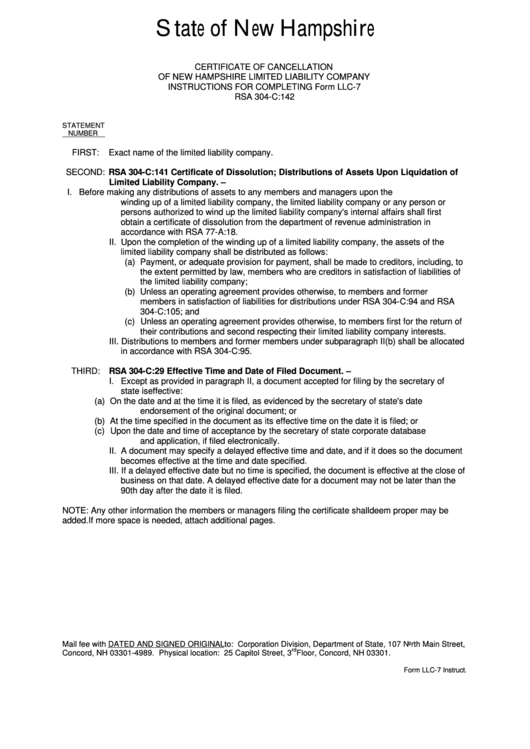

State of New Hampshire

CERTIFICATE OF CANCELLATION

OF NEW HAMPSHIRE LIMITED LIABILITY COMPANY

INSTRUCTIONS FOR COMPLETING Form LLC-7

RSA 304-C:142

STATEMENT

NUMBER

FIRST:

Exact name of the limited liability company.

SECOND: RSA 304-C:141 Certificate of Dissolution; Distributions of Assets Upon Liquidation of

Limited Liability Company. –

I. Before making any distributions of assets to any members and managers upon the

winding up of a limited liability company, the limited liability company or any person or

persons authorized to wind up the limited liability company's internal affairs shall first

obtain a certificate of dissolution from the department of revenue administration in

accordance with RSA 77-A:18.

II. Upon the completion of the winding up of a limited liability company, the assets of the

limited liability company shall be distributed as follows:

(a) Payment, or adequate provision for payment, shall be made to creditors, including, to

the extent permitted by law, members who are creditors in satisfaction of liabilities of

the limited liability company;

(b) Unless an operating agreement provides otherwise, to members and former

members in satisfaction of liabilities for distributions under RSA 304-C:94 and RSA

304-C:105; and

(c) Unless an operating agreement provides otherwise, to members first for the return of

their contributions and second respecting their limited liability company interests.

III. Distributions to members and former members under subparagraph II(b) shall be allocated

in accordance with RSA 304-C:95.

THIRD: RSA 304-C:29 Effective Time and Date of Filed Document. –

I. Except as provided in paragraph II, a document accepted for filing by the secretary of

state is effective:

(a) On the date and at the time it is filed, as evidenced by the secretary of state's date

endorsement of the original document; or

(b) At the time specified in the document as its effective time on the date it is filed; or

(c) Upon the date and time of acceptance by the secretary of state corporate database

and application, if filed electronically.

II. A document may specify a delayed effective time and date, and if it does so the document

becomes effective at the time and date specified.

III. If a delayed effective date but no time is specified, the document is effective at the close of

business on that date. A delayed effective date for a document may not be later than the

90th day after the date it is filed.

NOTE: Any other information the members or managers filing the certificate shall deem proper may be

added. If more space is needed, attach additional pages.

Mail fee with DATED AND SIGNED ORIGINAL to: Corporation Division, Department of State, 107 North Main Street,

rd

Concord, NH 03301-4989. Physical location: 25 Capitol Street, 3

Floor, Concord, NH 03301.

Form LLC-7 Instruct.

1

1 2

2