Form D-410g - Application For Extension For Filing Gift Tax Return

ADVERTISEMENT

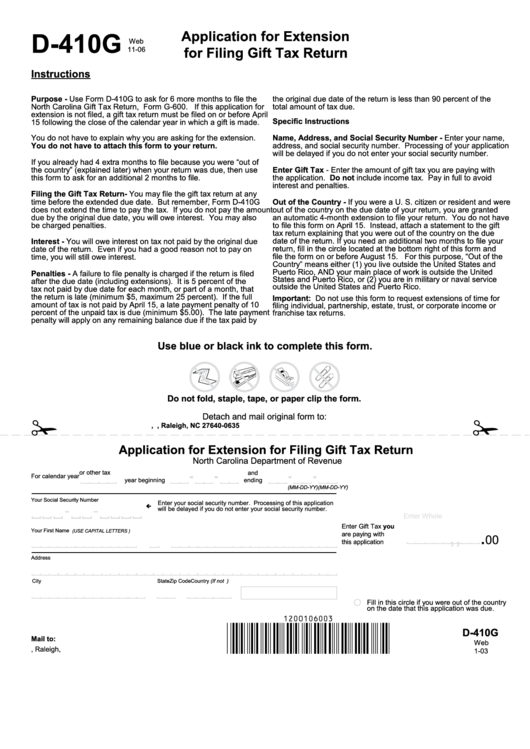

D-410G

Application for Extension

Web

for Filing Gift Tax Return

11-06

Instructions

Purpose - Use Form D-410G to ask for 6 more months to file the

the original due date of the return is less than 90 percent of the

North Carolina Gift Tax Return, Form G-600. If this application for

total amount of tax due.

extension is not filed, a gift tax return must be filed on or before April

Specific Instructions

15 following the close of the calendar year in which a gift is made.

You do not have to explain why you are asking for the extension.

Name, Address, and Social Security Number - Enter your name,

You do not have to attach this form to your return.

address, and social security number. Processing of your application

will be delayed if you do not enter your social security number.

If you already had 4 extra months to file because you were “out of

the country” (explained later) when your return was due, then use

Enter Gift Tax - Enter the amount of gift tax you are paying with

this form to ask for an additional 2 months to file.

the application. Do not include income tax. Pay in full to avoid

interest and penalties.

Filing the Gift Tax Return - You may file the gift tax return at any

time before the extended due date. But remember, Form D-410G

Out of the Country - If you were a U. S. citizen or resident and were

does not extend the time to pay the tax. If you do not pay the amount

out of the country on the due date of your return, you are granted

due by the original due date, you will owe interest. You may also

an automatic 4-month extension to file your return. You do not have

be charged penalties.

to file this form on April 15. Instead, attach a statement to the gift

tax return explaining that you were out of the country on the due

date of the return. If you need an additional two months to file your

Interest - You will owe interest on tax not paid by the original due

return, fill in the circle located at the bottom right of this form and

date of the return. Even if you had a good reason not to pay on

file the form on or before August 15. For this purpose, “Out of the

time, you will still owe interest.

Country” means either (1) you live outside the United States and

Puerto Rico, AND your main place of work is outside the United

Penalties - A failure to file penalty is charged if the return is filed

States and Puerto Rico, or (2) you are in military or naval service

after the due date (including extensions). It is 5 percent of the

outside the United States and Puerto Rico.

tax not paid by due date for each month, or part of a month, that

the return is late (minimum $5, maximum 25 percent). If the full

Important: Do not use this form to request extensions of time for

amount of tax is not paid by April 15, a late payment penalty of 10

filing individual, partnership, estate, trust, or corporate income or

percent of the unpaid tax is due (minimum $5.00). The late payment

franchise tax returns.

penalty will apply on any remaining balance due if the tax paid by

Use blue or black ink to complete this form.

Do not fold, staple, tape, or paper clip the form.

Detach and mail original form to:

N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0635

Application for Extension for Filing Gift Tax Return

North Carolina Department of Revenue

or other tax

and

For calendar year

year beginning

ending

(MM-DD-YY)

(MM-DD-YY)

Your Social Security Number

Enter your social security number. Processing of this application

will be delayed if you do not enter your social security number.

Enter Whole U.S. Dollars Only

Enter Gift Tax you

,

,

.

Your First Name

M.I.

Your Last Name

(USE CAPITAL LETTERS )

are paying with

00

this application

Address

Country (If not U.S.)

City

State

Zip Code

Fill in this circle if you were out of the country

on the date that this application was due.

D-410G

Mail to: N.C. Department of Revenue

Web

P.O. Box 25000, Raleigh, N.C. 27640-0635

1-03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1