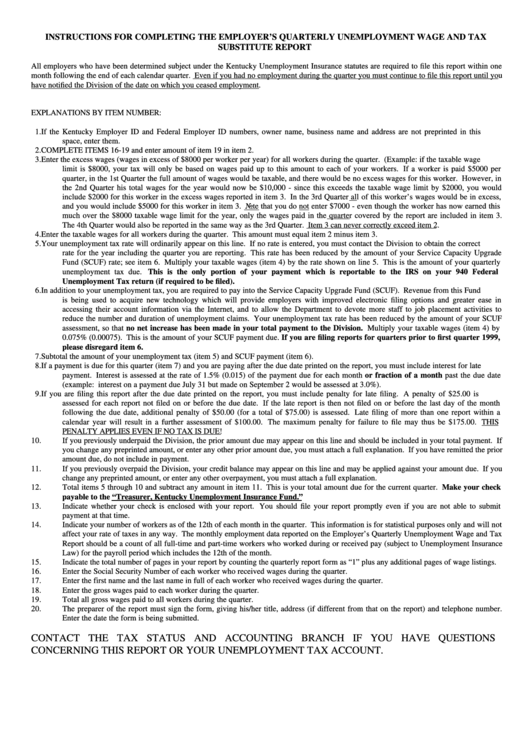

Instructions For Completing The Employer'S Quarterly Unemployment Wage And Tax Substitute Report Form

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING THE EMPLOYER’S QUARTERLY UNEMPLOYMENT WAGE AND TAX

SUBSTITUTE REPORT

All employers who have been determined subject under the Kentucky Unemployment Insurance statutes are required to file this report within one

month following the end of each calendar quarter. Even if you had no employment during the quarter you must continue to file this report until you

have notified the Division of the date on which you ceased employment.

EXPLANATIONS BY ITEM NUMBER:

1.

If the Kentucky Employer ID and Federal Employer ID numbers, owner name, business name and address are not preprinted in this

space, enter them.

2.

COMPLETE ITEMS 16-19 and enter amount of item 19 in item 2.

3.

Enter the excess wages (wages in excess of $8000 per worker per year) for all workers during the quarter. (Example: if the taxable wage

limit is $8000, your tax will only be based on wages paid up to this amount to each of your workers. If a worker is paid $5000 per

quarter, in the 1st Quarter the full amount of wages would be taxable, and there would be no excess wages for this worker. However, in

the 2nd Quarter his total wages for the year would now be $10,000 - since this exceeds the taxable wage limit by $2000, you would

include $2000 for this worker in the excess wages reported in item 3. In the 3rd Quarter all of this worker’s wages would be in excess,

and you would include $5000 for this worker in item 3. Note that you do not enter $7000 - even though the worker has now earned this

much over the $8000 taxable wage limit for the year, only the wages paid in the quarter covered by the report are included in item 3.

The 4th Quarter would also be reported in the same way as the 3rd Quarter. Item 3 can never correctly exceed item 2.

4.

Enter the taxable wages for all workers during the quarter. This amount must equal item 2 minus item 3.

5.

Your unemployment tax rate will ordinarily appear on this line. If no rate is entered, you must contact the Division to obtain the correct

rate for the year including the quarter you are reporting. This rate has been reduced by the amount of your Service Capacity Upgrade

Fund (SCUF) rate; see item 6. Multiply your taxable wages (item 4) by the rate shown on line 5. This is the amount of your quarterly

unemployment tax due.

This is the only portion of your payment which is reportable to the IRS on your 940 Federal

Unemployment Tax return (if required to be filed).

6.

In addition to your unemployment tax, you are required to pay into the Service Capacity Upgrade Fund (SCUF). Revenue from this Fund

is being used to acquire new technology which will provide employers with improved electronic filing options and greater ease in

accessing their account information via the Internet, and to allow the Department to devote more staff to job placement activities to

reduce the number and duration of unemployment claims. Your unemployment tax rate has been reduced by the amount of your SCUF

assessment, so that no net increase has been made in your total payment to the Division. Multiply your taxable wages (item 4) by

0.075% (0.00075). This is the amount of your SCUF payment due. If you are filing reports for quarters prior to first quarter 1999,

please disregard item 6.

7.

Subtotal the amount of your unemployment tax (item 5) and SCUF payment (item 6).

8.

If a payment is due for this quarter (item 7) and you are paying after the due date printed on the report, you must include interest for late

payment. Interest is assessed at the rate of 1.5% (0.015) of the payment due for each month or fraction of a month past the due date

(example: interest on a payment due July 31 but made on September 2 would be assessed at 3.0%).

9.

If you are filing this report after the due date printed on the report, you must include penalty for late filing. A penalty of $25.00 is

assessed for each report not filed on or before the due date. If the late report is then not filed on or before the last day of the month

following the due date, additional penalty of $50.00 (for a total of $75.00) is assessed. Late filing of more than one report within a

calendar year will result in a further assessment of $100.00. The maximum penalty for failure to file may thus be $175.00. THIS

PENALTY APPLIES EVEN IF NO TAX IS DUE!

10.

If you previously underpaid the Division, the prior amount due may appear on this line and should be included in your total payment. If

you change any preprinted amount, or enter any other prior amount due, you must attach a full explanation. If you have remitted the prior

amount due, do not include in payment.

11.

If you previously overpaid the Division, your credit balance may appear on this line and may be applied against your amount due. If you

change any preprinted amount, or enter any other overpayment, you must attach a full explanation.

12.

Total items 5 through 10 and subtract any amount in item 11. This is your total amount due for the current quarter. Make your check

payable to the “Treasurer, Kentucky Unemployment Insurance Fund.”

13.

Indicate whether your check is enclosed with your report. You should file your report promptly even if you are not able to submit

payment at that time.

14.

Indicate your number of workers as of the 12th of each month in the quarter. This information is for statistical purposes only and will not

affect your rate of taxes in any way. The monthly employment data reported on the Employer’s Quarterly Unemployment Wage and Tax

Report should be a count of all full-time and part-time workers who worked during or received pay (subject to Unemployment Insurance

Law) for the payroll period which includes the 12th of the month.

15.

Indicate the total number of pages in your report by counting the quarterly report form as “1” plus any additional pages of wage listings.

16.

Enter the Social Security Number of each worker who received wages during the quarter.

17.

Enter the first name and the last name in full of each worker who received wages during the quarter.

18.

Enter the gross wages paid to each worker during the quarter.

19.

Total all gross wages paid to all workers during the quarter.

20.

The preparer of the report must sign the form, giving his/her title, address (if different from that on the report) and telephone number.

Enter the date the form is being submitted.

CONTACT THE TAX STATUS AND ACCOUNTING BRANCH IF YOU HAVE QUESTIONS

CONCERNING THIS REPORT OR YOUR UNEMPLOYMENT TAX ACCOUNT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1