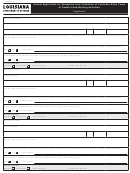

R-1048 (1/16)

Annual Application for Exemption from Collection of Louisiana Sales Taxes

at Certain Fund-Raising Activities

Supplement

Description of Event

Location of Event

City

State

ZIP

Dates of Event

How will the proceeds, after the payment of direct necessary expenses, be used? If the proceeds are to be donated to a nonprofit organization, explain

how the organization will use the funds.

Will the event potentially yield a profit to any promoter, individual, or business which has contracted to provide services or equipment for the event(s)?

Yes

No

If “Yes” explain:

Does any profit-seeking business enterprise, operating in the trade area where this event will be held, sell products or services that are identical or similar

to the products or services that will be sold by this organization during the fund-raising event(s)?

Yes

No

If “Yes” explain:

OFFICE USE ONLY

Approved

Disapproved

Date

________________________ Applies only to this event.

(mm/dd/yyyy)

Description of Event

Location of Event

City

State

ZIP

Dates of Event

How will the proceeds, after the payment of direct necessary expenses, be used? If the proceeds are to be donated to a nonprofit organization, explain

how the organization will use the funds.

Will the event potentially yield a profit to any promoter, individual, or business which has contracted to provide services or equipment for the event(s)?

Yes

No

If “Yes” explain:

Does any profit-seeking business enterprise, operating in the trade area where this event will be held, sell products or services that are identical or similar

to the products or services that will be sold by this organization during the fund-raising event(s)?

Yes

No

If “Yes” explain:

OFFICE USE ONLY

Approved

Disapproved

Date

________________________ Applies only to this event.

(mm/dd/yyyy)

Description of Event

Location of Event

City

State

ZIP

Dates of Event

How will the proceeds, after the payment of direct necessary expenses, be used? If the proceeds are to be donated to a nonprofit organization, explain

how the organization will use the funds.

Will the event potentially yield a profit to any promoter, individual, or business which has contracted to provide services or equipment for the event(s)?

Yes

No

If “Yes” explain:

Does any profit-seeking business enterprise, operating in the trade area where this event will be held, sell products or services that are identical or similar

to the products or services that will be sold by this organization during the fund-raising event(s)?

Yes

No

If “Yes” explain:

OFFICE USE ONLY

Approved

Disapproved

Date

________________________ Applies only to this event.

(mm/dd/yyyy)

1

1 2

2