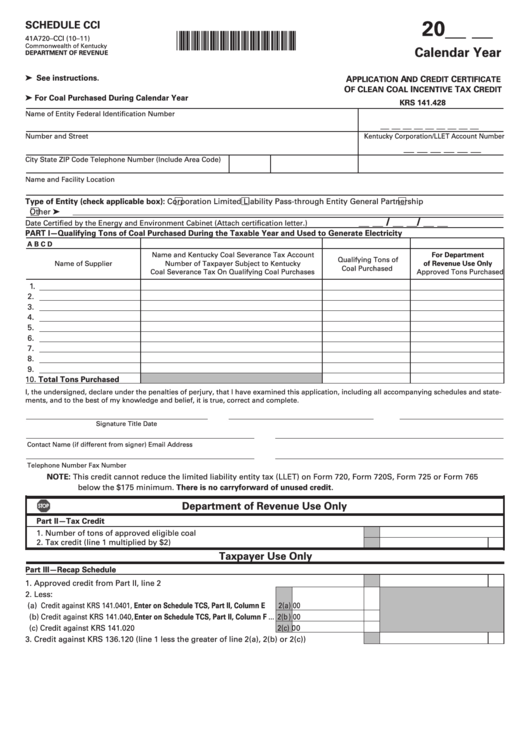

Schedule Cci (Form 41a720-Cci) - Application And Credit Certificate Of Clean Coal Incentive Tax Credit

ADVERTISEMENT

20__ __

SCHEDULE CCI

*1100020255*

41A720–CCI (10–11)

Commonwealth of Kentucky

Calendar Year

DEPARTMENT OF REvENUE

➤ See instructions.

A

A

C

C

PPLICATION

ND

REDIT

ERTIFICATE

O

C

C

I

T

C

F

LEAN

OAL

NCENTIvE

Ax

REDIT

➤ For Coal Purchased During Calendar Year

KRS 141.428

Name of Entity

Federal Identification Number

__ __ __ __ __ __ __ __ __

Number and Street

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

City

State

ZIP Code

Telephone Number (Include Area Code)

Name and Facility Location

Type of Entity (check applicable box):

Corporation

Limited Liability Pass-through Entity

General Partnership

Other ➤

__ __ / __ __/ __ __

Date Certified by the Energy and Environment Cabinet (Attach certification letter.)

PART I—Qualifying Tons of Coal Purchased During the Taxable Year and Used to Generate Electricity

A

B

C

D

Name and Kentucky Coal Severance Tax Account

For Department

Qualifying Tons of

Name of Supplier

Number of Taxpayer Subject to Kentucky

of Revenue Use Only

Coal Purchased

Coal Severance Tax On Qualifying Coal Purchases

Approved Tons Purchased

1.

2.

3.

4.

5.

6.

7.

8.

9.

10. Total Tons Purchased

I, the undersigned, declare under the penalties of perjury, that I have examined this application, including all accompanying schedules and state-

ments, and to the best of my knowledge and belief, it is true, correct and complete.

Signature

Title

Date

Contact Name (if different from signer)

Email Address

Telephone Number

Fax Number

NOTE: This credit cannot reduce the limited liability entity tax (LLET) on Form 720, Form 720S, Form 725 or Form 765

below the $175 minimum. There is no carryforward of unused credit.

Department of Revenue Use Only

Part II—Tax Credit

1. Number of tons of approved eligible coal ...........................................................................

1

2. Tax credit (line 1 multiplied by $2) .......................................................................................

2

00

Taxpayer Use Only

Part III—Recap Schedule

1. Approved credit from Part II, line 2 ...........................................................................................

1

00

2. Less:

(a) Credit against KRS 141.0401, Enter on Schedule TCS, Part II, Column E ....

2(a)

00

(b) Credit against KRS 141.040, Enter on Schedule TCS, Part II, Column F ... 2(b)

00

(c) Credit against KRS 141.020 .................................................................. 2(c)

00

3. Credit against KRS 136.120 (line 1 less the greater of line 2(a), 2(b) or 2(c)) .........................

3

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2