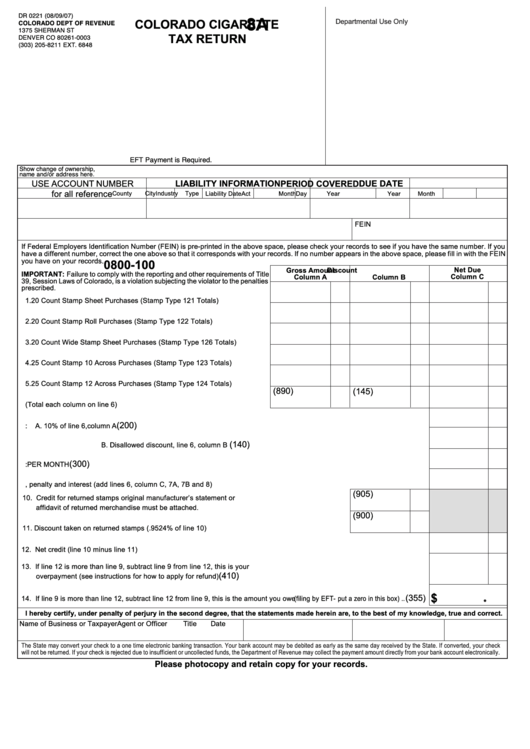

Form Dr 0221 - Colorado Cigarette Tax Return

ADVERTISEMENT

DR 0221 (08/09/07)

8A

Departmental Use Only

COLORADO CIGARETTE

COLORADO DEPT OF REVENUE

1375 SHERMAN ST

TAX RETURN

DENVER CO 80261-0003

(303) 205-8211 EXT. 6848

EFT Payment is Required.

Show change of ownership,

name and/or address here.

USE ACCOUNT NUMBER

LIABILITY INFORMATION

DUE DATE

PERIOD COVERED

for all reference

County

City

Industry

Type

Liability Date Act

Month

Day

Year

Year

Month

FEIN

If Federal Employers Identification Number (FEIN) is pre-printed in the above space, please check your records to see if you have the same number. If you

have a different number, correct the one above so that it corresponds with your records. If no number appears in the above space, please fill in with the FEIN

you have on your records.

0800-100

Gross Amount

Discount

Net Due

IMPORTANT: Failure to comply with the reporting and other requirements of Title

Column A

Column B

Column C

39, Session Laws of Colorado, is a violation subjecting the violator to the penalties

prescribed.

1. 20 Count Stamp Sheet Purchases (Stamp Type 121 Totals) .....................

2. 20 Count Stamp Roll Purchases (Stamp Type 122 Totals) ........................

3. 20 Count Wide Stamp Sheet Purchases (Stamp Type 126 Totals) ...........

4. 25 Count Stamp 10 Across Purchases (Stamp Type 123 Totals) ..............

5. 25 Count Stamp 12 Across Purchases (Stamp Type 124 Totals) ..............

(890)

(145)

6. Total purchases (Total each column on line 6) ...........................................

(200)

7. Late filing penalty:

A. 10% of line 6, column A ..............................................................................................................

(140)

B. Disallowed discount, line 6, column B ........................................................................................

(300)

8. Late filing interest:

PER MONTH .......................................................................................

9. Total of tax, penalty and interest (add lines 6, column C, 7A, 7B and 8).....................................................................................

(905)

10. Credit for returned stamps original manufacturer’s statement or

affidavit of returned merchandise must be attached. ...........................................................................

(900)

11. Discount taken on returned stamps (.9524% of line 10) ......................................................................

12. Net credit (line 10 minus line 11)................................................................................................................................................

13. If line 12 is more than line 9, subtract line 9 from line 12, this is your

(410)

overpayment (see instructions for how to apply for refund) ................................................................................................

$

(355)

14. If line 9 is more than line 12, subtract line 12 from line 9, this is the amount you owe (filing by EFT - put a zero in this box) ..

•

I hereby certify, under penalty of perjury in the second degree, that the statements made herein are, to the best of my knowledge, true and correct.

Name of Business or Taxpayer

Agent or Officer

Title

Date

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check

will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

Please photocopy and retain copy for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2