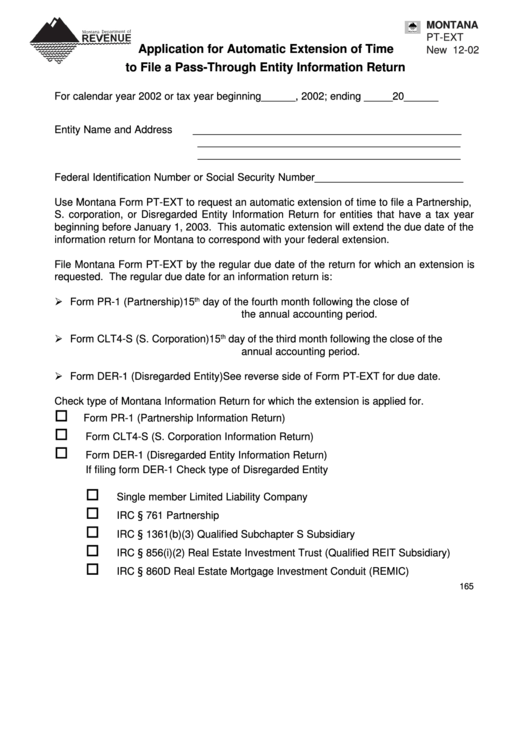

Form Pt-Ext - Application For Automatic Extension Of Time To File A Pass-Through Entity Information Return

ADVERTISEMENT

MONTANA

PT-EXT

Application for Automatic Extension of Time

New 12-02

to File a Pass-Through Entity Information Return

For calendar year 2002 or tax year beginning______, 2002; ending _____20______

Entity Name and Address

_______________________________________________

______________________________________________

______________________________________________

Federal Identification Number or Social Security Number__________________________

Use Montana Form PT-EXT to request an automatic extension of time to file a Partnership,

S. corporation, or Disregarded Entity Information Return for entities that have a tax year

beginning before January 1, 2003. This automatic extension will extend the due date of the

information return for Montana to correspond with your federal extension.

File Montana Form PT-EXT by the regular due date of the return for which an extension is

requested. The regular due date for an information return is:

th

Form PR-1 (Partnership)

15

day of the fourth month following the close of

the annual accounting period.

th

Form CLT4-S (S. Corporation)

15

day of the third month following the close of the

annual accounting period.

Form DER-1 (Disregarded Entity)

See reverse side of Form PT-EXT for due date.

Check type of Montana Information Return for which the extension is applied for.

Form PR-1 (Partnership Information Return)

Form CLT4-S (S. Corporation Information Return)

Form DER-1 (Disregarded Entity Information Return)

If filing form DER-1 Check type of Disregarded Entity

Single member Limited Liability Company

IRC § 761 Partnership

IRC § 1361(b)(3) Qualified Subchapter S Subsidiary

IRC § 856(i)(2) Real Estate Investment Trust (Qualified REIT Subsidiary)

IRC § 860D Real Estate Mortgage Investment Conduit (REMIC)

165

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1