Instructions For Form Gr-1040es - Declaration Of Estimated Income Tax And Form Gr-1124 - Quarterly Estimated Income Tax Payment Vouchers

ADVERTISEMENT

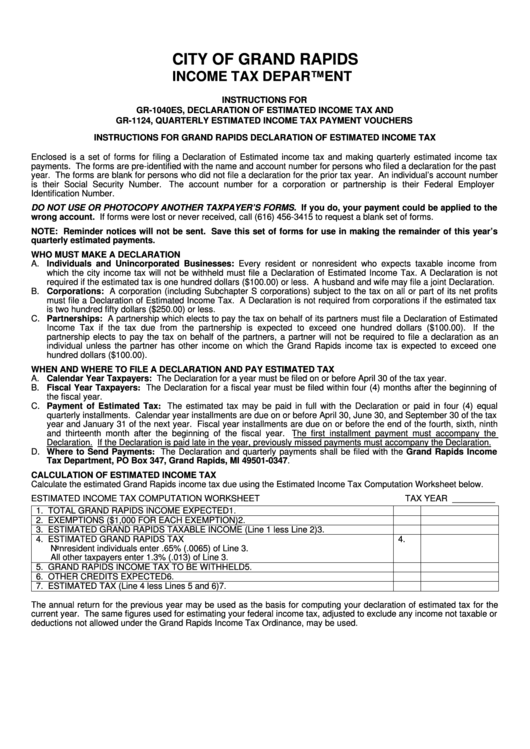

CITY OF GRAND RAPIDS

INCOME TAX DEPARTMENT

INSTRUCTIONS FOR

GR-1040ES, DECLARATION OF ESTIMATED INCOME TAX AND

GR-1124, QUARTERLY ESTIMATED INCOME TAX PAYMENT VOUCHERS

INSTRUCTIONS FOR GRAND RAPIDS DECLARATION OF ESTIMATED INCOME TAX

Enclosed is a set of forms for filing a Declaration of Estimated income tax and making quarterly estimated income tax

payments. The forms are pre-identified with the name and account number for persons who filed a declaration for the past

year. The forms are blank for persons who did not file a declaration for the prior tax year. An individual’s account number

is their Social Security Number.

The account number for a corporation or partnership is their Federal Employer

Identification Number.

DO NOT USE OR PHOTOCOPY ANOTHER TAXPAYER’S FORMS. If you do, your payment could be applied to the

wrong account. If forms were lost or never received, call (616) 456-3415 to request a blank set of forms.

NOTE: Reminder notices will not be sent. Save this set of forms for use in making the remainder of this year’s

quarterly estimated payments.

WHO MUST MAKE A DECLARATION

A. Individuals and Unincorporated Businesses: Every resident or nonresident who expects taxable income from

which the city income tax will not be withheld must file a Declaration of Estimated Income Tax. A Declaration is not

required if the estimated tax is one hundred dollars ($100.00) or less. A husband and wife may file a joint Declaration.

B. Corporations: A corporation (including Subchapter S corporations) subject to the tax on all or part of its net profits

must file a Declaration of Estimated Income Tax. A Declaration is not required from corporations if the estimated tax

is two hundred fifty dollars ($250.00) or less.

C. Partnerships: A partnership which elects to pay the tax on behalf of its partners must file a Declaration of Estimated

Income Tax if the tax due from the partnership is expected to exceed one hundred dollars ($100.00).

If the

partnership elects to pay the tax on behalf of the partners, a partner will not be required to file a declaration as an

individual unless the partner has other income on which the Grand Rapids income tax is expected to exceed one

hundred dollars ($100.00).

WHEN AND WHERE TO FILE A DECLARATION AND PAY ESTIMATED TAX

A. Calendar Year Taxpayers: The Declaration for a year must be filed on or before April 30 of the tax year.

B. Fiscal Year Taxpayers: The Declaration for a fiscal year must be filed within four (4) months after the beginning of

the fiscal year.

C. Payment of Estimated Tax: The estimated tax may be paid in full with the Declaration or paid in four (4) equal

quarterly installments. Calendar year installments are due on or before April 30, June 30, and September 30 of the tax

year and January 31 of the next year. Fiscal year installments are due on or before the end of the fourth, sixth, ninth

and thirteenth month after the beginning of the fiscal year. The first installment payment must accompany the

Declaration. If the Declaration is paid late in the year, previously missed payments must accompany the Declaration.

D. Where to Send Payments: The Declaration and quarterly payments shall be filed with the Grand Rapids Income

Tax Department, PO Box 347, Grand Rapids, MI 49501-0347.

CALCULATION OF ESTIMATED INCOME TAX

Calculate the estimated Grand Rapids income tax due using the Estimated Income Tax Computation Worksheet below.

ESTIMATED INCOME TAX COMPUTATION WORKSHEET

TAX YEAR _________

1. TOTAL GRAND RAPIDS INCOME EXPECTED

1.

2. EXEMPTIONS ($1,000 FOR EACH EXEMPTION)

2.

3. ESTIMATED GRAND RAPIDS TAXABLE INCOME (Line 1 less Line 2)

3.

4. ESTIMATED GRAND RAPIDS TAX

4.

Nonresident individuals enter .65% (.0065) of Line 3.

All other taxpayers enter 1.3% (.013) of Line 3.

5. GRAND RAPIDS INCOME TAX TO BE WITHHELD

5.

6. OTHER CREDITS EXPECTED

6.

7. ESTIMATED TAX (Line 4 less Lines 5 and 6)

7.

The annual return for the previous year may be used as the basis for computing your declaration of estimated tax for the

current year. The same figures used for estimating your federal income tax, adjusted to exclude any income not taxable or

deductions not allowed under the Grand Rapids Income Tax Ordinance, may be used.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2