Instructions For Form 593 Advance Draft - Real Estate Withholding Tax Statement

ADVERTISEMENT

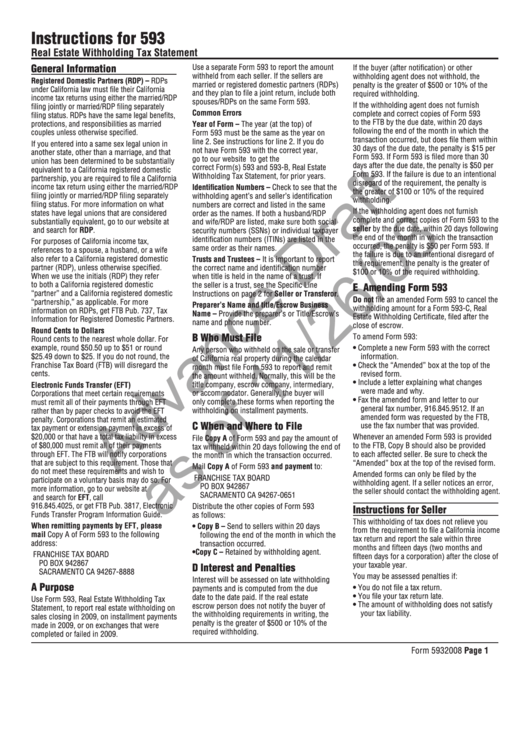

Instructions for 593

Real Estate Withholding Tax Statement

General Information

Use a separate Form 593 to report the amount

If the buyer (after notification) or other

withheld from each seller. If the sellers are

withholding agent does not withhold, the

Registered Domestic Partners (RDP) – RDPs

married or registered domestic partners (RDPs)

penalty is the greater of $500 or 10% of the

under California law must file their California

and they plan to file a joint return, include both

required withholding.

income tax returns using either the married/RDP

spouses/RDPs on the same Form 593.

If the withholding agent does not furnish

filing jointly or married/RDP filing separately

Common Errors

complete and correct copies of Form 593

filing status. RDPs have the same legal benefits,

to the FTB by the due date, within 20 days

protections, and responsibilities as married

Year of Form – The year (at the top) of

following the end of the month in which the

couples unless otherwise specified.

Form 593 must be the same as the year on

transaction occurred, but does file them within

line 2. See instructions for line 2. If you do

If you entered into a same sex legal union in

30 days of the due date, the penalty is $15 per

not have Form 593 with the correct year,

another state, other than a marriage, and that

Form 593. If Form 593 is filed more than 30

go to our website ftb.ca.gov to get the

union has been determined to be substantially

days after the due date, the penalty is $50 per

correct Form(s) 593 and 593-B, Real Estate

equivalent to a California registered domestic

Form 593. If the failure is due to an intentional

Withholding Tax Statement, for prior years.

partnership, you are required to file a California

disregard of the requirement, the penalty is

income tax return using either the married/RDP

Identification Numbers – Check to see that the

the greater of $100 or 10% of the required

filing jointly or married/RDP filing separately

withholding agent’s and seller’s identification

withholding.

filing status. For more information on what

numbers are correct and listed in the same

If the withholding agent does not furnish

states have legal unions that are considered

order as the names. If both a husband/RDP

complete and correct copies of Form 593 to the

substantially equivalent, go to our website at

and wife/RDP are listed, make sure both social

seller by the due date, within 20 days following

ftb.ca.gov and search for RDP.

security numbers (SSNs) or individual taxpayer

the end of the month in which the transaction

identification numbers (ITINs) are listed in the

For purposes of California income tax,

occurred, the penalty is $50 per Form 593. If

same order as their names.

references to a spouse, a husband, or a wife

the failure is due to an intentional disregard of

also refer to a California registered domestic

Trusts and Trustees – It is important to report

the requirement, the penalty is the greater of

partner (RDP), unless otherwise specified.

the correct name and identification number

$100 or 10% of the required withholding.

When we use the initials (RDP) they refer

when title is held in the name of a trust. If

to both a California registered domestic

the seller is a trust, see the Specific Line

E Amending Form 593

“partner” and a California registered domestic

Instructions on page 2 for Seller or Transferor.

Do not file an amended Form 593 to cancel the

“partnership,” as applicable. For more

Preparer’s Name and title/Escrow Business

withholding amount for a Form 593-C, Real

information on RDPs, get FTB Pub. 737, Tax

Name – Provide the preparer’s or Title/Escrow’s

Estate Withholding Certificate, filed after the

Information for Registered Domestic Partners.

name and phone number.

close of escrow.

Round Cents to Dollars

B Who Must File

To amend Form 593:

Round cents to the nearest whole dollar. For

example, round $50.50 up to $51 or round

• Complete a new Form 593 with the correct

Any person who withheld on the sale or transfer

$25.49 down to $25. If you do not round, the

information.

of California real property during the calendar

Franchise Tax Board (FTB) will disregard the

• Check the “Amended” box at the top of the

month must file Form 593 to report and remit

cents.

revised form.

the amount withheld. Normally, this will be the

• Include a letter explaining what changes

title company, escrow company, intermediary,

Electronic Funds Transfer (EFT)

were made and why.

or accommodator. Generally, the buyer will

Corporations that meet certain requirements

• Fax the amended form and letter to our

only complete these forms when reporting the

must remit all of their payments through EFT

general fax number, 916.845.9512. If an

rather than by paper checks to avoid the EFT

withholding on installment payments.

amended form was requested by the FTB,

penalty. Corporations that remit an estimated

C When and Where to File

use the fax number that was provided.

tax payment or extension payment in excess of

$20,000 or that have a total tax liability in excess

Whenever an amended Form 593 is provided

File Copy A of Form 593 and pay the amount of

of $80,000 must remit all of their payments

to the FTB, Copy B should also be provided

tax withheld within 20 days following the end of

through EFT. The FTB will notify corporations

to each affected seller. Be sure to check the

the month in which the transaction occurred.

that are subject to this requirement. Those that

“Amended” box at the top of the revised form.

Mail Copy A of Form 593 and payment to:

do not meet these requirements and wish to

Amended forms can only be filed by the

FRANCHISE TAX BOARD

participate on a voluntary basis may do so. For

withholding agent. If a seller notices an error,

PO BOX 942867

more information, go to our website at

the seller should contact the withholding agent.

SACRAMENTO CA 94267-0651

ftb.ca.gov and search for EFT, call

916.845.4025, or get FTB Pub. 3817, Electronic

Distribute the other copies of Form 593

Instructions for Seller

Funds Transfer Program Information Guide.

as follows:

This withholding of tax does not relieve you

When remitting payments by EFT, please

• Copy B – Send to sellers within 20 days

from the requirement to file a California income

mail Copy A of Form 593 to the following

following the end of the month in which the

tax return and report the sale within three

address:

transaction occurred.

months and fifteen days (two months and

• Copy C – Retained by withholding agent.

FRANCHISE TAX BOARD

fifteen days for a corporation) after the close of

PO BOX 942867

your taxable year.

D Interest and Penalties

SACRAMENTO CA 94267-8888

You may be assessed penalties if:

Interest will be assessed on late withholding

A Purpose

• You do not file a tax return.

payments and is computed from the due

• You file your tax return late.

date to the date paid. If the real estate

Use Form 593, Real Estate Withholding Tax

• The amount of withholding does not satisfy

escrow person does not notify the buyer of

Statement, to report real estate withholding on

your tax liability.

the withholding requirements in writing, the

sales closing in 2009, on installment payments

penalty is the greater of $500 or 10% of the

made in 2009, or on exchanges that were

required withholding.

completed or failed in 2009.

Form 593 2008 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3