Form Nyc-4s - General Corporation Tax Return - 2002 Page 2

ADVERTISEMENT

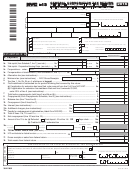

Form NYC-4S - 2002

NAME _____________________________________________________________

EIN __________________________

Page 2

Computation of NYC Taxable Net Income

S C H E D U L E

B

Federal taxable income before net operating loss deduction and special deductions (see instructions).. 1.

1.

2.

Interest on federal, state, municipal and other obligations not included in line 1................................. 2.

3a.

NYS Franchise Tax and other income taxes, including MTA surcharge, deducted on federal return (see instr.)...... 3a.

3b. NYC General Corporation Tax deducted on federal return (see instructions)...................................... 3b.

4.

ACRS depreciation and/or adjustment (attach Form NYC-399 or NYC-399Z) (see instructions)........ 4.

5.

Total (sum of lines 1 through 4) ............................................................................................................ 5.

6a. New York City net operating loss deduction (see instructions) .......... 6a.

6b. Depreciation and/or adjustment calculated under pre-ACRS or

S CORPORATIONS

see instructions

pre - 9/11/01 rules

........ 6b.

(attach Form NYC-399 or NYC-399Z) (see instr.)

for line 1

6c.

NYC and NYS tax refunds included in Schedule B,

line 1 (see instructions)....................................................................... 6c.

7.

Total (sum of lines 6a through 6c)......................................................................................................... 7.

8.

Taxable net income (line 5 less line 7) (enter on page 1, Schedule A, line 1) (see instructions) ......... 8.

Total Capital

S C H E D U L E

C

Basis used to determine average value in column C. Check one. (Attach detailed schedule)

- Annually

- Semi-annually

- Quarterly

COLUMN A

COLUMN B

COLUMN C

Beginning of Year

End of Year

Average Value

- Monthly

- Weekly

- Daily

1.

Total assets from federal return .............................................1.

2.

Real property and marketable securities included in line 1 ..........2.

3.

Subtract line 2 from line 1 ...............................................................3.

4.

Real property and marketable securities at fair market value ......4.

5.

Adjusted total assets (add lines 3 and 4) .......................................5.

6.

Total liabilities (see instructions) ......................................................6.

7.

Total capital (column C, line 5 less column C, line 6) (enter on page 1, Schedule A, line 2a or 2b) ..........................7.

Cer tain Stockholders

S C H E D U L E

D

Include all stockholders owning in excess of 5% of taxpayer's issued capital stock who received any compensation, including commissions.

Salary & All Other Compensation

Name and Address - Give actual residence (Attach rider if necessary)

Social Security Number

Official Title

Received from Corporation

(If none, enter "0")

Total, including any amount on rider (enter on page 1, Schedule A, line 3a)

1.

1.

S C H E D U L E E

The following infor mation must be entered for this retur n to be complete.

1.

New York City principal business activity

2.

Does the corporation have an interest in real property located in New York City? (see instructions).......................................................................YES

NO

3.

If "YES": (a) Attach a schedule of such property, including street address, borough, block and lot number.

(b) Was a controlling economic interest in this corporation (i.e., 50% or more of stock ownership) transferred during the tax year?....YES

NO

4.

Does the corporation have one or more qualified subchapter s subsidiaries (QSSS)? ............................................................................................YES

NO

If "YES" Attach a schedule showing the name, address and EIN, if any, of each QSSS and indicate whether the QSSS filed or was

required to file a City business income tax return. See instructions.

,

8

PREPAYMENTS CLAIMED ON SCHEDULE A

LINE

DATE

AMOUNT

TWELVE DIGIT TRANSACTION ID CODE

A. Mandatory first installment paid with preceding year's tax ....

Payment with declaration, Form NYC-400 (1) .............

B. Payment with Notice of Estimated Tax Due, (2) ...........

Payment with Estimated Tax Due (3) ...........................

C.Payment with extension, Form NYC-6 or NYC-6F ........

D.Overpayment credited from preceding year .................

E. TOTAL of A, B, C and D (enter on Schedule A, line 8) ...

RETURNS CLAIMING REFUNDS

RETURNS WITH REMITTANCES

ALL OTHER RETURNS

M A I L I N G

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

INSTRUCTIONS

PO BOX 5040

PO BOX 5050

PO BOX 5060

KINGSTON, NY 12402-5040

KINGSTON, NY 12402-5050

KINGSTON, NY 12402-5060

30420291

The due date for the calendar year 2002 return is on or before March 17, 2003. For fiscal years beginning in 2002, File within 2 1/2 months after the close of fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2