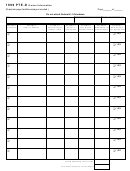

Form Pte-D - Owner Information - 2005 Page 2

ADVERTISEMENT

State of New Mexico

Taxation and Revenue Department

W-K 2005 -

New Mexico Income and Withholding from Pass-Through Entity

INSTRUCTIONS

This form is to be used by nonresident owners who have had tax withheld and paid to the State of New Mexico by a pass-through entity (on

the pass-through entity's PTE return) and who file their own New Mexico income tax returns. Form W-K must be attached to the nonresident

owner's New Mexico income tax return as verification that tax has been withheld and paid to the State of New Mexico. Upon request the pass-

through entity must submit a completed Form W-K to the nonresident owner for attachment to the New Mexico income tax return.

Nonresident owners may report tax withheld and paid to the State of New Mexico on their 2005 New Mexico income tax return.

l

Tax withheld on Form W-K is reported by the nonresident owner as follows:

If filing Form PIT-1, report the withholding on line 18, Form PIT-1.

l

If filing Form CIT-1, report the withholding on line 20, Form CIT-1.

l

If filing Form PTE, report the withholding on line 13, Form PTE.

l

W-K 2005

New Mexico Income and Withholding from Pass-Through Entity

Name of entity

Mailing address of entity

City

State

Zip code

New Mexico CRS ID number

Federal employer identification number (FEIN)

Name of owner

Mailing address of owner

City

State

Zip code

Owner SSN/FEIN

Owner's New Mexico income

Owner's New Mexico withholding

$

$

W-K 2005

New Mexico Income and Withholding from Pass-Through Entity

Name of entity

Mailing address of entity

City

State

Zip code

New Mexico CRS ID number

Federal employer identification number (FEIN)

Name of owner

Mailing address of owner

City

State

Zip code

Owner SSN/FEIN

Owner's New Mexico income

Owner's New Mexico withholding

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2