Form Dtf-383 - Income Tax Installment Payment Agreement Request - 2000

ADVERTISEMENT

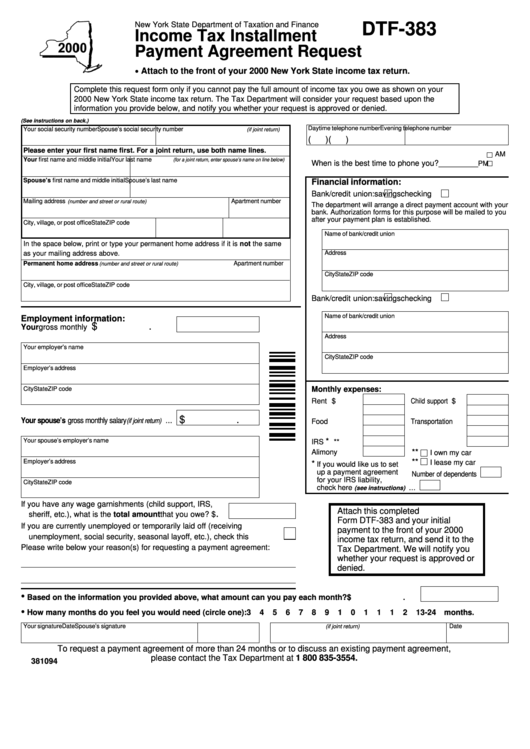

New York State Department of Taxation and Finance

DTF-383

Income Tax Installment

Payment Agreement Request

•

Attach to the front of your 2000 New York State income tax return.

Complete this request form only if you cannot pay the full amount of income tax you owe as shown on your

2000 New York State income tax return. The Tax Department will consider your request based upon the

information you provide below, and notify you whether your request is approved or denied.

(See instructions on back.)

Daytime telephone number

Evening telephone number

Your social security number

Spouse’s social security number

(if joint return)

(

)

(

)

Please enter your first name first. For a joint return, use both name lines.

AM

Your first name and middle initial

Your last name

(for a joint return, enter spouse’s name on line below)

When is the best time to phone you? _________

PM

Spouse’s first name and middle initial

Spouse’s last name

Financial information:

Bank/credit union:

savings

checking

Mailing address

Apartment number

(number and street or rural route)

The department will arrange a direct payment account with your

bank. Authorization forms for this purpose will be mailed to you

after your payment plan is established.

City, village, or post office

State

ZIP code

Name of bank/credit union

In the space below, print or type your permanent home address if it is not the same

as your mailing address above.

Address

Permanent home address

Apartment number

(number and street or rural route)

City

State

ZIP code

City, village, or post office

State

ZIP code

Bank/credit union:

savings

checking

Name of bank/credit union

Employment information:

$

.

Your gross monthly salary ..........................

Address

Your employer’s name

City

State

ZIP code

Employer’s address

Monthly expenses:

City

State

ZIP code

Rent ............ $

Child support .... $

Mortgage .......

Utilities .............

$

.

Your spouse’s gross monthly salary

...

(if joint return)

Food ..............

Transportation ....

Insurance ......

Credit cards .....

Your spouse’s employer’s name

*

IRS

.............

Auto loan ** .....

**

Alimony .........

I own my car

Employer’s address

**

I lease my car

*

If you would like us to set

up a payment agreement

Number of dependents

for your IRS liability,

City

State

ZIP code

check here

...

(see instructions)

If you have any wage garnishments (child support, IRS,

Attach this completed

.

sheriff, etc.), what is the total amount that you owe? ..... $

Form DTF-383 and your initial

If you are currently unemployed or temporarily laid off (receiving

payment to the front of your 2000

unemployment, social security, seasonal layoff, etc.), check this box .......

income tax return, and send it to the

Please write below your reason(s) for requesting a payment agreement:

Tax Department. We will notify you

whether your request is approved or

denied.

•

.

Based on the information you provided above, what amount can you pay each month? .............................. $

•

How many months do you feel you would need (circle one):

3

4

5

6

7

8

9

10 11 12 13-24 months.

Your signature

Date

Spouse’s signature

Date

(if joint return)

To request a payment agreement of more than 24 months or to discuss an existing payment agreement,

please contact the Tax Department at 1 800 835-3554.

381094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1