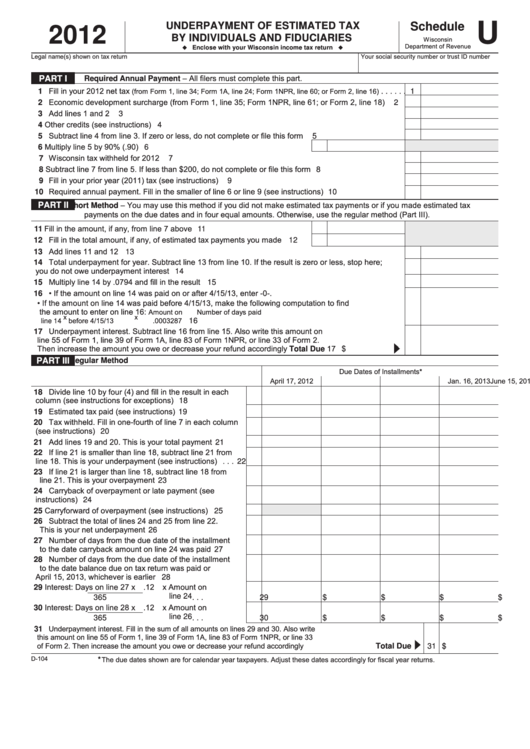

U

UNDERPAYMENT OF ESTIMATED TAX

Schedule

2012

BY INDIVIDUALS AND FIDUCIARIES

Wisconsin

Department of Revenue

u

u

Enclose with your Wisconsin income tax return

Legal name(s) shown on tax return

Your social security number or trust ID number

PART I

Required Annual Payment – All filers must complete this part.

1 Fill in your 2012 net tax

(from Form 1, line 34; Form 1A, line 24; Form 1NPR, line 60; or Form 2, line 16)

. . . . . .

1

2 Economic development surcharge (from Form 1, line 35; Form 1NPR, line 61; or Form 2, line 18) . . . .

2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Other credits (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Subtract line 4 from line 3. If zero or less, do not complete or file this form . . . . . . . . . . . . . . . . . . . . . . .

5

6 Multiply line 5 by 90% (.90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Wisconsin tax withheld for 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Subtract line 7 from line 5. If less than $200, do not complete or file this form . . . . . . . . . . . . . . . . . . . .

8

9 Fill in your prior year (2011) tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Required annual payment. Fill in the smaller of line 6 or line 9 (see instructions) . . . . . . . . . . . . . . . . . . 10

PART II

Short Method – You may use this method if you did not make estimated tax payments or if you made estimated tax

payments on the due dates and in four equal amounts. Otherwise, use the regular method (Part III).

11 Fill in the amount, if any, from line 7 above . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Fill in the total amount, if any, of estimated tax payments you made . . . . . . . 12

13 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Total underpayment for year. Subtract line 13 from line 10. If the result is zero or less, stop here;

you do not owe underpayment interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Multiply line 14 by .0794 and fill in the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 • If the amount on line 14 was paid on or after 4/15/13, enter -0-.

• If the amount on line 14 was paid before 4/15/13, make the following computation to find

the amount to enter on line 16:

Amount on

Number of days paid

x

x

before 4/15/13

.0003287

. . . . . . . .

16

line 14

17 Underpayment interest. Subtract line 16 from line 15. Also write this amount on

line 55 of Form 1, line 39 of Form 1A, line 83 of Form 1NPR, or line 33 of Form 2.

Then increase the amount you owe or decrease your refund accordingly . . . . . . . . . . . . . Total Due

17 $

PART III

Regular Method

Due Dates of Installments*

April 17, 2012

June 15, 2012

Sept. 17, 2012

Jan. 16, 2013

18 Divide line 10 by four (4) and fill in the result in each

column (see instructions for exceptions) . . . . . . . . . . . . . 18

19 Estimated tax paid (see instructions) . . . . . . . . . . . . . . . . 19

20 Tax withheld. Fill in one-fourth of line 7 in each column

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20. This is your total payment . . . . . . . . 21

22 If line 21 is smaller than line 18, subtract line 21 from

line 18. This is your underpayment (see instructions) . . . 22

23 If line 21 is larger than line 18, subtract line 18 from

line 21. This is your overpayment . . . . . . . . . . . . . . . . . . . 23

24 Carryback of overpayment or late payment (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Carryforward of overpayment (see instructions) . . . . . . . 25

26 Subtract the total of lines 24 and 25 from line 22.

This is your net underpayment . . . . . . . . . . . . . . . . . . . . . 26

27 Number of days from the due date of the installment

to the date carryback amount on line 24 was paid . . . . . . 27

28 Number of days from the due date of the installment

to the date balance due on tax return was paid or

April 15, 2013, whichever is earlier . . . . . . . . . . . . . . . . . 28

29 Interest:

Days on line 27

x .12 x

Amount on

line 24 . . . 29 $

365

$

$

$

30 Interest:

Days on line 28

x .12 x

Amount on

line 26 . . . 30 $

365

$

$

$

Underpayment interest. Fill in the sum of all amounts on lines 29 and 30. Also write

31

this amount on line 55 of Form 1, line 39 of Form 1A, line 83 of Form 1NPR, or line 33

of Form 2. Then increase the amount you owe or decrease your refund accordingly

. . . . . . . . . . . . . Total Due

31 $

D-104

The due dates shown are for calendar year taxpayers. Adjust these dates accordingly for fiscal year returns.

*

1

1 2

2