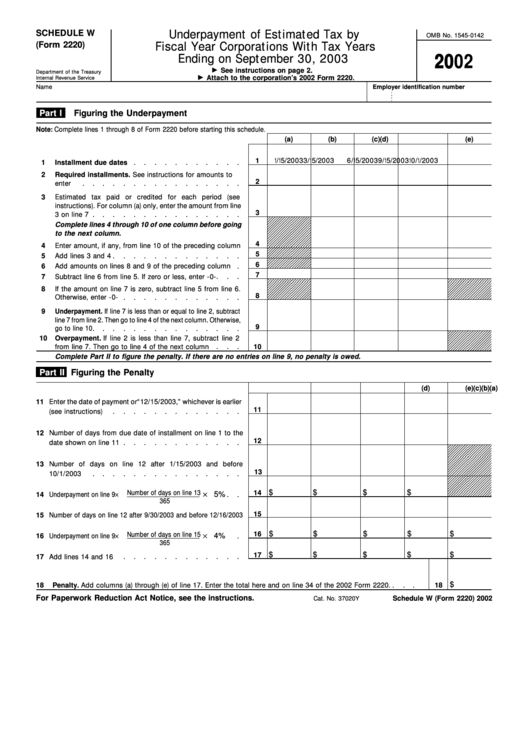

SCHEDULE W

Underpayment of Estimated Tax by

OMB No. 1545-0142

(Form 2220)

Fiscal Year Corporations With Tax Years

Ending on September 30, 2003

2002

See instructions on page 2.

Department of the Treasury

Attach to the corporation’s 2002 Form 2220.

Internal Revenue Service

Name

Employer identification number

Part I

Figuring the Underpayment

Note: Complete lines 1 through 8 of Form 2220 before starting this schedule.

(a)

(b)

(c)

(d)

(e)

1

1/15/2003

3/15/2003

6/15/2003

9/15/2003

10/1/2003

1

Installment due dates

2

Required installments. See instructions for amounts to

2

enter

3

Estimated tax paid or credited for each period (see

instructions). For column (a) only, enter the amount from line

3

3 on line 7

Complete lines 4 through 10 of one column before going

to the next column.

4

4

Enter amount, if any, from line 10 of the preceding column

5

5

Add lines 3 and 4

6

6

Add amounts on lines 8 and 9 of the preceding column

7

7

Subtract line 6 from line 5. If zero or less, enter -0-

8

If the amount on line 7 is zero, subtract line 5 from line 6.

8

Otherwise, enter -0-

9

Underpayment. If line 7 is less than or equal to line 2, subtract

line 7 from line 2. Then go to line 4 of the next column. Otherwise,

9

go to line 10

10

Overpayment. If line 2 is less than line 7, subtract line 2

from line 7. Then go to line 4 of the next column

10

Complete Part II to figure the penalty. If there are no entries on line 9, no penalty is owed.

Part II

Figuring the Penalty

(a)

(b)

(c)

(d)

(e)

11

Enter the date of payment or “12/15/2003,” whichever is earlier

11

(see instructions)

12

Number of days from due date of installment on line 1 to the

12

date shown on line 11

13

Number of days on line 12 after 1/15/2003 and before

13

10/1/2003

× 5%

$

$

$

$

Underpayment on line 9 ×

Number of days on line 13

14

14

365

15

15

Number of days on line 12 after 9/30/2003 and before 12/16/2003

× 4%

$

$

$

$

$

Underpayment on line 9 ×

16

Number of days on line 15

16

365

$

$

$

$

$

17

17

Add lines 14 and 16

$

18

Penalty. Add columns (a) through (e) of line 17. Enter the total here and on line 34 of the 2002 Form 2220.

18

For Paperwork Reduction Act Notice, see the instructions.

Schedule W (Form 2220) 2002

Cat. No. 37020Y

1

1