Instructions For Form T-77 - Discharge Of Estate Tax Lien

ADVERTISEMENT

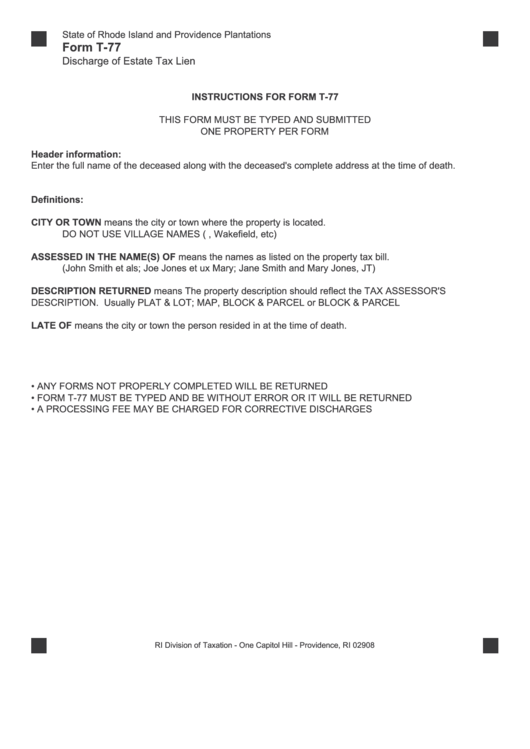

State of Rhode Island and Providence Plantations

Form T-77

Discharge of Estate Tax Lien

INSTRUCTIONS FOR FORM T-77

THIS FORM MUST BE TYPED AND SUBMITTED

ONE PROPERTY PER FORM

Header information:

Enter the full name of the deceased along with the deceased's complete address at the time of death.

Definitions:

CITY OR TOWN means the city or town where the property is located.

DO NOT USE VILLAGE NAMES (i.e. Esmond, Wakefield, etc)

ASSESSED IN THE NAME(S) OF means the names as listed on the property tax bill.

(John Smith et als; Joe Jones et ux Mary; Jane Smith and Mary Jones, JT)

DESCRIPTION RETURNED means The property description should reflect the TAX ASSESSOR'S

DESCRIPTION. Usually PLAT & LOT; MAP, BLOCK & PARCEL or BLOCK & PARCEL

LATE OF means the city or town the person resided in at the time of death.

• ANY FORMS NOT PROPERLY COMPLETED WILL BE RETURNED

• FORM T-77 MUST BE TYPED AND BE WITHOUT ERROR OR IT WILL BE RETURNED

• A PROCESSING FEE MAY BE CHARGED FOR CORRECTIVE DISCHARGES

RI Division of Taxation - One Capitol Hill - Providence, RI 02908

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1