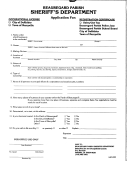

Application For Occupational License - Birmingham Occupational License Department - 2009 Page 2

ADVERTISEMENT

Section 3 – Renewal

(Complete this section to renew your business license.)

14.

Business Opened During 2008 Calendar Year:

A.

Gross Receipts:

____________________

B.

Deductions*: ____________________

____________________

C.

(A) Minus (B) Equals Taxable Receipts:

____________________

D.

No. of Days Operation:

_______

E.

(C/D) Equals Average Gross Receipts:’

____________________

F.

____________________

365 Times E Equals Est. Taxable Gross:

G.

Skip to Section 4 to Calculate Tax Due

Existing Business Opened prior to 2008 -The gross receipts for the prior calendar year, minus applicable deductions, are the taxable receipts.

A.

Gross Sales/Receipts:

____________________

B.

Deductions*:

____________________

C.

(A) Minus (B) Equals Taxable Receipts:

____________________

D.

Skip to Section 4 to Calculate Tax Due

15.

Retail Dealers of Gasoline and Motor Fuels-The tax is computed based on the amount of gallons of gasoline or motor fuels sold using the table in

R.S. 47:354.1 and the amount of gross sales of merchandise, services and rentals using the table in R.S. 47:354. The maximum sum of the tax using

the two tables shall not exceed $6,200.

A.

Gross Sales/Receipts:

____________________

(Do Not Include Sales of Motor Fuels)

____________________

B.

Deductions*: ____________________

____________________

C.

(A) Minus (B) Equals Taxable Receipts:

____________________

D.

Tax Due From Table 1:

____________________

E.

Gallons of Gasoline & Motor Fuels Sold:

____________________

F.

Tax Due on Line (E) From Table 1.1

____________________

G.

Total Tax Due Line (D) Plus Line (F):

____________________

H.

Maximum Tax Due:

$6,200.00

__________________

I.

Enter The Lesser of Line (G) or Line (H):

Sign and Date Application

J.

Section 4 – Calculate Tax Due

(Complete lines 16 through 22.)

16. Class: Indicate the class of business which constitutes the major portion of the gross receipts, fees, or commissions earned.

Retail

Wholesale

Commission

Public Utilities

Lending

Other

17. Use Appropriate Table to Calculate Tax Due:

Using the appropriate table for the class checked, calculate the tax due. For businesses not falling within the five classes listed, such as professionals or

pharmacy, multiply the taxable receipts by one-tenth of one percent (0.001). Be aware of the following maximum tax limits: retail motor vehicle

and boat dealers-$800.00; wholesale motor vehicle and boat dealers-$250.00; contractors-$750.00; hotels/motels $2 per room, plus a separate

license for any retail sales; nursing homes-$2 per room, plus a retail tax based on 1/3 of the taxable gross receipts; real estate broker-$2,200;

retail building materials dealers-taxed under wholesale schedule-$6,200.00

(For Others, Professionals, or Pharmacies Multiply Taxable Receipts by (1/10 of 1%) Occupational Tax Due $___________ ______________

18. Flat Fees: For those items subject to a flat fee, list total items by type, and calculate the tax due.

Item

Number

Fee

Total for Item

Total for Flat Fees

19. Amount of Tax Due (Total of Lines 17 and 18):

$____________________________

st

20. Interest of 1 ¼% (.0125) Due March 1

, additional interest due per month until paid in full:

$____________________________

21. Penalty (If filed March 1st or after) 5% of tax due for each 30 days or fraction thereof;

Maximum penalty of 25%

$____________________________

22. Total Occupational License Tax Due:

$____________________________

****DEDUCTIONS ARE ALLOWABLE FOR THESE BUSINESSES: SERVICE STATIONS, INTERSTATE SALES OF STOCKS & BONDS, AND

UNDERTAKERS****

I hereby swear that the amount of gross receipts as required for disclosure in order to obtain an occupational tax license has been examined by me and to the best of my

knowledge is true, correct, and complete. I understand issuance of an occupational tax license does not permit business operation unless business is properly zoned

and/or in compliance with all applicable laws/rules.

Signature of Applicant:

_________________________________________________Title:_______________________________ Date_________________

Print Name of Applicant: _________________________________________Telephone: __________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2