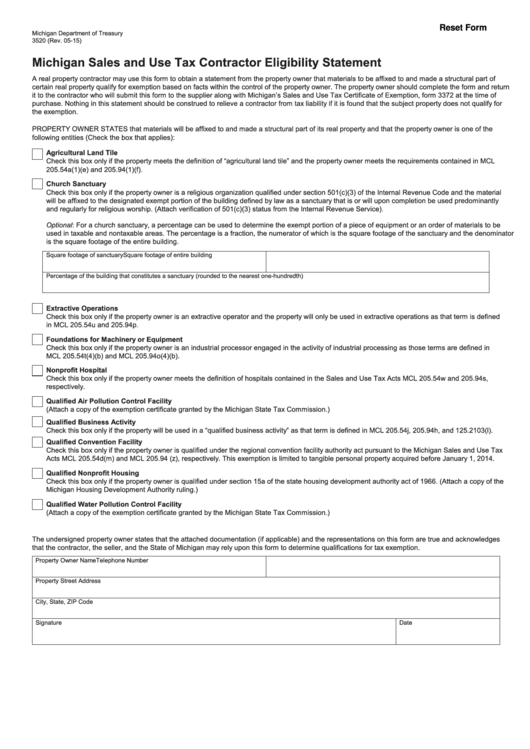

Reset Form

Michigan Department of Treasury

3520 (Rev. 05-15)

Michigan Sales and Use Tax Contractor Eligibility Statement

A real property contractor may use this form to obtain a statement from the property owner that materials to be affixed to and made a structural part of

certain real property qualify for exemption based on facts within the control of the property owner. The property owner should complete the form and return

it to the contractor who will submit this form to the supplier along with Michigan’s Sales and Use Tax Certificate of Exemption, form 3372 at the time of

purchase. Nothing in this statement should be construed to relieve a contractor from tax liability if it is found that the subject property does not qualify for

the exemption.

PROPERTY OWNER STATES that materials will be affixed to and made a structural part of its real property and that the property owner is one of the

following entities (Check the box that applies):

Agricultural Land Tile

Check this box only if the property meets the definition of “agricultural land tile” and the property owner meets the requirements contained in MCL

205.54a(1)(e) and 205.94(1)(f).

Church Sanctuary

Check this box only if the property owner is a religious organization qualified under section 501(c)(3) of the Internal Revenue Code and the material

will be affixed to the designated exempt portion of the building defined by law as a sanctuary that is or will upon completion be used predominantly

and regularly for religious worship. (Attach verification of 501(c)(3) status from the Internal Revenue Service).

Optional: For a church sanctuary, a percentage can be used to determine the exempt portion of a piece of equipment or an order of materials to be

used in taxable and nontaxable areas. The percentage is a fraction, the numerator of which is the square footage of the sanctuary and the denominator

is the square footage of the entire building.

Square footage of sanctuary

Square footage of entire building

Percentage of the building that constitutes a sanctuary (rounded to the nearest one-hundredth)

Extractive Operations

Check this box only if the property owner is an extractive operator and the property will only be used in extractive operations as that term is defined

in MCL 205.54u and 205.94p.

Foundations for Machinery or Equipment

Check this box only if the property owner is an industrial processor engaged in the activity of industrial processing as those terms are defined in

MCL 205.54t(4)(b) and MCL 205.94o(4)(b).

Nonprofit Hospital

Check this box only if the property owner meets the definition of hospitals contained in the Sales and Use Tax Acts MCL 205.54w and 205.94s,

respectively.

Qualified Air Pollution Control Facility

(Attach a copy of the exemption certificate granted by the Michigan State Tax Commission.)

Qualified Business Activity

Check this box only if the property will be used in a “qualified business activity” as that term is defined in MCL 205.54j, 205.94h, and 125.2103(l).

Qualified Convention Facility

Check this box only if the property owner is qualified under the regional convention facility authority act pursuant to the Michigan Sales and Use Tax

Acts MCL 205.54d(m) and MCL 205.94 (z), respectively. This exemption is limited to tangible personal property acquired before January 1, 2014.

Qualified Nonprofit Housing

Check this box only if the property owner is qualified under section 15a of the state housing development authority act of 1966. (Attach a copy of the

Michigan Housing Development Authority ruling.)

Qualified Water Pollution Control Facility

(Attach a copy of the exemption certificate granted by the Michigan State Tax Commission.)

The undersigned property owner states that the attached documentation (if applicable) and the representations on this form are true and acknowledges

that the contractor, the seller, and the State of Michigan may rely upon this form to determine qualifications for tax exemption.

Property Owner Name

Telephone Number

Property Street Address

City, State, ZIP Code

Signature

Date

1

1