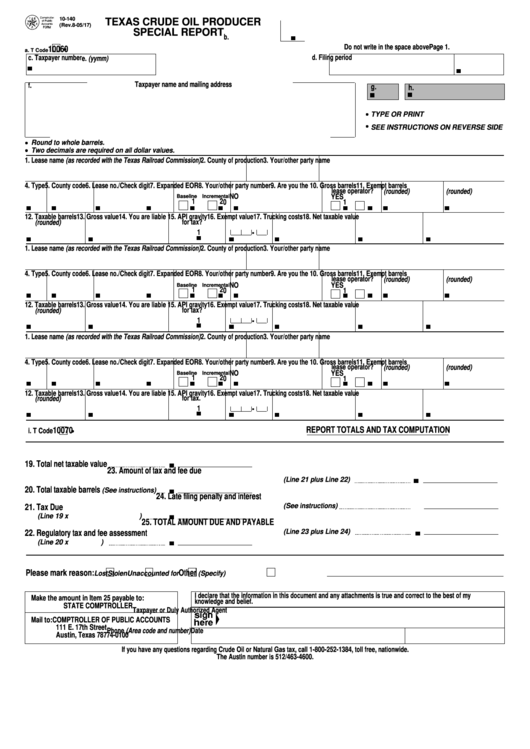

10-140

TEXAS CRUDE OIL PRODUCER

(Rev.8-05/17)

SPECIAL REPORT

b.

Do not write in the space above

Page 1.

10060

a. T Code

d. Filing period

c. Taxpayer number

e. (yymm)

Taxpayer name and mailing address

f.

g.

h.

TYPE OR PRINT

SEE INSTRUCTIONS ON REVERSE SIDE

Round to whole barrels.

Two decimals are required on all dollar values.

1. Lease name (as recorded with the Texas Railroad Commission)

2. County of production

3. Your/other party name

4. Type 5. County code 6. Lease no./Check digit

7. Expanded EOR

8. Your/other party number

9. Are you the

10. Gross barrels

11. Exempt barrels

lease operator?

(rounded)

(rounded)

NO

YES

Baseline Incremental

1

2

0

1

12. Taxable barrels

13. Gross value

14. You are liable

15. API gravity 16. Exempt value

17. Trucking costs

18. Net taxable value

(rounded)

for tax?

.

1

1. Lease name (as recorded with the Texas Railroad Commission)

2. County of production

3. Your/other party name

4. Type 5. County code 6. Lease no./Check digit

7. Expanded EOR

8. Your/other party number

9. Are you the

10. Gross barrels

11. Exempt barrels

lease operator?

(rounded)

(rounded)

YES

NO

Baseline Incremental

1

2

1

0

12. Taxable barrels

13. Gross value

14. You are liable

15. API gravity 16. Exempt value

17. Trucking costs

18. Net taxable value

for tax?

(rounded)

.

1

1. Lease name (as recorded with the Texas Railroad Commission)

2. County of production

3. Your/other party name

4. Type 5. County code 6. Lease no./Check digit

7. Expanded EOR

8. Your/other party number

9. Are you the

10. Gross barrels

11. Exempt barrels

lease operator?

(rounded)

(rounded)

NO

YES

Baseline Incremental

1

2

0

1

12. Taxable barrels

13. Gross value

14. You are liable

15. API gravity 16. Exempt value

17. Trucking costs

18. Net taxable value

for tax.

(rounded)

.

1

10070

REPORT TOTALS AND TAX COMPUTATION

i. T Code

19. Total net taxable value

23. Amount of tax and fee due

(Line 21 plus Line 22)

20. Total taxable barrels

(See instructions)

24. Late filing penalty and interest

(See instructions)

21. Tax Due

(Line 19 x

)

25. TOTAL AMOUNT DUE AND PAYABLE

(Line 23 plus Line 24)

22. Regulatory tax and fee assessment

(Line 20 x

)

Please mark reason:

Other

Lost

Stolen

Unaccounted for

(Specify)

I declare that the information in this document and any attachments is true and correct to the best of my

Make the amount in Item 25 payable to:

knowledge and belief.

STATE COMPTROLLER

Taxpayer or Duly Authorized Agent

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Phone (Area code and number)

Date

Austin, Texas 78774-0100

If you have any questions regarding Crude Oil or Natural Gas tax, call 1-800-252-1384, toll free, nationwide.

The Austin number is 512/463-4600.

1

1 2

2