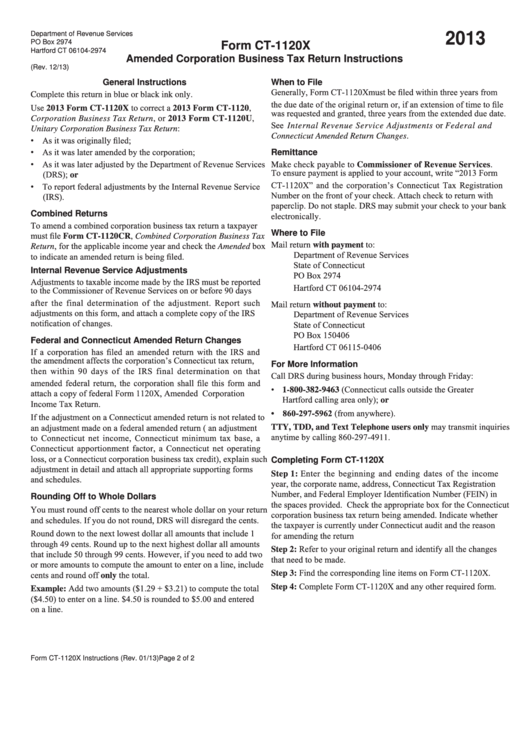

Form Ct-1120x - Amended Corporation Business Tax Return Instructions - 2013

ADVERTISEMENT

Department of Revenue Services

2013

PO Box 2974

Form CT-1120X

Hartford CT 06104-2974

Amended Corporation Business Tax Return Instructions

(Rev. 12/13)

General Instructions

When to File

Generally, Form CT-1120X must be filed within three years from

Complete this return in blue or black ink only.

the due date of the original return or, if an extension of time to file

Use 2013 Form CT-1120X to correct a 2013 Form CT-1120,

was requested and granted, three years from the extended due date.

Corporation Business Tax Return, or 2013 Form CT-1120U,

See Internal Revenue Service Adjustments or Federal and

Unitary Corporation Business Tax Return:

Connecticut Amended Return Changes.

• As it was originally filed;

• As it was later amended by the corporation;

Remittance

• As it was later adjusted by the Department of Revenue Services

Make check payable to Commissioner of Revenue Services.

(DRS); or

To ensure payment is applied to your account, write “2013 Form

CT-1120X” and the corporation’s Connecticut Tax Registration

• To report federal adjustments by the Internal Revenue Service

Number on the front of your check. Attach check to return with

(IRS).

paperclip. Do not staple. DRS may submit your check to your bank

Combined Returns

electronically.

To amend a combined corporation business tax return a taxpayer

Where to File

must file Form CT-1120CR, Combined Corporation Business Tax

Mail return with payment to:

Return, for the applicable income year and check the Amended box

to indicate an amended return is being filed.

Department of Revenue Services

State of Connecticut

Internal Revenue Service Adjustments

PO Box 2974

Adjustments to taxable income made by the IRS must be reported

Hartford CT 06104-2974

to the Commissioner of Revenue Services on or before 90 days

after the final determination of the adjustment. Report such

Mail return without payment to:

adjustments on this form, and attach a complete copy of the IRS

Department of Revenue Services

notification of changes.

State of Connecticut

PO Box 150406

Federal and Connecticut Amended Return Changes

Hartford CT 06115-0406

If a corporation has filed an amended return with the IRS and

the amendment affects the corporation’s Connecticut tax return,

For More Information

then within 90 days of the IRS final determination on that

Call DRS during business hours, Monday through Friday:

amended federal return, the corporation shall file this form and

• 1-800-382-9463 (Connecticut calls outside the Greater

attach a copy of federal Form 1120X, Amended U.S. Corporation

Hartford calling area only); or

Income Tax Return.

• 860-297-5962 (from anywhere).

If the adjustment on a Connecticut amended return is not related to

an adjustment made on a federal amended return (e.g. an adjustment

TTY, TDD, and Text Telephone users only may transmit inquiries

anytime by calling 860-297-4911.

to Connecticut net income, Connecticut minimum tax base, a

Connecticut apportionment factor, a Connecticut net operating

loss, or a Connecticut corporation business tax credit), explain such

Completing Form CT-1120X

adjustment in detail and attach all appropriate supporting forms

Step 1: Enter the beginning and ending dates of the income

and schedules.

year, the corporate name, address, Connecticut Tax Registration

Number, and Federal Employer Identification Number (FEIN) in

Rounding Off to Whole Dollars

the spaces provided. Check the appropriate box for the Connecticut

You must round off cents to the nearest whole dollar on your return

corporation business tax return being amended. Indicate whether

and schedules. If you do not round, DRS will disregard the cents.

the taxpayer is currently under Connecticut audit and the reason

Round down to the next lowest dollar all amounts that include 1

for amending the return

through 49 cents. Round up to the next highest dollar all amounts

Step 2: Refer to your original return and identify all the changes

that include 50 through 99 cents. However, if you need to add two

that need to be made.

or more amounts to compute the amount to enter on a line, include

cents and round off only the total.

Step 3: Find the corresponding line items on Form CT-1120X.

Step 4: Complete Form CT-1120X and any other required form.

Example: Add two amounts ($1.29 + $3.21) to compute the total

($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered

on a line.

Form CT-1120X Instructions (Rev. 01/13)

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2