Instructions For Form R-1029 - Sales Tax Return

ADVERTISEMENT

R-1029-I (7/07)

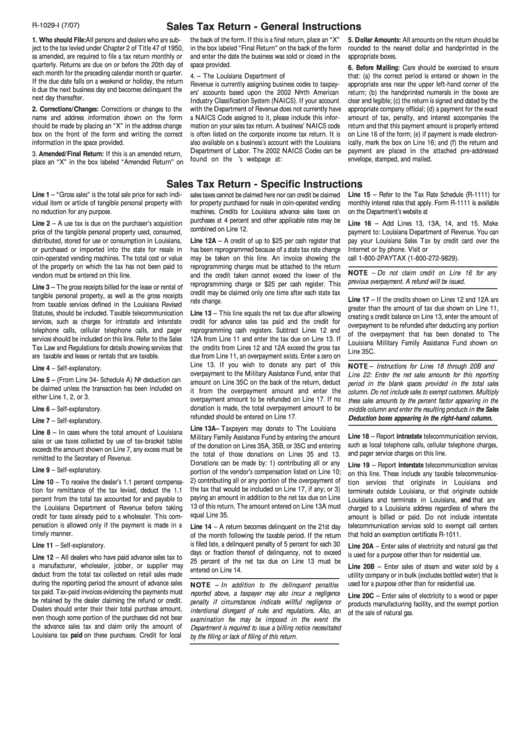

Sales Tax Return - General Instructions

1. Who should File: All persons and dealers who are sub-

the back of the form. If this is a final return, place an “X”

5. Dollar Amounts: All amounts on the return should be

ject to the tax levied under Chapter 2 of Title 47 of 1950,

in the box labeled “Final Return” on the back of the form

rounded to the nearest dollar and handprinted in the

as amended, are required to file a tax return monthly or

and enter the date the business was sold or closed in the

appropriate boxes.

quarterly. Returns are due on or before the 20th day of

space provided.

6. Before Mailing: Care should be exercised to ensure

each month for the preceding calendar month or quarter.

4. U.S. NAICS Code – The Louisiana Department of

that: (a) the correct period is entered or shown in the

If the due date falls on a weekend or holiday, the return

Revenue is currently assigning business codes to taxpay-

appropriate area near the upper left-hand corner of the

is due the next business day and becomes delinquent the

ers’ accounts based upon the 2002 North American

return; (b) the handprinted numerals in the boxes are

next day thereafter.

Industry Classification System (NAICS). If your account

clear and legible; (c) the return is signed and dated by the

2. Corrections/Changes: Corrections or changes to the

with the Department of Revenue does not currently have

appropriate company official; (d) a payment for the exact

name and address information shown on the form

a NAICS Code assigned to it, please include this infor-

amount of tax, penalty, and interest accompanies the

should be made by placing an “X” in the address change

mation on your sales tax return. A business’ NAICS code

return and that this payment amount is properly entered

box on the front of the form and writing the correct

is often listed on the corporate income tax return. It is

on Line 16 of the form; (e) if payment is made electron-

information in the space provided.

also available on a business’s account with the Louisiana

ically, mark the box on Line 16; and (f ) the return and

Department of Labor. The 2002 NAICS Codes can be

payment are placed in the attached pre-addressed

3. Amended/Final Return: If this is an amended return,

found on the U.S. Census Bureau’s webpage at:

envelope, stamped, and mailed.

place an “X” in the box labeled “Amended Return” on

Sales Tax Return - Specific Instructions

Line 1 – “Gross sales” is the total sale price for each indi-

sales taxes cannot be claimed here nor can credit be claimed

Line 15 – Refer to the Tax Rate Schedule (R-1111) for

vidual item or article of tangible personal property with

for property purchased for resale in coin-operated vending

monthly interest rates that apply. Form R-1111 is available

no reduction for any purpose.

machines. Credits for Louisiana advance sales taxes on

on the Department’s website at

purchases at 4 percent and other applicable rates may be

Line 2 – A use tax is due on the purchaser’s acquisition

Line 16 – Add Lines 13, 13A, 14, and 15. Make

combined on Line 12.

price of the tangible personal property used, consumed,

payment to: Louisiana Department of Revenue. You can

distributed, stored for use or consumption in Louisiana,

Line 12A – A credit of up to $25 per cash register that

pay your Louisiana Sales Tax by credit card over the

or purchased or imported into the state for resale in

has been reprogrammed because of a state tax rate change

Internet or by phone. Visit or

coin-operated vending machines. The total cost or value

may be taken on this line. An invoice showing the

call 1-800-2PAYTAX (1-800-272-9829).

of the property on which the tax has not been paid to

reprogramming charges must be attached to the return

NOTE – Do not claim credit on Line 16 for any

vendors must be entered on this line.

and the credit taken cannot exceed the lower of the

previous overpayment. A refund will be issued.

reprogramming charge or $25 per cash register. This

Line 3 – The gross receipts billed for the lease or rental of

credit may be claimed only one time after each state tax

tangible personal property, as well as the gross receipts

Line 17 – If the credits shown on Lines 12 and 12A are

rate change.

from taxable services defined in the Louisiana Revised

greater than the amount of tax due shown on Line 11,

Statutes, should be included. Taxable telecommunication

Line 13 – This line equals the net tax due after allowing

creating a credit balance on Line 13, enter the amount of

services, such as charges for intrastate and interstate

credit for advance sales tax paid and the credit for

overpayment to be refunded after deducting any portion

telephone calls, cellular telephone calls, and pager

reprogramming cash registers. Subtract Lines 12 and

of the overpayment that has been donated to The

services should be included on this line. Refer to the Sales

12A from Line 11 and enter the tax due on Line 13. If

Louisiana Military Family Assistance Fund shown on

Tax Law and Regulations for details showing services that

the credits from Lines 12 and 12A exceed the gross tax

Line 35C.

are taxable and leases or rentals that are taxable.

due from Line 11, an overpayment exists. Enter a zero on

Line 13. If you wish to donate any part of this

NOTE – Instructions for Lines 18 through 20B and

Line 4 – Self-explanatory.

overpayment to the Military Assistance Fund, enter that

Line 22: Enter the net sales amounts for this reporting

Line 5 – (From Line 34- Schedule A) No deduction can

amount on Line 35C on the back of the return, deduct

period in the blank spaces provided in the total sales

be claimed unless the transaction has been included on

it from the overpayment amount and enter the

column. Do not include sales to exempt customers. Multiply

either Line 1, 2, or 3.

overpayment amount to be refunded on Line 17. If no

these sales amounts by the percent factor appearing in the

donation is made, the total overpayment amount to be

Line 6 – Self-explanatory.

middle column and enter the resulting products in the Sales

refunded should be entered on Line 17.

Deduction boxes appearing in the right-hand column.

Line 7 – Self-explanatory.

Line 13A – Taxpayers may donate to The Louisiana

Line 8 – In cases where the total amount of Louisiana

Line 18 – Report intrastate telecommunication services,

Military Family Assistance Fund by entering the amount

sales or use taxes collected by use of tax-bracket tables

such as local telephone calls, cellular telephone charges,

of the donation on Lines 35A, 35B, or 35C and entering

exceeds the amount shown on Line 7, any excess must be

and pager service charges on this line.

the total of those donations on Lines 35 and 13.

remitted to the Secretary of Revenue.

Donations can be made by: 1) contributing all or any

Line 19 – Report interstate telecommunication services

Line 9 – Self-explanatory.

portion of the vendor’s compensation listed on Line 10;

on this line. These include any taxable telecommunica-

2) contributing all or any portion of the overpayment of

Line 10 – To receive the dealer’s 1.1 percent compensa-

tion services that originate in Louisiana and

the tax that would be included on Line 17, if any; or 3)

tion for remittance of the tax levied, deduct the 1.1

terminate outside Louisiana, or that originate outside

paying an amount in addition to the net tax due on Line

percent from the total tax accounted for and payable to

Louisiana and terminate in Louisiana, and that are

13 of this return. The amount entered on Line 13A must

the Louisiana Department of Revenue before taking

charged to a Louisiana address regardless of where the

equal Line 35.

credit for taxes already paid to a wholesaler. This com-

amount is billed or paid. Do not include interstate

pensation is allowed only if the payment is made in a

telecommunication services sold to exempt call centers

Line 14 – A return becomes delinquent on the 21st day

timely manner.

that hold an exemption certificate R-1011.

of the month following the taxable period. If the return

is filed late, a delinquent penalty of 5 percent for each 30

Line 11 – Self-explanatory.

Line 20A – Enter sales of electricity and natural gas that

days or fraction thereof of delinquency, not to exceed

is used for a purpose other than for residential use.

Line 12 – All dealers who have paid advance sales tax to

25 percent of the net tax due on Line 13 must be

a manufacturer, wholesaler, jobber, or supplier may

Line 20B – Enter sales of steam and water sold by a

entered on Line 14.

deduct from the total tax collected on retail sales made

utility company or in bulk (excludes bottled water) that is

during the reporting period the amount of advance sales

used for a purpose other than for residential use.

NOTE – In addition to the delinquent penalties

tax paid. Tax-paid invoices evidencing the payments must

reported above, a taxpayer may also incur a negligence

Line 20C – Enter sales of electricity to a wood or paper

be retained by the dealer claiming the refund or credit.

penalty if circumstances indicate willful negligence or

products manufacturing facility, and the exempt portion

Dealers should enter their their total purchase amount,

intentional disregard of rules and regulations. Also, an

of the sale of natural gas.

even though some portion of the purchases did not bear

examination fee may be imposed in the event the

the advance sales tax and claim only the amount of

Department is required to issue a billing notice necessitated

Louisiana tax paid on these purchases. Credit for local

by the filing or lack of filing of this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2