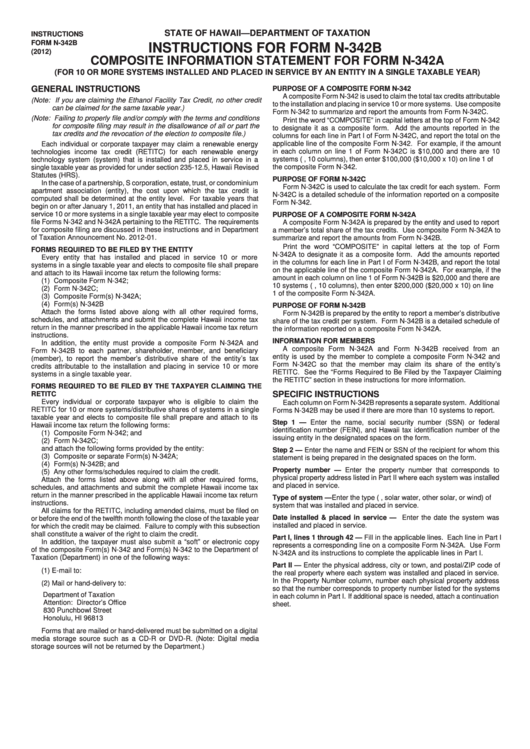

Instructions For Form N-342b & Composite Information Statement For Form N-342a - Department Of Taxation State Of Hawaii - 2012

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM N-342B

INSTRUCTIONS FOR FORM N-342B

(2012)

COMPOSITE INFORMATION STATEMENT FOR FORM N-342A

(FOR 10 OR MORE SYSTEMS INSTALLED AND PLACED IN SERVICE BY AN ENTITY IN A SINGLE TAXABLE YEAR)

GENERAL INSTRUCTIONS

PURPOSE OF A COMPOSITE FORM N-342

A composite Form N-342 is used to claim the total tax credits attributable

(Note: If you are claiming the Ethanol Facility Tax Credit, no other credit

to the installation and placing in service 10 or more systems. Use composite

can be claimed for the same taxable year.)

Form N-342 to summarize and report the amounts from Form N-342C.

(Note: Failing to properly file and/or comply with the terms and conditions

Print the word “COMPOSITE” in capital letters at the top of Form N-342

for composite filing may result in the disallowance of all or part the

to designate it as a composite form. Add the amounts reported in the

tax credits and the revocation of the election to composite file.)

columns for each line in Part I of Form N-342C, and report the total on the

applicable line of the composite Form N-342. For example, if the amount

Each individual or corporate taxpayer may claim a renewable energy

technologies income tax credit (RETITC) for each renewable energy

in each column on line 1 of Form N-342C is $10,000 and there are 10

systems (i.e., 10 columns), then enter $100,000 ($10,000 x 10) on line 1 of

technology system (system) that is installed and placed in service in a

the composite Form N-342.

single taxable year as provided for under section 235-12.5, Hawaii Revised

Statutes (HRS).

PURPOSE OF FORM N-342C

In the case of a partnership, S corporation, estate, trust, or condominium

Form N-342C is used to calculate the tax credit for each system. Form

apartment association (entity), the cost upon which the tax credit is

N-342C is a detailed schedule of the information reported on a composite

computed shall be determined at the entity level. For taxable years that

Form N-342.

begin on or after January 1, 2011, an entity that has installed and placed in

service 10 or more systems in a single taxable year may elect to composite

PURPOSE OF A COMPOSITE FORM N-342A

file Forms N-342 and N-342A pertaining to the RETITC. The requirements

A composite Form N-342A is prepared by the entity and used to report

for composite filing are discussed in these instructions and in Department

a member’s total share of the tax credits. Use composite Form N-342A to

of Taxation Announcement No. 2012-01.

summarize and report the amounts from Form N-342B.

Print the word “COMPOSITE” in capital letters at the top of Form

FORMS REQUIRED TO BE FILED BY THE ENTITY

N-342A to designate it as a composite form. Add the amounts reported

Every entity that has installed and placed in service 10 or more

in the columns for each line in Part I of Form N-342B, and report the total

systems in a single taxable year and elects to composite file shall prepare

on the applicable line of the composite Form N-342A. For example, if the

and attach to its Hawaii income tax return the following forms:

amount in each column on line 1 of Form N-342B is $20,000 and there are

(1) Composite Form N-342;

10 systems (i.e., 10 columns), then enter $200,000 ($20,000 x 10) on line

(2) Form N-342C;

1 of the composite Form N-342A.

(3) Composite Form(s) N-342A;

(4) Form(s) N-342B

PURPOSE OF FORM N-342B

Attach the forms listed above along with all other required forms,

Form N-342B is prepared by the entity to report a member’s distributive

schedules, and attachments and submit the complete Hawaii income tax

share of the tax credit per system. Form N-342B is a detailed schedule of

return in the manner prescribed in the applicable Hawaii income tax return

the information reported on a composite Form N-342A.

instructions.

INFORMATION FOR MEMBERS

In addition, the entity must provide a composite Form N-342A and

A composite Form N-342A and Form N-342B received from an

Form N-342B to each partner, shareholder, member, and beneficiary

entity is used by the member to complete a composite Form N-342 and

(member), to report the member’s distributive share of the entity’s tax

Form N-342C so that the member may claim its share of the entity’s

credits attributable to the installation and placing in service 10 or more

RETITC. See the “Forms Required to Be Filed by the Taxpayer Claiming

systems in a single taxable year.

the RETITC” section in these instructions for more information.

FORMS REQUIRED TO BE FILED BY THE TAXPAYER CLAIMING THE

SPECIFIC INSTRUCTIONS

RETITC

Each column on Form N-342B represents a separate system. Additional

Every individual or corporate taxpayer who is eligible to claim the

Forms N-342B may be used if there are more than 10 systems to report.

RETITC for 10 or more systems/distributive shares of systems in a single

taxable year and elects to composite file shall prepare and attach to its

Step 1 — Enter the name, social security number (SSN) or federal

Hawaii income tax return the following forms:

identification number (FEIN), and Hawaii tax identification number of the

(1) Composite Form N-342; and

issuing entity in the designated spaces on the form.

(2) Form N-342C;

and attach the following forms provided by the entity:

Step 2 — Enter the name and FEIN or SSN of the recipient for whom this

(3) Composite or separate Form(s) N-342A;

statement is being prepared in the designated spaces on the form.

(4) Form(s) N-342B; and

Property number — Enter the property number that corresponds to

(5) Any other forms/schedules required to claim the credit.

physical property address listed in Part II where each system was installed

Attach the forms listed above along with all other required forms,

and placed in service.

schedules, and attachments and submit the complete Hawaii income tax

return in the manner prescribed in the applicable Hawaii income tax return

Type of system — Enter the type (i.e., solar water, other solar, or wind) of

instructions.

system that was installed and placed in service.

All claims for the RETITC, including amended claims, must be filed on

Date installed & placed in service — Enter the date the system was

or before the end of the twelfth month following the close of the taxable year

installed and placed in service.

for which the credit may be claimed. Failure to comply with this subsection

shall constitute a waiver of the right to claim the credit.

Part I, lines 1 through 42 — Fill in the applicable lines. Each line in Part I

In addition, the taxpayer must also submit a “soft” or electronic copy

represents a corresponding line on a composite Form N-342A. Use Form

of the composite Form(s) N-342 and Form(s) N-342 to the Department of

N-342A and its instructions to complete the applicable lines in Part I.

Taxation (Department) in one of the following ways:

Part II — Enter the physical address, city or town, and postal/ZIP code of

(1)

E-mail to: Tax.Directors.Office@hawaii.gov

the real property where each system was installed and placed in service.

In the Property Number column, number each physical property address

(2)

Mail or hand-delivery to:

so that the number corresponds to property number listed for the systems

Department of Taxation

in each column in Part I. If additional space is needed, attach a continuation

Attention: Director’s Office

sheet.

830 Punchbowl Street

Honolulu, HI 96813

Forms that are mailed or hand-delivered must be submitted on a digital

media storage source such as a CD-R or DVD-R. (Note: Digital media

storage sources will not be returned by the Department.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1