Notice Of Mortgage Payment Change Page 2

Download a blank fillable Notice Of Mortgage Payment Change in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Notice Of Mortgage Payment Change with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Page 3

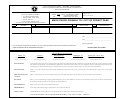

PREPAYMENT OPTIONS

How

When

What it means

1. *by paying an extra regular mortgage payment (principal,

on any regular payment date.

interest and taxes)

your principal mortgage balance

at anytime, sum total must not

2. * by paying up to 15% of the original principal amount

will be reduced by that amount

of your mortgage

exceed the yearly maximum.

3. by increasing your regular monthly mortgage

once each year of the term of your

payment by up to 15% of the current principal and

mortgage

interest payment

*Only items 1 & 2 qualify for the Miss a Payment option.

Miss a Payment Option

You may miss any scheduled payment as long as you have prepaid an amount equal to the amount of the payment you

intend to miss in this term, and your mortgage is not in default. You cannot however, miss your mortgage credit insurance

premium, if applicable. Extra payments or prepayments may not be used to miss a payment if this mortgage is assumed

by a subsequent purchaser.

Prepayment Costs

When you prepay some, or the entire principal of your mortgage, you will incur prepayment costs unless the partial

prepayment is in accordance with the Prepayment Options chart. The costs to pay off some, or the entire principal

amount of your mortgage early is 3 months’ interest costs at the current mortgage rate on the amount you want to pay.

Portable Mortgage

As long as we agree in writing, you may transfer your existing mortgage balance to a new home or you may combine

your existing balance with additional funds and, depending on the remaining term of the existing mortgage, obtain an

extended term.

Continuing Liability

Unless you prepay the balance of the principal amount owing, you must continue to make your regular monthly mortgage

payments.

(Include the total number of pages in box 2 of the Charge/Mortgage of Land (Form 2).

E0394ON (02/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2