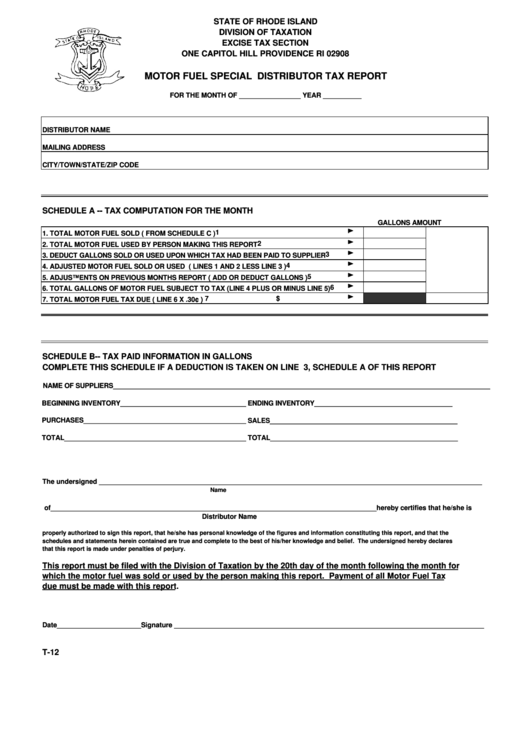

Form T-12 - Motor Fuel Special Distributor Tax Report

ADVERTISEMENT

STATE OF RHODE ISLAND

DIVISION OF TAXATION

EXCISE TAX SECTION

ONE CAPITOL HILL PROVIDENCE RI 02908

MOTOR FUEL SPECIAL DISTRIBUTOR TAX REPORT

FOR THE MONTH OF ________________ YEAR __________

DISTRIBUTOR NAME

MAILING ADDRESS

CITY/TOWN/STATE/ZIP CODE

SCHEDULE A -- TAX COMPUTATION FOR THE MONTH

GALLONS

AMOUNT

1

1. TOTAL MOTOR FUEL SOLD ( FROM SCHEDULE C )

2

2. TOTAL MOTOR FUEL USED BY PERSON MAKING THIS REPORT

3

3. DEDUCT GALLONS SOLD OR USED UPON WHICH TAX HAD BEEN PAID TO SUPPLIER

4

4. ADJUSTED MOTOR FUEL SOLD OR USED ( LINES 1 AND 2 LESS LINE 3 )

5

5. ADJUSTMENTS ON PREVIOUS MONTHS REPORT ( ADD OR DEDUCT GALLONS )

6

6. TOTAL GALLONS OF MOTOR FUEL SUBJECT TO TAX (LINE 4 PLUS OR MINUS LINE 5)

7

$

7. TOTAL MOTOR FUEL TAX DUE ( LINE 6 X .30¢ )

SCHEDULE B-- TAX PAID INFORMATION IN GALLONS

COMPLETE THIS SCHEDULE IF A DEDUCTION IS TAKEN ON LINE 3, SCHEDULE A OF THIS REPORT

NAME OF SUPPLIERS________________________________________________________________________________________________________________

BEGINNING INVENTORY_____________________________________

ENDING INVENTORY____________________________________

PURCHASES________________________________________________

SALES_________________________________________________

TOTAL_____________________________________________________

TOTAL_________________________________________________

The undersigned ____________________________________________________________________________________________________

Name

of_____________________________________________________________________________________hereby certifies that he/she is

Distributor Name

properly authorized to sign this report, that he/she has personal knowledge of the figures and information constituting this report, and that the

schedules and statements herein contained are true and complete to the best of his/her knowledge and belief. The undersigned hereby declares

that this report is made under penalties of perjury.

This report must be filed with the Division of Taxation by the 20th day of the month following the month for

which the motor fuel was sold or used by the person making this report. Payment of all Motor Fuel Tax

due must be made with this report.

Date______________________Signature _________________________________________________________________________________

T-12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2