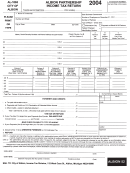

SCHEDULE C - INCOME FROM PARTNERSHIP

IF A COPY OF YOUR U.S. PARTNERSHIP RETURN OF INCOME IS ATTACHED, OMIT THIS SCHEDULE.

For the Year Ending __________________________________, 19 ______

A. Name as shown on page 1 of Form AL-1065

B. Principal Business Activity

C. Business Location

(Number and street or rural route)

(City or post office)

(State)

(Zip Code)

D. Telephone

Name of Person in Charge of Records

ORDINARY INCOME FROM BUSINESS

1. $

1.

Gross receipts after deducting allowances, rebates and returns

$

2.

Inventory at beginning of year (if different than last year's closing inventory, attach explanation)

2.

3.

Cost of merchandise purchased _________________________, less any items withdrawn

from business for personal use

3.

4.

Cost of labor (do not include amounts paid to partners)

4.

5.

Material and supplies

5.

6.

Other costs (explain in attached statement)

6.

7.

Total of lines 2 through 6

7.

8.

Inventory at end of year

8.

9.

Cost of goods sold (line 7 less line 8)

9.

10.

Gross profit (subtract line 9 from line 1)

10.

11.

Miscellaneous income (do not include any items included on lines 25 through 31)

11.

12.

Total income (add lines 10 and 11)

12.

OTHER BUSINESS DEDUCTIONS

$

13.

Salaries and wages not included on line 4 (exclude any paid to partners)

13.

14.

Payments to partners - salaries and interest - enter here and on Sch. E, Col 2

14.

15.

Rent on business property

15.

16.

Losses of business property (attach statement listing items and location)

16.

17.

Depreciation

17.

18.

Taxes

18.

19.

Other business expenses (attach statement)

19.

20.

Total of lines 13 through 19

20.

21.

Ordinary income from business - line 12 less line 20

21.

22.

City of Albion and Michigan income tax if included in line 20 above

22.

23.

Interest and other costs included in line 20 which were incurred in connection with the production of tax

exempt income or partner's personal expenses which were charged to the business

23.

24.

Total adjusted ordinary income from business for the year (add lines 21 through 23). Enter here and on

Sch. E, Col. 1

24.

OTHER PARTNERSHIP INCOME OR LOSS

(taxable or nontaxable depending on residency of partners)

25.

Dividends $ _____________________, Interest $ _____________________ (enter total of dividends and interest)

25.

26.

Income (or loss) from other partnerships and other income

26.

*27.

Net gain (or loss) from sale or exchange of property other than capital assets (See Note)

*27.

*28.

Net short term gain (or loss) from sale or exchange of capital assets (See Note)

*28.

*29.

Net long term gain (or loss) from sale or exchange of capital assets (See Note)

*29.

*30.

Net gain (or loss) from sale or exchange of property under Section 1231

*30.

31.

Rents $ __________________, Royalties $ _________________ (enter total of rents and royalties)

31.

32.

Total partnership income to account for (add lines 24 through 31)

32.

*NOTE: The amounts on lines 27, 28, 29 and 30 should agree with the amounts reported on Schedule D of your federal partnership form 1065.

SCHEDULES B AND E ARE TO BE USED TO COMPUTE THE

TAXABLE PORTION OF THE INCOME OF THE PARTNERSHIP AS SHOWN ON LINE 32 ABOVE

AL-1065 Page 2.

1

1 2

2 3

3 4

4