Instructions For Form Dtf-383 - Income Tax Installment Payment Agreement Request - 1999

ADVERTISEMENT

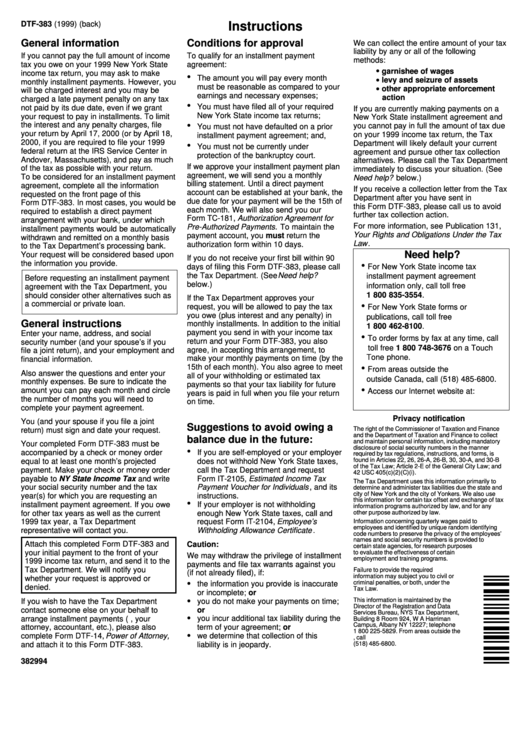

DTF-383 (1999) (back)

Instructions

General information

Conditions for approval

We can collect the entire amount of your tax

liability by any or all of the following

If you cannot pay the full amount of income

To qualify for an installment payment

methods:

tax you owe on your 1999 New York State

agreement:

•

garnishee of wages

income tax return, you may ask to make

•

The amount you will pay every month

•

levy and seizure of assets

monthly installment payments. However, you

must be reasonable as compared to your

•

other appropriate enforcement

will be charged interest and you may be

earnings and necessary expenses;

action

charged a late payment penalty on any tax

•

You must have filed all of your required

not paid by its due date, even if we grant

If you are currently making payments on a

New York State income tax returns;

your request to pay in installments. To limit

New York State installment agreement and

•

the interest and any penalty charges, file

you cannot pay in full the amount of tax due

You must not have defaulted on a prior

your return by April 17, 2000 (or by April 18,

on your 1999 income tax return, the Tax

installment payment agreement; and,

2000, if you are required to file your 1999

Department will likely default your current

•

You must not be currently under

federal return at the IRS Service Center in

agreement and pursue other tax collection

protection of the bankruptcy court.

Andover, Massachusetts), and pay as much

alternatives. Please call the Tax Department

If we approve your installment payment plan

of the tax as possible with your return.

immediately to discuss your situation. (See

agreement, we will send you a monthly

To be considered for an installment payment

Need help? below.)

billing statement. Until a direct payment

agreement, complete all the information

If you receive a collection letter from the Tax

account can be established at your bank, the

requested on the front page of this

Department after you have sent in

due date for your payment will be the 15th of

Form DTF-383. In most cases, you would be

this Form DTF-383, please call us to avoid

each month. We will also send you our

required to establish a direct payment

further tax collection action.

Form TC-181, Authorization Agreement for

arrangement with your bank, under which

For more information, see Publication 131,

Pre-Authorized Payments. To maintain the

installment payments would be automatically

Your Rights and Obligations Under the Tax

payment account, you must return the

withdrawn and remitted on a monthly basis

Law .

authorization form within 10 days.

to the Tax Department’s processing bank.

Need help?

Your request will be considered based upon

If you do not receive your first bill within 90

the information you provide.

•

days of filing this Form DTF-383, please call

For New York State income tax

the Tax Department. (See Need help?

installment payment agreement

Before requesting an installment payment

below.)

information only, call toll free

agreement with the Tax Department, you

should consider other alternatives such as

1 800 835-3554.

If the Tax Department approves your

a commercial or private loan.

•

request, you will be allowed to pay the tax

For New York State forms or

you owe (plus interest and any penalty) in

publications, call toll free

General instructions

monthly installments. In addition to the initial

1 800 462-8100.

payment you send in with your income tax

Enter your name, address, and social

•

To order forms by fax at any time, call

return and your Form DTF-383, you also

security number (and your spouse’s if you

toll free 1 800 748-3676 on a Touch

agree, in accepting this arrangement, to

file a joint return), and your employment and

Tone phone.

make your monthly payments on time (by the

financial information.

15th of each month). You also agree to meet

•

From areas outside the U.S. and

Also answer the questions and enter your

all of your withholding or estimated tax

outside Canada, call (518) 485-6800.

monthly expenses. Be sure to indicate the

payments so that your tax liability for future

•

amount you can pay each month and circle

Access our Internet website at:

years is paid in full when you file your return

the number of months you will need to

on time.

complete your payment agreement.

Privacy notification

You (and your spouse if you file a joint

Suggestions to avoid owing a

The right of the Commissioner of Taxation and Finance

return) must sign and date your request.

and the Department of Taxation and Finance to collect

balance due in the future:

and maintain personal information, including mandatory

Your completed Form DTF-383 must be

disclosure of social security numbers in the manner

•

accompanied by a check or money order

If you are self-employed or your employer

required by tax regulations, instructions, and forms, is

found in Articles 22, 26, 26-A, 26-B, 30, 30-A, and 30-B

equal to at least one month’s projected

does not withhold New York State taxes,

of the Tax Law; Article 2-E of the General City Law; and

payment. Make your check or money order

call the Tax Department and request

42 USC 405(c)(2)(C)(i).

payable to NY State Income Tax and write

Form IT-2105, Estimated Income Tax

The Tax Department uses this information primarily to

Payment Voucher for Individuals , and its

your social security number and the tax

determine and administer tax liabilities due the state and

city of New York and the city of Yonkers. We also use

year(s) for which you are requesting an

instructions.

this information for certain tax offset and exchange of tax

•

installment payment agreement. If you owe

If your employer is not withholding

information programs authorized by law, and for any

for other tax years as well as the current

enough New York State taxes, call and

other purpose authorized by law.

request Form IT-2104, Employee’s

1999 tax year, a Tax Department

Information concerning quarterly wages paid to

employees and identified by unique random identifying

representative will contact you.

Withholding Allowance Certificate .

code numbers to preserve the privacy of the employees’

names and social security numbers is provided to

Attach this completed Form DTF-383 and

Caution:

certain state agencies, for research purposes

your initial payment to the front of your

to evaluate the effectiveness of certain

We may withdraw the privilege of installment

employment and training programs.

1999 income tax return, and send it to the

payments and file tax warrants against you

Tax Department. We will notify you

Failure to provide the required

(if not already filed), if:

information may subject you to civil or

whether your request is approved or

•

criminal penalties, or both, under the

the information you provide is inaccurate

denied.

Tax Law.

or incomplete; or

•

This information is maintained by the

If you wish to have the Tax Department

you do not make your payments on time;

Director of the Registration and Data

contact someone else on your behalf to

or

Services Bureau, NYS Tax Department,

•

arrange installment payments (e.g., your

you incur additional tax liability during the

Building 8 Room 924, W A Harriman

Campus, Albany NY 12227; telephone

attorney, accountant, etc.), please also

term of your agreement; or

1 800 225-5829. From areas outside the

•

complete Form DTF-14, Power of Attorney,

we determine that collection of this

U.S. and outside Canada, call

and attach it to this Form DTF-383.

liability is in jeopardy.

(518) 485-6800.

382994

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1