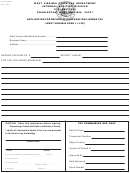

Special Tax Notice Regarding Rollover

Options under TRS

TRS 6PG1 (09-17)

to the entry, in the margin, you must write the letters "PSO." This is an annual election - you

will need to report the exclusion for each year in which you want to claim the exclusion.

If you are not a TRS member, or if you are a member but are receiving a TRS payment as

a beneficiary or alternate payee of another member

Payments after death of the member. If you receive a distribution after the member's death that

you do not roll over, the distribution will generally be taxed in the same manner described

elsewhere in this notice. However, the 10% additional income tax on early distributions and the

special rules for public safety officers do not apply, and the special rule described under the

section "If you were born on or before January 1, 1936" applies only if the member was born

on or before January 1,1936.

If you are a surviving spouse. If you receive a payment from TRS as the surviving spouse of

a deceased member, you have the same rollover options that the member would have had, as

described elsewhere in this notice. In addition, if you choose to do a rollover to an IRA, you

may treat the IRA as your own or as an inherited IRA.

An IRA you treat as your own is treated like any other IRA of yours, so that payments made to

you before you are age 59 ½ will be subject to the 10% additional income tax on early

distributions (unless an exception applies) and required minimum distributions from your IRA

do not have to start until after you are age 70 ½.

If you treat the IRA as an inherited IRA, payments from the IRA will not be subject to the 10%

additional income tax on early distributions. However, if the member had started taking required

minimum distributions, you will have to receive required minimum distributions from the

inherited IRA. If the member had not started taking required minimum distributions from TRS,

you will not have to start receiving required minimum distributions from the inherited IRA until

the year the member would have been age 70 ½.

If you are a surviving beneficiary other than a spouse. If you receive a payment from TRS

because of the member's death and you are a designated beneficiary other than a surviving

spouse, the only rollover option you have is to a direct rollover to an inherited IRA. Payments

from the inherited IRA will not be subject to the 10% additional income tax on early distributions.

You will have to receive required minimum distributions from the inherited IRA.

Payments under a qualified domestic relations order. If you are the spouse or former spouse

of the member who receives a payment from TRS under a qualified domestic relations order

(QDRO), you generally have the same options the member would have (for example, you may

roll over the payment to your own IRA or another eligible employer plan that will accept it). If

you are an alternate payee other than the spouse or former spouse of the member, you

generally have the same options as a surviving beneficiary other than the spouse, so that the

only rollover option you have is to do a direct rollover to an inherited IRA. Payments under the

QDRO will not be subject to the 10% additional income tax on early distributions.

Teacher Retirement System of Texas

Page 6 of 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13