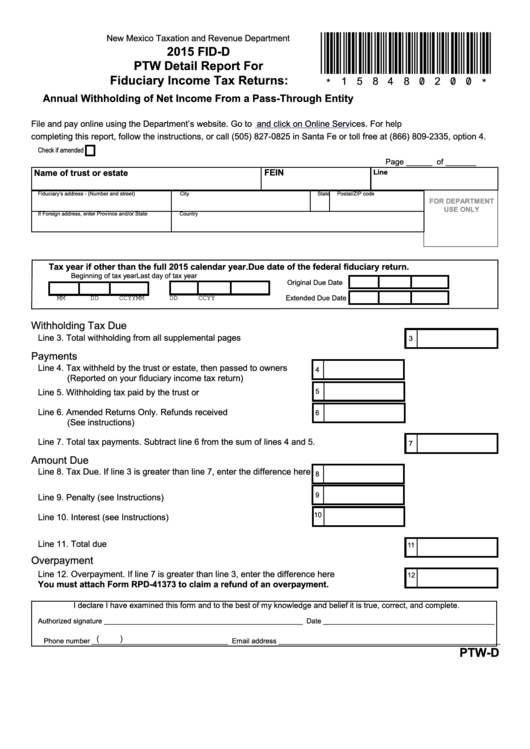

Form Fid-D - Ptw Detail Report For Fiduciary Income Tax Returns - Annual Withholding Of Net Income From A Pass-Through Entity - 2015

ADVERTISEMENT

New Mexico Taxation and Revenue Department

*158480200*

2015 FID-D

PTW Detail Report For

Fiduciary Income Tax Returns:

Annual Withholding of Net Income From a Pass-Through Entity

File and pay online using the Department’s website. Go to

and click on Online Services. For help

completing this report, follow the instructions, or call (505) 827-0825 in Santa Fe or toll free at (866) 809-2335, option 4.

Check if amended

Page ______ of _______

FEIN

Name of trust or estate

Line 1. Total New Mexico net income

Fiduciary’s address - (Number and street)

City

State

Postal/ZIP code

FOR DEPARTMENT

USE ONLY

If Foreign address, enter Province and/or State

Country

Tax year if other than the full 2015 calendar year.

Due date of the federal fiduciary return.

Beginning of tax year

Last day of tax year

Original Due Date

MM

DD

CCYY

MM

DD

CCYY

Extended Due Date

Withholding Tax Due

Line 3. Total withholding from all supplemental pages .................................................................

3

Payments

Line 4. Tax withheld by the trust or estate, then passed to owners .......

4

(Reported on your fiduciary income tax return)

Line 5. Withholding tax paid by the trust or estate.................................

5

Line 6. Amended Returns Only. Refunds received ................................

6

(See instructions)

Line 7. Total tax payments. Subtract line 6 from the sum of lines 4 and 5. ..................................

7

Amount Due

Line 8. Tax Due. If line 3 is greater than line 7, enter the difference here

8

9

Line 9. Penalty (see Instructions) ..........................................................

10

Line 10. Interest (see Instructions) ........................................................

Line 11. Total due .........................................................................................................................

11

Overpayment

Line 12. Overpayment. If line 7 is greater than line 3, enter the difference here ..........................

12

You must attach Form RPD-41373 to claim a refund of an overpayment.

I declare I have examined this form and to the best of my knowledge and belief it is true, correct, and complete.

Authorized signature ___________________________________________________ Date ____________________________________________

(

)

Phone number ___________________________________ Email address _________________________________________________________

PTW-D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3