Form Rd-106a - Instructions For Preparing And Filing Convention And Tourism Tax Return (Hotel/motel)

ADVERTISEMENT

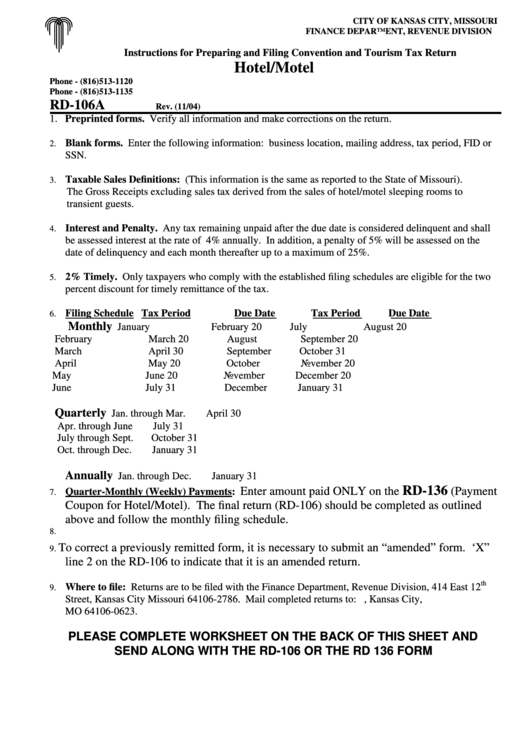

CITY OF KANSAS CITY, MISSOURI

FINANCE DEPARTMENT, REVENUE DIVISION

Instructions for Preparing and Filing Convention and Tourism Tax Return

Hotel/Motel

Phone - (816)513-1120

Phone - (816)513-1135

RD-106A

Rev. (11/04)

1. Preprinted forms. Verify all information and make corrections on the return.

Blank forms. Enter the following information: business location, mailing address, tax period, FID or

2.

SSN.

Taxable Sales Definitions: (This information is the same as reported to the State of Missouri).

3.

The Gross Receipts excluding sales tax derived from the sales of hotel/motel sleeping rooms to

transient guests.

Interest and Penalty. Any tax remaining unpaid after the due date is considered delinquent and shall

4.

be assessed interest at the rate of 4% annually. In addition, a penalty of 5% will be assessed on the

date of delinquency and each month thereafter up to a maximum of 25%.

2% Timely. Only taxpayers who comply with the established filing schedules are eligible for the two

5.

percent discount for timely remittance of the tax.

Filing Schedule Tax Period

Due Date

Tax Period

Due Date

6.

Monthly

January

February 20

July

August 20

February

March 20

August

September 20

March

April 30

September

October 31

April

May 20

October

November 20

May

June 20

November

December 20

June

July 31

December

January 31

Quarterly

Jan. through Mar.

April 30

Apr. through June

July 31

July through Sept.

October 31

Oct. through Dec.

January 31

Annually

Jan. through Dec.

January 31

RD-136

Enter amount paid ONLY on the

(Payment

Quarter-Monthly (Weekly) Payments:

7.

Coupon for Hotel/Motel). The final return (RD-106) should be completed as outlined

above and follow the monthly filing schedule.

8.

To correct a previously remitted form, it is necessary to submit an “amended” form. ‘X”

9.

line 2 on the RD-106 to indicate that it is an amended return.

th

Where to file: Returns are to be filed with the Finance Department, Revenue Division, 414 East 12

9.

Street, Kansas City Missouri 64106-2786. Mail completed returns to: P.O. Box 15623, Kansas City,

MO 64106-0623.

PLEASE COMPLETE WORKSHEET ON THE BACK OF THIS SHEET AND

SEND ALONG WITH THE RD-106 OR THE RD 136 FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2