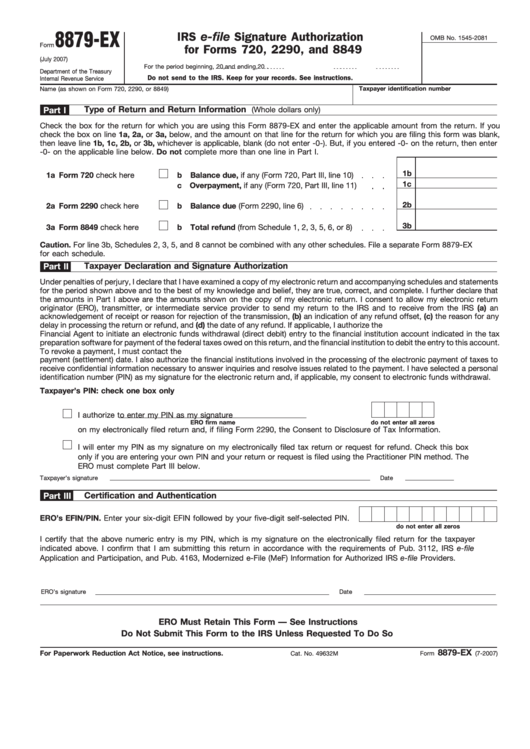

8879-EX

IRS e-file Signature Authorization

OMB No. 1545-2081

Form

for Forms 720, 2290, and 8849

(July 2007)

For the period beginning

,

20

,

and ending

, 20

.

Department of the Treasury

Do not send to the IRS. Keep for your records.

See instructions.

Internal Revenue Service

Name (as shown on Form 720, 2290, or 8849)

Taxpayer identification number

Type of Return and Return Information

Part I

(Whole dollars only)

Check the box for the return for which you are using this Form 8879-EX and enter the applicable amount from the return. If you

check the box on line 1a, 2a, or 3a, below, and the amount on that line for the return for which you are filing this form was blank,

then leave line 1b, 1c, 2b, or 3b, whichever is applicable, blank (do not enter -0-). But, if you entered -0- on the return, then enter

-0- on the applicable line below. Do not complete more than one line in Part I.

1b

1a

Form 720 check here

b

Balance due, if any (Form 720, Part III, line 10)

1c

c

Overpayment, if any (Form 720, Part III, line 11)

2b

2a

Form 2290 check here

b

Balance due (Form 2290, line 6)

3b

3a

Form 8849 check here

b

Total refund (from Schedule 1, 2, 3, 5, 6, or 8)

Caution. For line 3b, Schedules 2, 3, 5, and 8 cannot be combined with any other schedules. File a separate Form 8879-EX

for each schedule.

Taxpayer Declaration and Signature Authorization

Part II

Under penalties of perjury, I declare that I have examined a copy of my electronic return and accompanying schedules and statements

for the period shown above and to the best of my knowledge and belief, they are true, correct, and complete. I further declare that

the amounts in Part I above are the amounts shown on the copy of my electronic return. I consent to allow my electronic return

originator (ERO), transmitter, or intermediate service provider to send my return to the IRS and to receive from the IRS (a) an

acknowledgement of receipt or reason for rejection of the transmission, (b) an indication of any refund offset, (c) the reason for any

delay in processing the return or refund, and (d) the date of any refund. If applicable, I authorize the U.S. Treasury and its designated

Financial Agent to initiate an electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax

preparation software for payment of the federal taxes owed on this return, and the financial institution to debit the entry to this account.

To revoke a payment, I must contact the U.S. Treasury Financial Agent at 1-888-353-4537 no later than 2 business days before the

payment (settlement) date. I also authorize the financial institutions involved in the processing of the electronic payment of taxes to

receive confidential information necessary to answer inquiries and resolve issues related to the payment. I have selected a personal

identification number (PIN) as my signature for the electronic return and, if applicable, my consent to electronic funds withdrawal.

Taxpayer’s PIN: check one box only

I authorize

to enter my PIN

as my signature

ERO firm name

do not enter all zeros

on my electronically filed return and, if filing Form 2290, the Consent to Disclosure of Tax Information.

I will enter my PIN as my signature on my electronically filed tax return or request for refund. Check this box

only if you are entering your own PIN and your return or request is filed using the Practitioner PIN method. The

ERO must complete Part III below.

Taxpayer’s signature

Date

Certification and Authentication

Part III

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the electronically filed return for the taxpayer

indicated above. I confirm that I am submitting this return in accordance with the requirements of Pub. 3112, IRS e-file

Application and Participation, and Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers.

ERO’s signature

Date

ERO Must Retain This Form — See Instructions

Do Not Submit This Form to the IRS Unless Requested To Do So

8879-EX

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 49632M

Form

(7-2007)

1

1