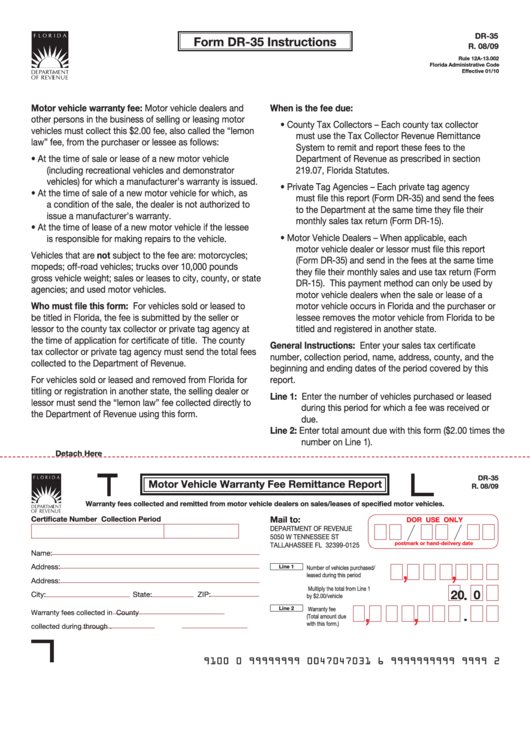

Form Dr-35 - Motor Vehicle Warranty Fee Remittance Report

ADVERTISEMENT

DR-35

Form DR-35 Instructions

R. 08/09

Rule 12A-13.002

Florida Administrative Code

Effective 01/10

Motor vehicle warranty fee: Motor vehicle dealers and

When is the fee due:

other persons in the business of selling or leasing motor

•

County Tax Collectors – Each county tax collector

vehicles must collect this $2.00 fee, also called the “lemon

must use the Tax Collector Revenue Remittance

law” fee, from the purchaser or lessee as follows:

System to remit and report these fees to the

•

At the time of sale or lease of a new motor vehicle

Department of Revenue as prescribed in section

(including recreational vehicles and demonstrator

219.07, Florida Statutes.

vehicles) for which a manufacturer’s warranty is issued.

•

Private Tag Agencies – Each private tag agency

•

At the time of sale of a new motor vehicle for which, as

must file this report (Form DR-35) and send the fees

a condition of the sale, the dealer is not authorized to

to the Department at the same time they file their

issue a manufacturer’s warranty.

monthly sales tax return (Form DR-15).

•

At the time of lease of a new motor vehicle if the lessee

•

Motor Vehicle Dealers – When applicable, each

is responsible for making repairs to the vehicle.

motor vehicle dealer or lessor must file this report

Vehicles that are not subject to the fee are: motorcycles;

(Form DR-35) and send in the fees at the same time

mopeds; off-road vehicles; trucks over 10,000 pounds

they file their monthly sales and use tax return (Form

gross vehicle weight; sales or leases to city, county, or state

DR-15). This payment method can only be used by

agencies; and used motor vehicles.

motor vehicle dealers when the sale or lease of a

Who must file this form: For vehicles sold or leased to

motor vehicle occurs in Florida and the purchaser or

be titled in Florida, the fee is submitted by the seller or

lessee removes the motor vehicle from Florida to be

lessor to the county tax collector or private tag agency at

titled and registered in another state.

the time of application for certificate of title. The county

General Instructions: Enter your sales tax certificate

tax collector or private tag agency must send the total fees

number, collection period, name, address, county, and the

collected to the Department of Revenue.

beginning and ending dates of the period covered by this

For vehicles sold or leased and removed from Florida for

report.

titling or registration in another state, the selling dealer or

Line 1: Enter the number of vehicles purchased or leased

lessor must send the “lemon law” fee collected directly to

during this period for which a fee was received or

the Department of Revenue using this form.

due.

Line 2: Enter total amount due with this form ($2.00 times the

number on Line 1).

Detach Here

DR-35

Motor Vehicle Warranty Fee Remittance Report

R. 08/09

Warranty fees collected and remitted from motor vehicle dealers on sales/leases of specified motor vehicles.

Mail to:

Certificate Number

Collection Period

DOR USE ONLY

DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

postmark or hand-delivery date

TALLAHASSEE FL 32399-0125

Name:

,

,

Address:

Line 1

Number of vehicles purchased/

leased during this period

Address:

Multiply the total from Line 1

2

0 0

City:

State:

ZIP:

by $2.00/vehicle

,

,

Line 2

Warranty fee

Warranty fees collected in

County

(Total amount due

with this form.)

collected during

through

.

9100 0 99999999 0047047031 6 9999999999 9999 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1