Clear Form

Schedule

2006

INVOLUNTARY MOVE OF A MOBILE HOME

MH

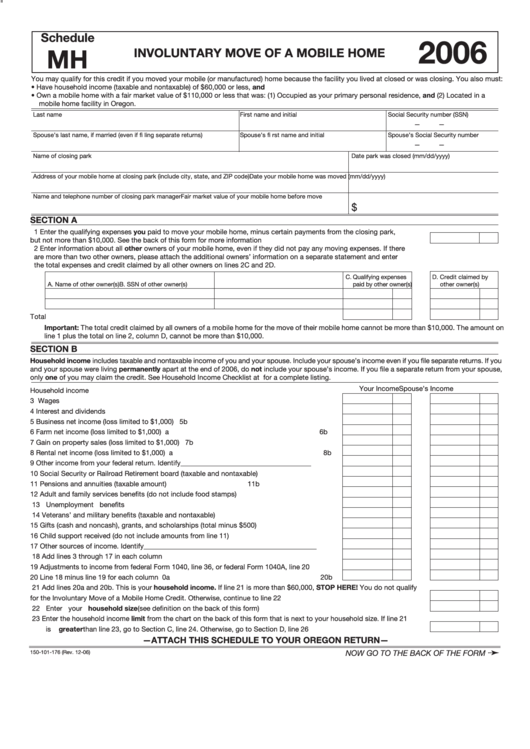

You may qualify for this credit if you moved your mobile (or manufactured) home because the facility you lived at closed or was closing. You also must:

• Have household income (taxable and nontaxable) of $60,000 or less, and

• Own a mobile home with a fair market value of $110,000 or less that was: (1) Occupied as your primary personal residence, and (2) Located in a

mobile home facility in Oregon.

Last name

First name and initial

Social Security number (SSN)

—

—

Spouse’s last name, if married (even if fi ling separate returns)

Spouse’s fi rst name and initial

Spouse’s Social Security number

—

—

Name of closing park

Date park was closed (mm/dd/yyyy)

Address of your mobile home at closing park (include city, state, and ZIP code)

Date your mobile home was moved (mm/dd/yyyy)

Name and telephone number of closing park manager

Fair market value of your mobile home before move

$

SECTION A

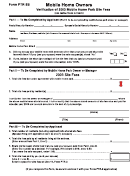

1 Enter the qualifying expenses you paid to move your mobile home, minus certain payments from the closing park,

but not more than $10,000. See the back of this form for more information ........................................................................... 1

2 Enter information about all other owners of your mobile home, even if they did not pay any moving expenses. If there

are more than two other owners, please attach the additional owners’ information on a separate statement and enter

the total expenses and credit claimed by all other owners on lines 2C and 2D.

C. Qualifying expenses

D. Credit claimed by

A. Name of other owner(s)

B. SSN of other owner(s)

paid by other owner(s)

other owner(s)

Total .......................................................................................................................................... 2C

2D

Important: The total credit claimed by all owners of a mobile home for the move of their mobile home cannot be more than $10,000. The amount on

line 1 plus the total on line 2, column D, cannot be more than $10,000.

SECTION B

Household income includes taxable and nontaxable income of you and your spouse. Include your spouse’s income even if you file separate returns. If you

and your spouse were living permanently apart at the end of 2006, do not include your spouse’s income. If you file a separate return from your spouse,

only one of you may claim the credit. See Household Income Checklist at for a complete listing.

Your Income

Spouse’s Income

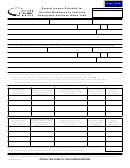

Household income

3 Wages ...................................................................................................................................... 3a

3b

4 Interest and dividends .............................................................................................................. 4a

4b

5 Business net income (loss limited to $1,000) ........................................................................... 5a

5b

6 Farm net income (loss limited to $1,000) ................................................................................. 6a

6b

7 Gain on property sales (loss limited to $1,000) ........................................................................ 7a

7b

8 Rental net income (loss limited to $1,000) ............................................................................... 8a

8b

9 Other income from your federal return. Identify_____________________________________ .... 9a

9b

10 Social Security or Railroad Retirement board (taxable and nontaxable) ................................. 10a

10b

11 Pensions and annuities (taxable amount) ................................................................................ 11a

11b

12 Adult and family services benefits (do not include food stamps) ............................................ 12a

12b

13 Unemployment benefits ........................................................................................................... 13a

13b

14 Veterans’ and military benefits (taxable and nontaxable) ......................................................... 14a

14b

15 Gifts (cash and noncash), grants, and scholarships (total minus $500) .................................. 15a

15b

16 Child support received (do not include amounts from line 11) ................................................ 16a

16b

17 Other sources of income. Identify_________________________________________________ .... 17a

17b

18 Add lines 3 through 17 in each column .................................................................................... 18a

18b

19 Adjustments to income from federal Form 1040, line 36, or federal Form 1040A, line 20 ...... 19a

19b

20 Line 18 minus line 19 for each column .................................................................................... 20a

20b

21 Add lines 20a and 20b. This is your household income. If line 21 is more than $60,000, STOP HERE! You do not qualify

for the Involuntary Move of a Mobile Home Credit. Otherwise, continue to line 22 ................................................................. 21

22 Enter your household size (see definition on the back of this form) ........................................................................................ 22

23 Enter the household income limit from the chart on the back of this form that is next to your household size. If line 21

is greater than line 23, go to Section C, line 24. Otherwise, go to Section D, line 26 ............................................................. 23

—ATTACH THIS SCHEDULE TO YOUR OREGON RETURN—

➛

150-101-176 (Rev. 12-06)

NOW GO TO THE BACK OF THE FORM

1

1 2

2