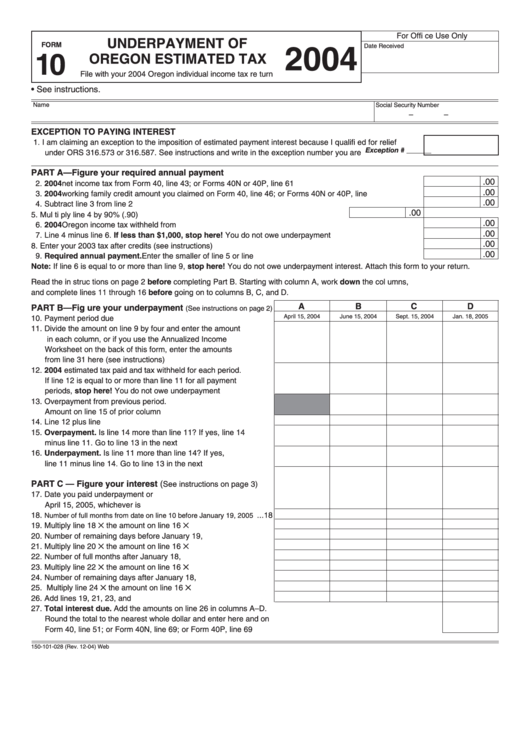

For Offi ce Use Only

UNDERPAYMENT OF

FORM

Date Received

2004

10

OREGON ESTIMATED TAX

Clear Form

File with your 2004 Oregon individual income tax re turn

• See instructions.

Name

Social Security Number

–

–

EXCEPTION TO PAYING INTEREST

1. I am claiming an exception to the imposition of estimated payment interest because I qualifi ed for relief

Exception # _______

under ORS 316.573 or 316.587. See instructions and write in the exception number you are claiming............ 1

PART A—Figure your required annual payment

.00

2. 2004 net income tax from Form 40, line 43; or Forms 40N or 40P, line 61 ....................................................... 2

.00

3. 2004 working family credit amount you claimed on Form 40, line 46; or Forms 40N or 40P, line 64................. 3

.00

4. Subtract line 3 from line 2 .................................................................................................................................. 4

.00

5. Mul ti ply line 4 by 90% (.90) ..............................................................................................5

.00

6. 2004 Oregon income tax withheld from income................................................................................................. 6

.00

7. Line 4 minus line 6. If less than $1,000, stop here! You do not owe underpayment interest........................... 7

.00

8. Enter your 2003 tax after credits (see instructions)............................................................................................ 8

.00

9. Required annual payment. Enter the smaller of line 5 or line 8....................................................................... 9

Note: If line 6 is equal to or more than line 9, stop here! You do not owe underpayment interest. Attach this form to your return.

Read the in struc tions on page 2 before completing Part B. Starting with column A, work down the col umns,

and complete lines 11 through 16 before going on to columns B, C, and D.

A

B

C

D

PART B—Fig ure your underpayment

(See instructions on page 2)

April 15, 2004

June 15, 2004

Sept. 15, 2004

Jan. 18, 2005

10. Payment period due date ............................................................ 10

11. Divide the amount on line 9 by four and enter the amount

in each column, or if you use the Annualized Income

Worksheet on the back of this form, enter the amounts

from line 31 here (see instructions)............................................. 11

12. 2004 estimated tax paid and tax withheld for each period.

If line 12 is equal to or more than line 11 for all payment

periods, stop here! You do not owe underpayment interest....... 12

13. Overpayment from previous period.

Amount on line 15 of prior column .............................................. 13

14. Line 12 plus line 13 ..................................................................... 14

15. Overpayment. Is line 14 more than line 11? If yes, line 14

minus line 11. Go to line 13 in the next column........................... 15

16. Underpayment. Is line 11 more than line 14? If yes,

line 11 minus line 14. Go to line 13 in the next column ............... 16

PART C — Figure your interest (

See instructions on page 3)

17. Date you paid underpayment or

April 15, 2005, whichever is earlier ............................................. 17

18.

... 18

Number of full months from date on line 10 before January 19, 2005

19. Multiply line 18 ✕ the amount on line 16 ✕ .005 ......................... 19

20. Number of remaining days before January 19, 2005 .................. 20

21. Multiply line 20 ✕ the amount on line 16 ✕ .000164 ................... 21

22. Number of full months after January 18, 2005 ............................ 22

23. Multiply line 22 ✕ the amount on line 16 ✕ .004167 ................... 23

24. Number of remaining days after January 18, 2005 ..................... 24

25. Multiply line 24 ✕ the amount on line 16 ✕ .000137 ................... 25

26. Add lines 19, 21, 23, and 25 ....................................................... 26

27. Total interest due. Add the amounts on line 26 in columns A–D.

Round the total to the nearest whole dollar and enter here and on

Form 40, line 51; or Form 40N, line 69; or Form 40P, line 69 .................................................................................. 27

150-101-028 (Rev. 12-04) Web

1

1 2

2