Form R - Income Tax Return - City Of Ontario

ADVERTISEMENT

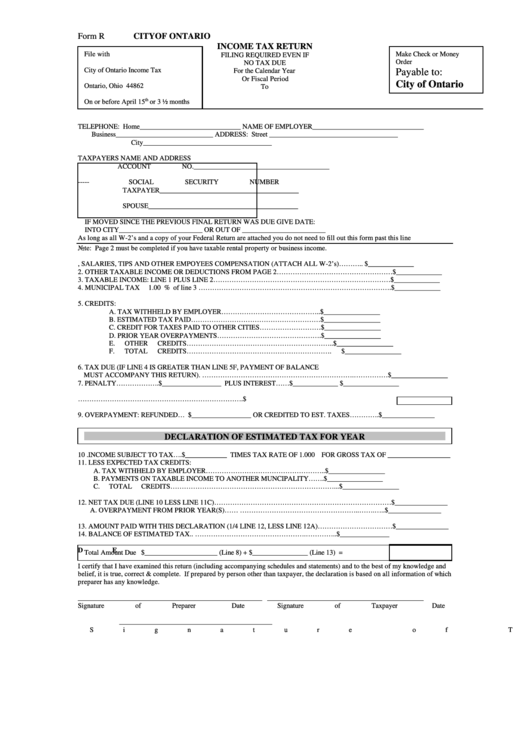

Form R

CITY OF ONTARIO

INCOME TAX RETURN

File with

Make Check or Money

FILING REQUIRED EVEN IF

Order

NO TAX DUE

City of Ontario Income Tax

For the Calendar Year

Payable to:

P.O. Box 166

Or Fiscal Period

City of Ontario

Ontario, Ohio 44862

To

th

On or before April 15

or 3 ½ months

TELEPHONE: Home_____________________________

NAME OF EMPLOYER________________________________

Business____________________________

ADDRESS: Street _____________________________________

City_____________________________________

TAXPAYERS NAME AND ADDRESS

ACCOUNT NO._______________________________________

-----

SOCIAL SECURITY NUMBER

TAXPAYER________________________________________

SPOUSE___________________________________________

IF MOVED SINCE THE PREVIOUS FINAL RETURN WAS DUE GIVE DATE:

INTO CITY________________________ OR OUT OF ________________________

As long as all W-2’s and a copy of your Federal Return are attached you do not need to fill out this form past this line

Note: Page 2 must be completed if you have taxable rental property or business income.

1.WAGES, SALARIES, TIPS AND OTHER EMPOYEES COMPENSATION (ATTACH ALL W-2’s)……….. $_____________

2. OTHER TAXABLE INCOME OR DEDUCTIONS FROM PAGE 2……………………………………………$_____________

3. TAXABLE INCOME: LINE 1 PLUS LINE 2……………………………………………………………………$_____________

4. MUNICIPAL TAX

1.00 % of line 3 ………………………………………………………………………….$_____________

5. CREDITS:

A.

TAX WITHHELD BY EMPLOYER……………………………………..$________________

B.

ESTIMATED TAX PAID…………………………………………………$________________

C.

CREDIT FOR TAXES PAID TO OTHER CITIES………………………$________________

D.

PRIOR YEAR OVERPAYMENTS……………………………………….$________________

E.

OTHER CREDITS………………………………………………………..$________________

F.

TOTAL CREDITS………………………………………………………. $________________

6. TAX DUE (IF LINE 4 IS GREATER THAN LINE 5F, PAYMENT OF BALANCE

MUST ACCOMPANY THIS RETURN). ………………………………………………………….……………$________________

7. PENALTY……………….$_________________

PLUS INTEREST……$_____________

$________________

8.AMOUNT DUE BEFORE ESTIMATED TAXES……………………………………………………………….$

9. OVERPAYMENT: REFUNDED… $_________________

OR CREDITED TO EST. TAXES………….$_______________

DECLARATION OF ESTIMATED TAX FOR YEAR

10 .INCOME SUBJECT TO TAX….$____________ TIMES TAX RATE OF 1.000 FOR GROSS TAX OF __________________

11. LESS EXPECTED TAX CREDITS:

A.

TAX WITHHELD BY EMPLOYER……………………………………………..$________________

B.

PAYMENTS ON TAXABLE INCOME TO ANOTHER MUNCIPALITY…….$________________

C.

TOTAL CREDITS………………………………………………………………...$________________

12. NET TAX DUE (LINE 10 LESS LINE 11C)……………………………………………………………………$_______________

A.

OVERPAYMENT FROM PRIOR YEAR(S)…… ……………………………………………..…….…..$_______________

13. AMOUNT PAID WITH THIS DECLARATION (1/4 LINE 12, LESS LINE 12A)……………………………$_______________

14. BALANCE OF ESTIMATED TAX.. ………………………………………….…………..$______________

DE

Total Amount Due $_____________________ (Line 8) + $________________ (Line 13) =

I certify that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and

belief, it is true, correct & complete. If prepared by person other than taxpayer, the declaration is based on all information of which

preparer has any knowledge.

_____________________________________________________

_____________________________________________

Signature of Preparer

Date

Signature of Taxpayer

Date

____________________________________________

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2