Form Ct-1120a-Fs - Corporation Business Tax Return Apportionment Computation Of Income From Financial Service Company Activities

ADVERTISEMENT

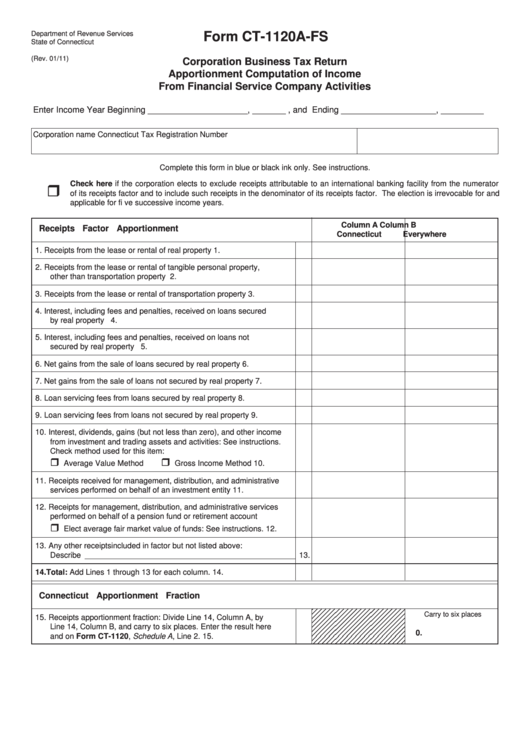

Department of Revenue Services

Form CT-1120A-FS

State of Connecticut

(Rev. 01/11)

Corporation Business Tax Return

Apportionment Computation of Income

From Financial Service Company Activities

Enter Income Year Beginning _____________________, _______ , and Ending ____________________, _________

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only. See instructions.

Check here if the corporation elects to exclude receipts attributable to an international banking facility from the numerator

of its receipts factor and to include such receipts in the denominator of its receipts factor. The election is irrevocable for and

applicable for fi ve successive income years.

Column A

Column B

Receipts Factor Apportionment

Connecticut

Everywhere

1. Receipts from the lease or rental of real property

1.

2. Receipts from the lease or rental of tangible personal property,

other than transportation property

2.

3. Receipts from the lease or rental of transportation property

3.

4. Interest, including fees and penalties, received on loans secured

by real property

4.

5. Interest, including fees and penalties, received on loans not

secured by real property

5.

6. Net gains from the sale of loans secured by real property

6.

7. Net gains from the sale of loans not secured by real property

7.

8. Loan servicing fees from loans secured by real property

8.

9. Loan servicing fees from loans not secured by real property

9.

10. Interest, dividends, gains (but not less than zero), and other income

from investment and trading assets and activities: See instructions.

Check method used for this item:

Average Value Method

Gross Income Method

10.

11. Receipts received for management, distribution, and administrative

services performed on behalf of an investment entity

11.

12. Receipts for management, distribution, and administrative services

performed on behalf of a pension fund or retirement account

Elect average fair market value of funds: See instructions.

12.

13. Any other receipts included in factor but not listed above:

Describe ________________________________________________ 13.

14. Total: Add Lines 1 through 13 for each column.

14.

Connecticut Apportionment Fraction

Carry to six places

15. Receipts apportionment fraction: Divide Line 14, Column A, by

Line 14, Column B, and carry to six places. Enter the result here

0.

and on Form CT-1120, Schedule A, Line 2.

15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7