Instructions For Form Fr-127 - Extension Of Time To File A Dc Income Tax Return

ADVERTISEMENT

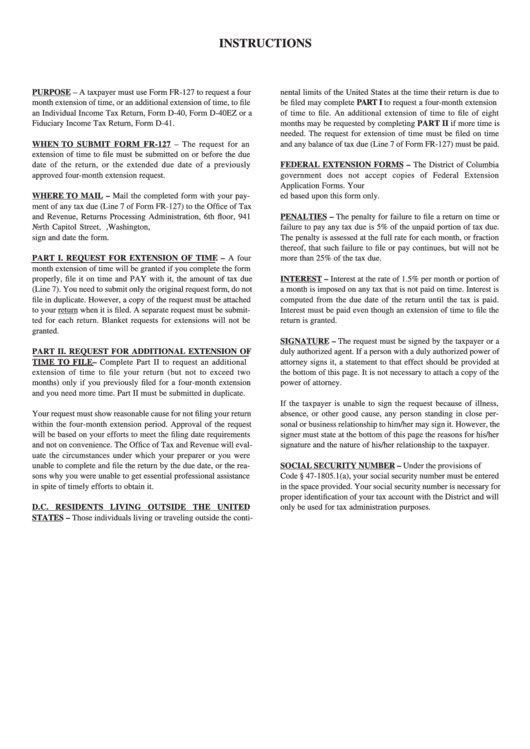

INSTRUCTIONS

PURPOSE – A taxpayer must use Form FR-127 to request a four

nental limits of the United States at the time their return is due to

month extension of time, or an additional extension of time, to file

be filed may complete PART I to request a four-month extension

an Individual Income Tax Return, Form D-40, Form D-40EZ or a

of time to file. An additional extension of time to file of eight

Fiduciary Income Tax Return, Form D-41.

months may be requested by completing PART II if more time is

needed. The request for extension of time must be filed on time

WHEN TO SUBMIT FORM FR-127 – The request for an

and any balance of tax due (Line 7 of Form FR-127) must be paid.

extension of time to file must be submitted on or before the due

date of the return, or the extended due date of a previously

FEDERAL EXTENSION FORMS – The District of Columbia

approved four-month extension request.

government does not accept copies of Federal Extension

Application Forms. Your D.C. Extension Request will be evaluat-

WHERE TO MAIL – Mail the completed form with your pay-

ed based upon this form only.

ment of any tax due (Line 7 of Form FR-127) to the Office of Tax

and Revenue, Returns Processing Administration, 6th floor, 941

PENALTIES – The penalty for failure to file a return on time or

North Capitol Street, N.E., Washington, D.C. 20002. Be sure to

failure to pay any tax due is 5% of the unpaid portion of tax due.

sign and date the form.

The penalty is assessed at the full rate for each month, or fraction

thereof, that such failure to file or pay continues, but will not be

PART I. REQUEST FOR EXTENSION OF TIME – A four

more than 25% of the tax due.

month extension of time will be granted if you complete the form

properly, file it on time and PAY with it, the amount of tax due

INTEREST – Interest at the rate of 1.5% per month or portion of

(Line 7). You need to submit only the original request form, do not

a month is imposed on any tax that is not paid on time. Interest is

file in duplicate. However, a copy of the request must be attached

computed from the due date of the return until the tax is paid.

to your return when it is filed. A separate request must be submit-

Interest must be paid even though an extension of time to file the

ted for each return. Blanket requests for extensions will not be

return is granted.

granted.

SIGNATURE – The request must be signed by the taxpayer or a

PART II. REQUEST FOR ADDITIONAL EXTENSION OF

duly authorized agent. If a person with a duly authorized power of

TIME TO FILE – Complete Part II to request an additional

attorney signs it, a statement to that effect should be provided at

extension of time to file your return (but not to exceed two

the bottom of this page. It is not necessary to attach a copy of the

months) only if you previously filed for a four-month extension

power of attorney.

and you need more time. Part II must be submitted in duplicate.

If the taxpayer is unable to sign the request because of illness,

Your request must show reasonable cause for not filing your return

absence, or other good cause, any person standing in close per-

within the four-month extension period. Approval of the request

sonal or business relationship to him/her may sign it. However, the

will be based on your efforts to meet the filing date requirements

signer must state at the bottom of this page the reasons for his/her

and not on convenience. The Office of Tax and Revenue will eval-

signature and the nature of his/her relationship to the taxpayer.

uate the circumstances under which your preparer or you were

unable to complete and file the return by the due date, or the rea-

SOCIAL SECURITY NUMBER – Under the provisions of D.C.

sons why you were unable to get essential professional assistance

Code § 47-1805.1(a), your social security number must be entered

in spite of timely efforts to obtain it.

in the space provided. Your social security number is necessary for

proper identification of your tax account with the District and will

D.C. RESIDENTS LIVING OUTSIDE THE UNITED

only be used for tax administration purposes.

STATES – Those individuals living or traveling outside the conti-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1