Form I-2 - Annual Individual Occupational License Fee Return

ADVERTISEMENT

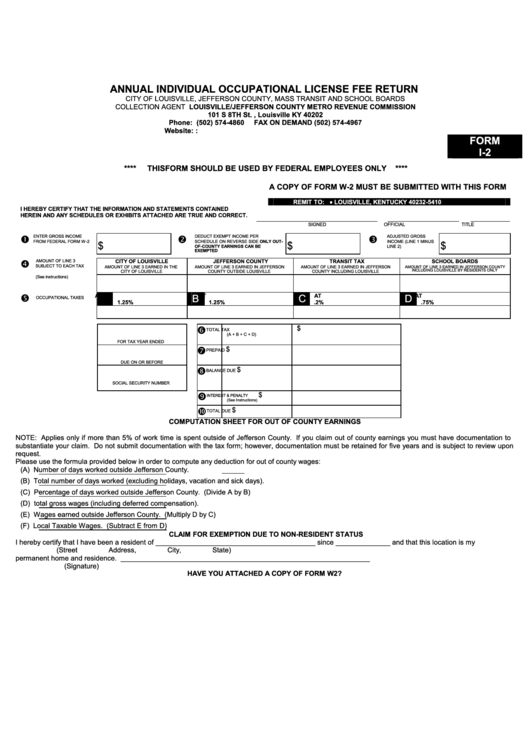

ANNUAL INDIVIDUAL OCCUPATIONAL LICENSE FEE RETURN

CITY OF LOUISVILLE, JEFFERSON COUNTY, MASS TRANSIT AND SCHOOL BOARDS

COLLECTION AGENT LOUISVILLE/JEFFERSON COUNTY METRO REVENUE COMMISSION

101 S 8TH St. , Louisville KY 40202

Phone: (502) 574-4860

FAX ON DEMAND (502) 574-4967

Website:

FORM

I-2

****

THIS FORM SHOULD BE USED BY FEDERAL EMPLOYEES ONLY

****

A COPY OF FORM W-2 MUST BE SUBMITTED WITH THIS FORM

REMIT TO: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

I HEREBY CERTIFY THAT THE INFORMATION AND STATEMENTS CONTAINED

HEREIN AND ANY SCHEDULES OR EXHIBITS ATTACHED ARE TRUE AND CORRECT.

SIGNED

OFFICIAL TITLE

DATE

ENTER GROSS INCOME

DEDUCT EXEMPT INCOME PER

ADJUSTED GROSS

FROM FEDERAL FORM W-2

SCHEDULE ON REVERSE SIDE ONLY OUT-

INCOME (LINE 1 MINUS

$

$

$

OF-COUNTY EARNINGS CAN BE

LINE 2)

EXEMPTED

AMOUNT OF LINE 3

CITY OF LOUISVILLE

JEFFERSON COUNTY

TRANSIT TAX

SCHOOL BOARDS

SUBJECT TO EACH TAX

AMOUNT OF LINE 3 EARNED IN THE

AMOUNT OF LINE 3 EARNED IN JEFFERSON

AMOUNT OF LINE 3 EARNED IN JEFFERSON

AMOUNT OF LINE 3 EARNED IN JEFFERSON COUNTY

INCLUDING LOUISVILLE BY RESIDENTS ONLY

CITY OF LOUISVILLE

COUNTY OUTSIDE LOUISVILLE

COUNTY INCLUDING LOUISVILLE

(See instructions)

A

AT

B

AT

C

AT

D

AT

OCCUPATIONAL TAXES

1.25%

1.25%

.2%

.75%

$

TOTAL TAX

(A + B + C + D)

FOR TAX YEAR ENDED

$

PREPAID

DUE ON OR BEFORE

$

BALANCE DUE

SOCIAL SECURITY NUMBER

$

INTEREST & PENALTY

(See Instructions)

$

TOTAL DUE

COMPUTATION SHEET FOR OUT OF COUNTY EARNINGS

NOTE: Applies only if more than 5% of work time is spent outside of Jefferson County. If you claim out of county earnings you must have documentation to

substantiate your claim. Do not submit documentation with the tax form; however, documentation must be retained for five years and is subject to review upon

request.

Please use the formula provided below in order to compute any deduction for out of county wages:

(A)

Number of days worked outside Jefferson County.

(B)

Total number of days worked (excluding holidays, vacation and sick days).

(C)

Percentage of days worked outside Jefferson County. (Divide A by B)

(D)

total gross wages (including deferred compensation).

(E)

Wages earned outside Jefferson County. (Multiply D by C)

(F)

Local Taxable Wages. (Subtract E from D)

CLAIM FOR EXEMPTION DUE TO NON-RESIDENT STATUS

I hereby certify that I have been a resident of _________________________________________ since ______________ and that this location is my

(Street Address, City, State)

permanent home and residence. ________________________________________________________________

(Signature)

HAVE YOU ATTACHED A COPY OF FORM W2?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2