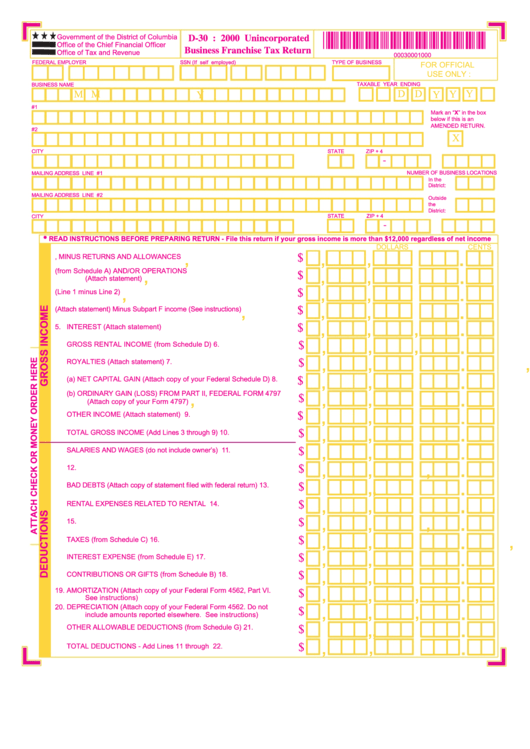

Form D-30 - Unincorporated Business Franchise Tax Return - 2000

ADVERTISEMENT

*00030001000*

Government of the District of Columbia

D-30 : 2000 Unincorporated

Office of the Chief Financial Officer

Business Franchise Tax Return

Office of Tax and Revenue

00030001000

FEDERAL EMPLOYER I.D. NUMBER

SSN (If self employed)

TYPE OF BUSINESS

FOR OFFICIAL

USE ONLY :

BUSINESS NAME

TAXABLE YEAR ENDING

M M

D D

Y

Y

Y

Y

D.C. ADDRESS LINE #1

Mark an “X” in the box

below if this is an

AMENDED RETURN.

D.C. ADDRESS LINE #2

X

CITY

STATE

ZIP + 4

-

NUMBER OF BUSINESS LOCATIONS

MAILING ADDRESS LINE #1

In the

District:

MAILING ADDRESS LINE #2

Outside

the

District:

STATE

CITY

ZIP + 4

-

•

READ INSTRUCTIONS BEFORE PREPARING RETURN - File this return if your gross income is more than $12,000 regardless of net income

DOLLARS

CENTS

$

1. GROSS RECEIPTS, MINUS RETURNS AND ALLOWANCES ......................

,

,

,

2. COST OF GOODS SOLD (from Schedule A) AND/OR OPERATIONS

$

,

,

,

(Attach statement)................................................................................

$

3. GROSS PROFIT (Line 1 minus Line 2).........................................................

,

,

,

$

4. DIVIDENDS (Attach statement) Minus Subpart F income (See instructions)

,

,

,

$

5.

INTEREST (Attach statement) ..................................................................

,

,

,

$

6.

GROSS RENTAL INCOME (from Schedule D)...........................................

,

,

,

$

7.

ROYALTIES (Attach statement).....................................................................

,

,

,

$

8.

(a) NET CAPITAL GAIN (Attach copy of your Federal Schedule D)..............

,

,

,

(b) ORDINARY GAIN (LOSS) FROM PART II, FEDERAL FORM 4797

$

,

,

,

(Attach copy of your Form 4797).......................................................

$

9.

OTHER INCOME (Attach statement) ..........................................................

,

,

,

$

10.

TOTAL GROSS INCOME (Add Lines 3 through 9)...........................................

,

,

,

$

11.

SALARIES AND WAGES (do not include owner’s) ..........................................

,

,

,

$

12.

REPAIRS............................................................................................................

,

,

,

$

13.

BAD DEBTS (Attach copy of statement filed with federal return).....................

,

,

,

$

14.

RENTAL EXPENSES RELATED TO RENTAL INCOME..................................

,

,

,

$

15.

RENT ..............................................................................................................

,

,

,

$

16.

TAXES (from Schedule C).............................................................................

,

,

,

$

17.

INTEREST EXPENSE (from Schedule E).....................................................

,

,

,

$

18.

CONTRIBUTIONS OR GIFTS (from Schedule B).........................................

,

,

,

19.

AMORTIZATION (Attach copy of your Federal Form 4562, Part VI.

$

,

,

,

See instructions) ...............................................................................

20.

DEPRECIATION (Attach copy of your Federal Form 4562. Do not

$

,

,

,

include amounts reported elsewhere. See instructions)...................

21.

OTHER ALLOWABLE DEDUCTIONS (from Schedule G) .............................

$

,

,

,

$

,

,

,

22.

TOTAL DEDUCTIONS - Add Lines 11 through 21.........................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5