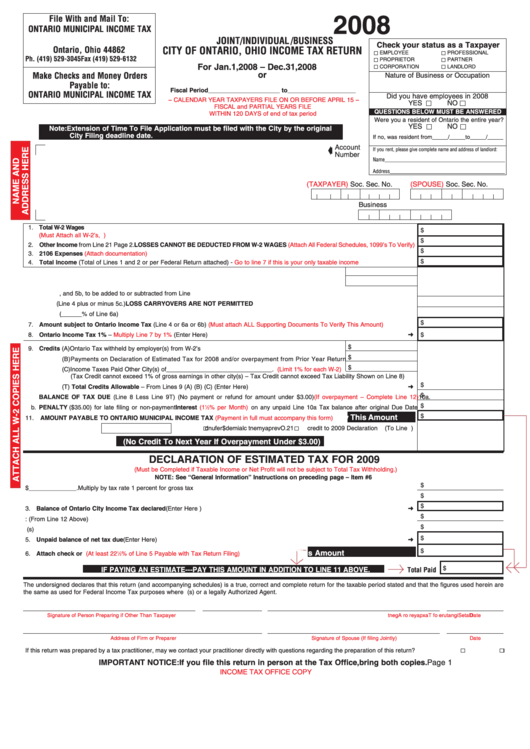

Income Tax Return - City Of Ontario - State Of Ohio - 2008

ADVERTISEMENT

File With and Mail To:

2008

ONTARIO MUNICIPAL INCOME TAX

P.O. Box 166

JOINT/INDIVIDUAL /BUSINESS

Check your status as a Taxpayer

Ontario, Ohio 44862

CITY OF ONTARIO, OHIO INCOME TAX RETURN

EMPLOYEE

PROFESSIONAL

Ph. (419) 529-3045 Fax (419) 529-6132

PROPRIETOR

PARTNER

For Jan. 1, 2008 – Dec. 31, 2008

CORPORATION

LANDLORD

or

Make Checks and Money Orders

Nature of Business or Occupation

Payable to:

Fiscal Period_____________________ to____________________

ONTARIO MUNICIPAL INCOME TAX

Did you have employees in 2008

– CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15 –

YES

NO

FISCAL and PARTIAL YEARS FILE

QUESTIONS BELOW MUST BE ANSWERED

WITHIN 120 DAYS of end of tax period

Were you a resident of Ontario the entire year?

YES

NO

Note: Extension of Time To File Application must be filed with the City by the original

City Filing deadline date.

If no, was resident from_____/_____to_____/_____

MO.

DAY

MO.

DAY

Account

If you rent, please give complete name and address of landlord:

Number

Name_____________________________________________

Address___________________________________________

(TAXPAYER)

Soc. Sec. No.

(SPOUSE)

Soc. Sec. No.

Business Fed. I.D. No.

1. Total W-2 Wages

$

(Must Attach all W-2’s, etc. To

Verify).....................................................................................................................................................................

$

2. Other Income from Line 21 Page 2. LOSSES CANNOT BE DEDUCTED FROM W-2 WAGES

(Attach All Federal Schedules, 1099’s To Verify)

$

3. 2106 Expenses

(Attach documentation)

$

4. Total Income (Total of Lines 1 and 2 or per Federal Return attached) -

Go to line 7 if this is your only taxable

income....................................

5a. Items not deductible from Line M Schedule X................................................................................... Add

b. Items not taxable from Line Z Schedule X.....................................................................................Deduct

c. Difference between Lines 5a, and 5b, to be added to or subtracted from Line 4.................................................................................

6a. Adjusted Net Income (Line 4 plus or minus 5c.) LOSS CARRYOVERS ARE NOT PERMITTED.......................................................

b. Amount allocable to Ontario if Schedule Y Page 2 is used (______% of Line 6a)...............................................................................

$

7. Amount subject to Ontario Income Tax (Line 4 or 6a or 6b)

(Must attach ALL Supporting Documents To Verify This Amount)

.....................

8. Ontario Income Tax 1% –

Multiply Line 7 by 1%

........................................................................................................................(Enter Here

)

$

$

9. Credits (A) Ontario Tax withheld by employer(s) from W-2’s .................................................................................

$

8. Credits

(B) Payments on Declaration of Estimated Tax for 2008 and/or overpayment from Prior Year Return

$

8. Credits

(C) Income Taxes Paid Other City(s) of_______________________________.

(Limit 1% for each W-2)

(Tax Credit cannot exceed 1% of gross earnings in other city(s) – Tax Credit cannot exceed Tax Liability Shown on Line 8)

$

8. Credits

(T) Total Credits Allowable – From Lines 9 (A) (B) (C).................................................................................................(Enter Here

)

$

10a.

BALANCE OF TAX DUE (Line 8 Less Line 9T) (No payment or refund for amount under $3.00)

(If overpayment – Complete Line 12)

$

b. PENALTY ($35.00) for late filing or non-payment Interest

(1

1

⁄

% per Month)

on any unpaid Line 10a Tax balance after original Due Date

2

$

Pay This Amount

11.

AMOUNT PAYABLE TO ONTARIO MUNICIPAL INCOME TAX

(Payment in full must accompany this form)

............

#

1

. 2

O

e v

p r

y a

m

e

t n

c

i a l

m

e

d

$

e r

u f

n

d

credit to 2009 Declaration

(To Line 4A. Below)

(No Credit To Next Year If Overpayment Under $3.00)

DECLARATION OF ESTIMATED TAX FOR 2009

(Must be Completed if Taxable Income or Net Profit will not be subject to Total Tax Withholding.)

NOTE: See “General Information” Instructions on preceding page – Item #6

$

1. Total estimated income subject to tax $______________. Multiply by tax rate 1 percent for gross tax total .........................................................

$

2. Less any estimated tax to be withheld ....................................................................................................................................................................

$

3. Balance of Ontario City Income Tax declared ............................................................................................................................(Enter Here

)

$

4. Less credits: A. Overpayment (From Line 12 Above) ..........................................................................................................................................

$

4. Less credits:

B. Previous payment(s) ...................................................................................................................................................................

$

5. Unpaid balance of net tax due .....................................................................................................................................................(Enter Here

)

$

Estimate - Pay This Amount

6. Attach check or M.O. for amount due

(At least 22

⁄

% of Line 5 Payable with Tax Return Filing)

......

#

1

2

$

IF PAYING AN ESTIMATE---PAY THIS AMOUNT IN ADDITION TO LINE 11 ABOVE.

Total Paid

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are

the same as used for Federal Income Tax purposes where applicable. This Tax Return is Not Legally filed if not signed by the Taxpayer(s) or a legally Authorized Agent.

Signature of Person Preparing if Other Than Taxpayer

D

a

e t

S

g i

n

a

u t

e r

f o

a T

x

p

y a

r e

r o

A

g

e

t n

Date

Address of Firm or Preparer

Signature of Spouse (If filing Jointly)

Date

If this return was prepared by a tax practitioner, may we contact your practitioner directly with questions regarding the preparation of this return? .....................Yes

No

IMPORTANT NOTICE: If you file this return in person at the Tax Office, bring both copies.

Page 1

INCOME TAX OFFICE COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3