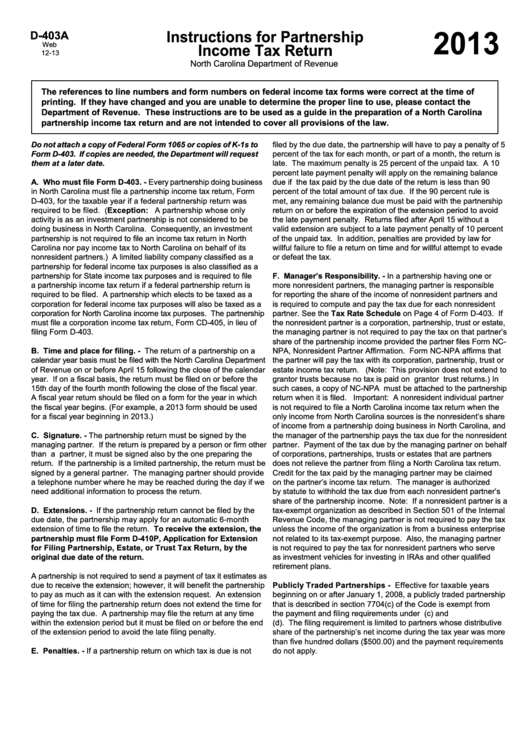

Form D-403a - Instructions For Partnership Income Tax Return - 2013

ADVERTISEMENT

2013

Instructions for Partnership

D-403A

Web

Income Tax Return

12-13

North Carolina Department of Revenue

The references to line numbers and form numbers on federal income tax forms were correct at the time of

printing. If they have changed and you are unable to determine the proper line to use, please contact the

Department of Revenue. These instructions are to be used as a guide in the preparation of a North Carolina

partnership income tax return and are not intended to cover all provisions of the law.

Do not attach a copy of Federal Form 1065 or copies of K-1s to

filed by the due date, the partnership will have to pay a penalty of 5

Form D-403. If copies are needed, the Department will request

percent of the tax for each month, or part of a month, the return is

them at a later date.

late. The maximum penalty is 25 percent of the unpaid tax. A 10

percent late payment penalty will apply on the remaining balance

A. Who must file Form D-403. - Every partnership doing business

due if the tax paid by the due date of the return is less than 90

in North Carolina must file a partnership income tax return, Form

percent of the total amount of tax due. If the 90 percent rule is

D-403, for the taxable year if a federal partnership return was

met, any remaining balance due must be paid with the partnership

required to be filed. (Exception:

A partnership whose only

return on or before the expiration of the extension period to avoid

activity is as an investment partnership is not considered to be

the late payment penalty. Returns filed after April 15 without a

doing business in North Carolina. Consequently, an investment

valid extension are subject to a late payment penalty of 10 percent

partnership is not required to file an income tax return in North

of the unpaid tax. In addition, penalties are provided by law for

Carolina nor pay income tax to North Carolina on behalf of its

willful failure to file a return on time and for willful attempt to evade

nonresident partners.) A limited liability company classified as a

or defeat the tax.

partnership for federal income tax purposes is also classified as a

partnership for State income tax purposes and is required to file

F. Manager’s Responsibility. - In a partnership having one or

a partnership income tax return if a federal partnership return is

more nonresident partners, the managing partner is responsible

required to be filed. A partnership which elects to be taxed as a

for reporting the share of the income of nonresident partners and

corporation for federal income tax purposes will also be taxed as a

is required to compute and pay the tax due for each nonresident

corporation for North Carolina income tax purposes. The partnership

partner. See the Tax Rate Schedule on Page 4 of Form D-403. If

must file a corporation income tax return, Form CD-405, in lieu of

the nonresident partner is a corporation, partnership, trust or estate,

filing Form D-403.

the managing partner is not required to pay the tax on that partner’s

share of the partnership income provided the partner files Form NC-

B. Time and place for filing. - The return of a partnership on a

NPA, Nonresident Partner Affirmation. Form NC-NPA affirms that

calendar year basis must be filed with the North Carolina Department

the partner will pay the tax with its corporation, partnership, trust or

of Revenue on or before April 15 following the close of the calendar

estate income tax return. (Note: This provision does not extend to

year. If on a fiscal basis, the return must be filed on or before the

grantor trusts because no tax is paid on grantor trust returns.) In

15th day of the fourth month following the close of the fiscal year.

such cases, a copy of NC-NPA must be attached to the partnership

A fiscal year return should be filed on a form for the year in which

return when it is filed. Important: A nonresident individual partner

the fiscal year begins. (For example, a 2013 form should be used

is not required to file a North Carolina income tax return when the

for a fiscal year beginning in 2013.)

only income from North Carolina sources is the nonresident’s share

of income from a partnership doing business in North Carolina, and

C. Signature. - The partnership return must be signed by the

the manager of the partnership pays the tax due for the nonresident

managing partner. If the return is prepared by a person or firm other

partner. Payment of the tax due by the managing partner on behalf

than a partner, it must be signed also by the one preparing the

of corporations, partnerships, trusts or estates that are partners

return. If the partnership is a limited partnership, the return must be

does not relieve the partner from filing a North Carolina tax return.

signed by a general partner. The managing partner should provide

Credit for the tax paid by the managing partner may be claimed

a telephone number where he may be reached during the day if we

on the partner’s income tax return. The manager is authorized

need additional information to process the return.

by statute to withhold the tax due from each nonresident partner’s

share of the partnership income. Note: If a nonresident partner is a

D. Extensions. - If the partnership return cannot be filed by the

tax-exempt organization as described in Section 501 of the Internal

due date, the partnership may apply for an automatic 6-month

Revenue Code, the managing partner is not required to pay the tax

extension of time to file the return. To receive the extension, the

unless the income of the organization is from a business enterprise

partnership must file Form D-410P, Application for Extension

not related to its tax-exempt purpose. Also, the managing partner

for Filing Partnership, Estate, or Trust Tax Return, by the

is not required to pay the tax for nonresident partners who serve

original due date of the return.

as investment vehicles for investing in IRAs and other qualified

retirement plans.

A partnership is not required to send a payment of tax it estimates as

due to receive the extension; however, it will benefit the partnership

Publicly Traded Partnerships - Effective for taxable years

to pay as much as it can with the extension request. An extension

beginning on or after January 1, 2008, a publicly traded partnership

of time for filing the partnership return does not extend the time for

that is described in section 7704(c) of the Code is exempt from

paying the tax due. A partnership may file the return at any time

the payment and filing requirements under G.S. 105-154(c) and

within the extension period but it must be filed on or before the end

(d). The filing requirement is limited to partners whose distributive

of the extension period to avoid the late filing penalty.

share of the partnership’s net income during the tax year was more

than five hundred dollars ($500.00) and the payment requirements

E. Penalties. - If a partnership return on which tax is due is not

do not apply.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4