Form Ui-3s - Employer'S Quarterly Unemployment Wage And Tax Substitute Report

ADVERTISEMENT

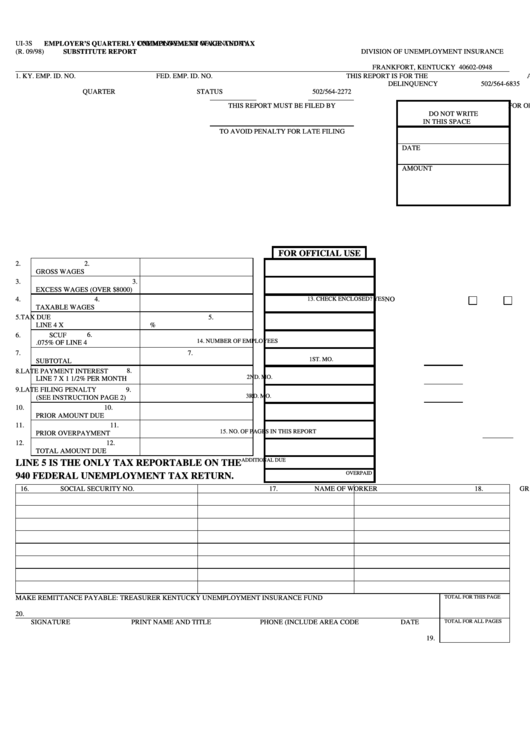

UI-3S

COMMONWEALTH OF KENTUCKY

EMPLOYER’S QUARTERLY UNEMPLOYMENT WAGE AND TAX

(R. 09/98)

DIVISION OF UNEMPLOYMENT INSURANCE

SUBSTITUTE REPORT

P.O. BOX 948

FRANKFORT, KENTUCKY 40602-0948

1. KY. EMP. ID. NO.

FED. EMP. ID. NO.

THIS REPORT IS FOR THE

ACCOUNTING

502/564-2168

DELINQUENCY

502/564-6835

QUARTER

STATUS

502/564-2272

THIS REPORT MUST BE FILED BY

FOR OFFICIAL USE

DO NOT WRITE

IN THIS SPACE

TO AVOID PENALTY FOR LATE FILING

DATE

AMOUNT

FOR OFFICIAL USE

2.

2.

GROSS WAGES

3.

3.

EXCESS WAGES (OVER $8000)

4.

4.

13. CHECK ENCLOSED? YES

NO

TAXABLE WAGES

5.

TAX DUE

5.

LINE 4 X

%

6.

SCUF

6.

14. NUMBER OF EMPLOYEES

.075% OF LINE 4

7.

7.

1ST. MO.

SUBTOTAL

8.

LATE PAYMENT INTEREST

8.

2ND. MO.

LINE 7 X 1 1/2% PER MONTH

9.

LATE FILING PENALTY

9.

3RD. MO.

(SEE INSTRUCTION PAGE 2)

10.

10.

PRIOR AMOUNT DUE

11.

11.

15. NO. OF PAGES IN THIS REPORT

PRIOR OVERPAYMENT

12.

12.

TOTAL AMOUNT DUE

ADDITIONAL DUE

LINE 5 IS THE ONLY TAX REPORTABLE ON THE

OVERPAID

940 FEDERAL UNEMPLOYMENT TAX RETURN.

16.

SOCIAL SECURITY NO.

17.

NAME OF WORKER

18.

GROSS WAGES

TOTAL FOR THIS PAGE

MAKE REMITTANCE PAYABLE: TREASURER KENTUCKY UNEMPLOYMENT INSURANCE FUND

20.

TOTAL FOR ALL PAGES

SIGNATURE

PRINT NAME AND TITLE

PHONE (INCLUDE AREA CODE

DATE

19.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1