Form Mo-Nft - No Franchise Tax Due - 2014

ADVERTISEMENT

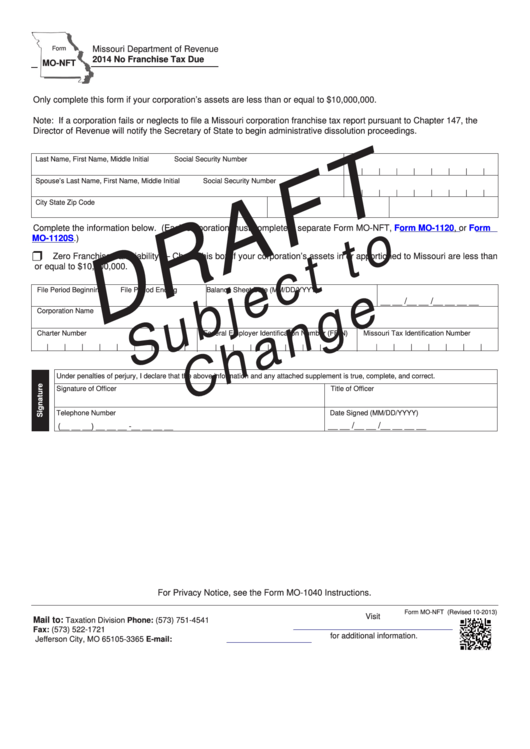

Missouri Department of Revenue

Form

2014 No Franchise Tax Due

MO-NFT

Only complete this form if your corporation’s assets are less than or equal to $10,000,000.

Note: If a corporation fails or neglects to file a Missouri corporation franchise tax report pursuant to Chapter 147, the

Director of Revenue will notify the Secretary of State to begin administrative dissolution proceedings.

Last Name, First Name, Middle Initial

Social Security Number

|

|

|

|

|

|

|

|

Spouse’s Last Name, First Name, Middle Initial

Social Security Number

|

|

|

|

|

|

|

|

City

State

Zip Code

Complete the information below. (Each corporation must complete a separate Form MO-NFT,

Form

MO-1120, or

Form

MO-1120S.)

r

Zero Franchise Tax Liability — Check this box if your corporation’s assets in or apportioned to Missouri are less than

or equal to $10,000,000.

File Period Beginning

File Period Ending

Balance Sheet Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Corporation Name

Charter Number

Federal Employer Identification Number (FEIN)

Missouri Tax Identification Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature of Officer

Title of Officer

Telephone Number

Date Signed (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

(__ __ __) __ __ __ -__ __ __ __

For Privacy Notice, see the Form MO-1040 Instructions.

Form MO-NFT (Revised 10-2013)

Visit

Mail to:

Taxation Division

Phone: (573) 751-4541

P.O. Box 3365

Fax: (573) 522-1721

for additional information.

Jefferson City, MO 65105-3365

E-mail:

franchise@dor.mo.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1