Form R-I - Individual Income Tax Return - City Of Dayton - 2008

ADVERTISEMENT

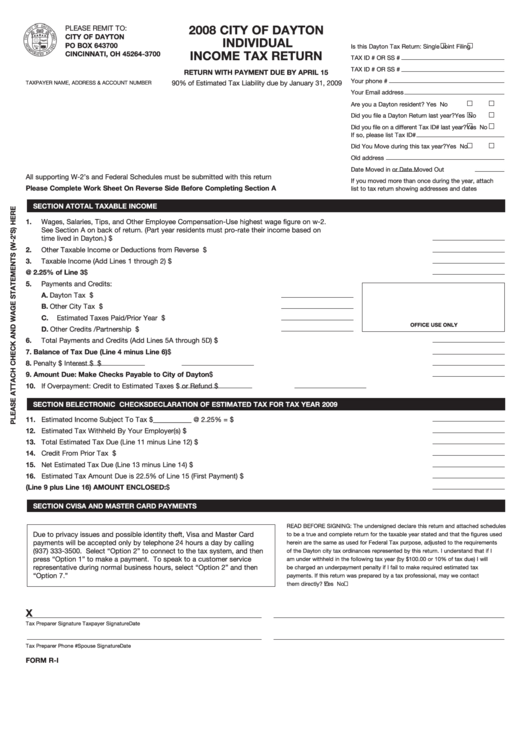

PLEASE REMIT TO:

2008 CITY OF DAYTON

CITY OF DAYTON

INDIVIDUAL

PO BOX 643700

Is this Dayton Tax Return:

Single

Joint Filing

CINCINNATI, OH 45264-3700

INCOME TAX RETURN

TAX ID # OR SS #

TAX ID # OR SS #

RETURN WITH PAYMENT DUE BY APRIL 15

Your phone #

90% of Estimated Tax Liability due by January 31, 2009

TAXPAYER NAME, ADDRESS & ACCOUNT NUMBER

Your Email address

Are you a Dayton resident?

Yes

No

Did you file a Dayton Return last year?

Yes

No

Did you file on a different Tax ID# last year?

Yes

No

If so, please list Tax ID#

Did You Move during this tax year?

Yes

No

Old address

Date Moved in

or Date Moved Out

All supporting W-2’s and Federal Schedules must be submitted with this return

If you moved more than once during the year, attach

Please Complete Work Sheet On Reverse Side Before Completing Section A

list to tax return showing addresses and dates

SECTION A

TOTAL TAXABLE INCOME

1.

Wages, Salaries, Tips, and Other Employee Compensation-Use highest wage figure on w-2.

See Section A on back of return. (Part year residents must pro-rate their income based on

time lived in Dayton.) ....................................................................................................................................................................... $

2.

Other Taxable Income or Deductions from Reverse Side............................................................................................................... $

3.

Taxable Income (Add Lines 1 through 2)......................................................................................................................................... $

4.

Dayton Tax Due @ 2.25% of Line 3 .............................................................................................................................................. $

Payments and Credits:

5.

A.

Dayton Tax Withheld ............................................................................... $

B.

Other City Tax Withheld .......................................................................... $

C.

Estimated Taxes Paid/Prior Year Credit.................................................. $

OFFICE USE ONLY

Other Credits /Partnership Payments..................................................... $

D.

Total Payments and Credits (Add Lines 5A through 5D) ................................................................................................................ $

6.

7.

Balance of Tax Due (Line 4 minus Line 6) .................................................................................................................................. $

8.

Penalty $

Interest $

.................................................... Total Penalty/Interest $

9.

Amount Due: Make Checks Payable to City of Dayton............................................................................................................. $

10. If Overpayment: Credit to Estimated Taxes $

or Refund $

SECTION B

ELECTRONIC CHECKS

DECLARATION OF ESTIMATED TAX FOR TAX YEAR 2009

11. Estimated Income Subject To Tax $___________ @ 2.25% =......................................................................................................... $

12. Estimated Tax Withheld By Your Employer(s) ................................................................................................................................. $

13. Total Estimated Tax Due (Line 11 minus Line 12) ........................................................................................................................... $

14. Credit From Prior Tax Year............................................................................................................................................................... $

15. Net Estimated Tax Due (Line 13 minus Line 14) ............................................................................................................................. $

16. Estimated Tax Amount Due is 22.5% of Line 15 (First Payment)................................................................................................... $

17. TOTAL AMOUNT DUE (Line 9 plus Line 16) AMOUNT ENCLOSED: ........................................................................................ $

SECTION C

VISA AND MASTER CARD PAYMENTS

READ BEFORE SIGNING: The undersigned declare this return and attached schedules

Due to privacy issues and possible identity theft, Visa and Master Card

to be a true and complete return for the taxable year stated and that the figures used

payments will be accepted only by telephone 24 hours a day by calling

herein are the same as used for Federal Tax purpose, adjusted to the requirements

(937) 333-3500. Select “Option 2” to connect to the tax system, and then

of the Dayton city tax ordinances represented by this return. I understand that if I

press “Option 1” to make a payment. To speak to a customer service

am under withheld in the following tax year (by $100.00 or 10% of tax due) I will

representative during normal business hours, select “Option 2” and then

be charged an underpayment penalty if I fail to make required estimated tax

“Option 7.”

payments. If this return was prepared by a tax professional, may we contact

them directly?

Yes

No

X

Tax Preparer Signature

Taxpayer Signature

Date

Tax Preparer Phone #

Spouse Signature

Date

FORM R-I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2