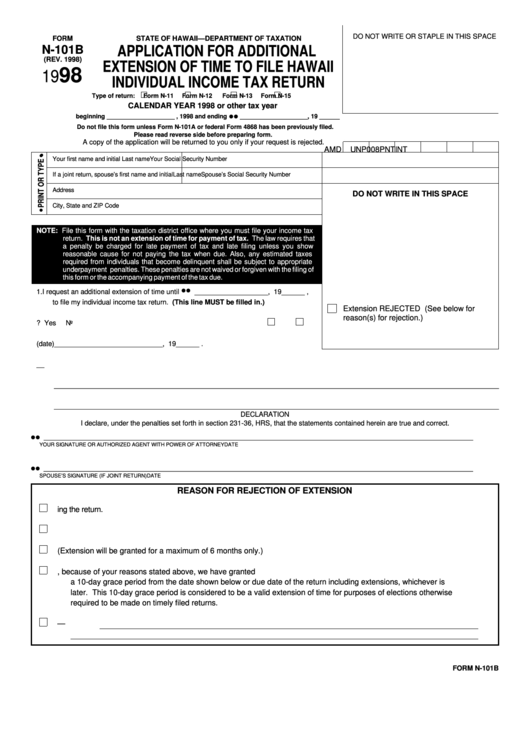

DO NOT WRITE OR STAPLE IN THIS SPACE

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

N-101B

APPLICATION FOR ADDITIONAL

(REV. 1998)

EXTENSION OF TIME TO FILE HAWAII

98

19

INDIVIDUAL INCOME TAX RETURN

Type of return:

Form N-11

Form N-12

Form N-13

Form N-15

CALENDAR YEAR 1998 or other tax year

• •

beginning ____________________ , 1998 and ending

____________________, 19 ______

Do not file this form unless Form N-101A or federal Form 4868 has been previously filed.

Please read reverse side before preparing form.

A copy of the application will be returned to you only if your request is rejected.

AMD

UNP

008

PNT

INT

Your first name and initial

Last name

Your Social Security Number

If a joint return, spouse’s first name and initial

Last name

Spouse’s Social Security Number

Address

DO NOT WRITE IN THIS SPACE

City, State and ZIP Code

NOTE: File this form with the taxation district office where you must file your income tax

return. This is not an extension of time for payment of tax. The law requires that

a penalty be charged for late payment of tax and late filing unless you show

reasonable cause for not paying the tax when due. Also, any estimated taxes

required from individuals that become delinquent shall be subject to appropriate

underpayment penalties. These penalties are not waived or forgiven with the filing of

this form or the accompanying payment of the tax due.

• •

1.

I request an additional extension of time until

___________________ , 19 ______ ,

to file my individual income tax return. (This line MUST be filled in.)

Extension REJECTED (See below for

reason(s) for rejection.)

2.

Were you previously granted an extension of time to file for this year?

Yes

No

3.

Previous extension granted to (date) ____________________________ , 19 ______ .

4.

State in detail why you need an additional extension. _________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that the statements contained herein are true and correct.

• •

_________________________________________________________________________

______________________________________

YOUR SIGNATURE OR AUTHORIZED AGENT WITH POWER OF ATTORNEY

DATE

• •

_________________________________________________________________________

______________________________________

SPOUSE’S SIGNATURE (IF JOINT RETURN)

DATE

REASON FOR REJECTION OF EXTENSION

1. The request was not in this office or mailed on or before the expiration of the automatic 4-month extension for filing the return.

2. Your application cannot be considered because no previous extension of time to file the return was granted.

3. The 6-month limitation has expired. (Extension will be granted for a maximum of 6 months only.)

4. We have NOT approved the application. However, because of your reasons stated above, we have granted

a 10-day grace period from the date shown below or due date of the return including extensions, whichever is

later. This 10-day grace period is considered to be a valid extension of time for purposes of elections otherwise

required to be made on timely filed returns.

5. Other —

FORM N-101B

1

1