ATX

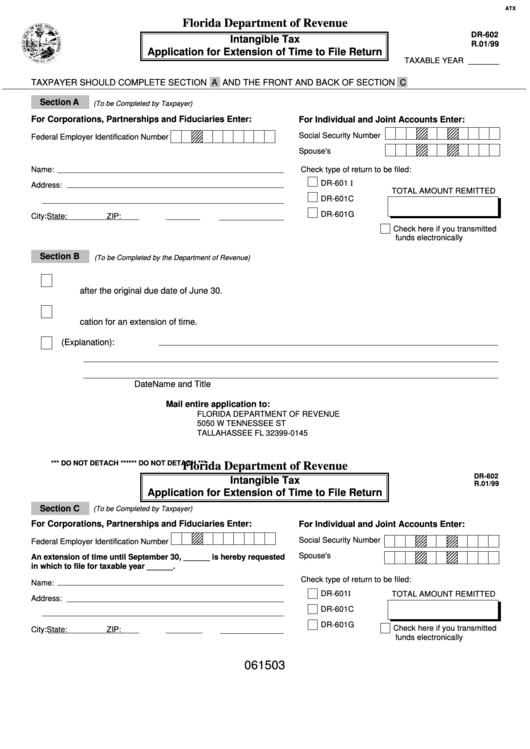

Florida Department of Revenue

DR-602

Intangible Tax

R.01/99

Application for Extension of Time to File Return

TAXABLE YEAR _______

TAXPAYER SHOULD COMPLETE SECTION A AND THE FRONT AND BACK OF SECTION C

Section A

(To be Completed by Taxpayer)

For Corporations, Partnerships and Fiduciaries Enter:

For Individual and Joint Accounts Enter:

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

Social Security Number

Federal Employer Identification Number

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

Spouse's S.S. Number

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

Name:

Check type of return to be filed:

DR-601 I

Address:

TOTAL AMOUNT REMITTED

DR-601C

DR-601G

City:

State:

ZIP:

Check here if you transmitted

funds electronically

Section B

(To be Completed by the Department of Revenue)

1.

Your application for extension has been denied due to late filing. Your application was postmarked or signed

after the original due date of June 30.

2.

Your application for extension has been denied. Reasonable cause has not been shown to grant your appli-

cation for an extension of time.

3.

Other (Explanation):

Date

Name and Title

Mail entire application to:

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0145

*** DO NOT DETACH ***

*** DO NOT DETACH ***

Florida Department of Revenue

DR-602

Intangible Tax

R.01/99

Application for Extension of Time to File Return

Section C

(To be Completed by Taxpayer)

For Corporations, Partnerships and Fiduciaries Enter:

For Individual and Joint Accounts Enter:

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

Social Security Number

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

Federal Employer Identification Number

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

Spouse's S.S. Number

1 2 3 4 5

1 2 3 4 5

An extension of time until September 30, ______ is hereby requested

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

in which to file for taxable year ______.

Check type of return to be filed:

Name:

DR-601I

TOTAL AMOUNT REMITTED

Address:

DR-601C

DR-601G

Check here if you transmitted

City:

State:

ZIP:

funds electronically

061503

1

1