Form Ww-1 - Employer'S Return Of Tax Withheld - 2016

ADVERTISEMENT

2016

2016

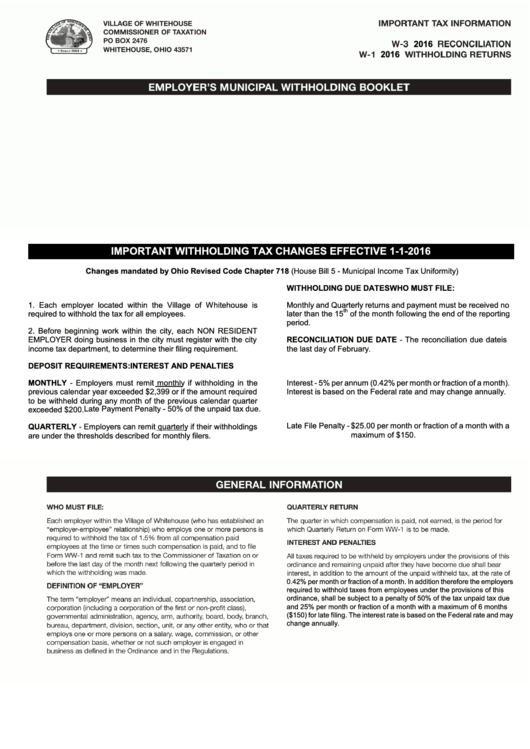

IMPORTANT WITHHOLDING TAX CHANGES EFFECTIVE 1-1-2016

Changes mandated by Ohio Revised Code Chapter 718 (House Bill 5 - Municipal Income Tax Uniformity)

WHO MUST FILE:

WITHHOLDING DUE DATES

1. Each employer located within the Village of Whitehouse is

Monthly and Quarterly returns and payment must be received no

th

required to withhold the tax for all employees.

later than the 15

of the month following the end of the reporting

period.

2. Before beginning work within the city, each NON RESIDENT

EMPLOYER doing business in the city must register with the city

RECONCILIATION DUE DATE - The reconciliation due date is

income tax department, to determine their filing requirement.

the last day of February.

DEPOSIT REQUIREMENTS:

INTEREST AND PENALTIES

MONTHLY - Employers must remit monthly if withholding in the

Interest - 5% per annum (0.42% per month or fraction of a month).

previous calendar year exceeded $2,399 or if the amount required

Interest is based on the Federal rate and may change annually.

to be withheld during any month of the previous calendar quarter

Late Payment Penalty - 50% of the unpaid tax due.

exceeded $200.

Late File Penalty -

$25.00 per month or fraction of a month with a

QUARTERLY - Employers can remit quarterly if their withholdings

maximum of $150.

are under the thresholds described for monthly filers.

0.42% per month or fraction of a month. In addition therefore the employers

required to withhold taxes from employees under the provisions of this

ordinance, shall be subject to a penalty of 50% of the tax unpaid tax due

and 25% per month or fraction of a month with a maximum of 6 months

($150) for late filing. The interest rate is based on the Federal rate and may

change annually.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4