Form Dtf-802 - Statement Of Transaction - Sale Or Gift Of Motor Vehicle, Trailer, All-Terrain Vehicle (Atv), Vessel (Boat), Or Snowmobile

ADVERTISEMENT

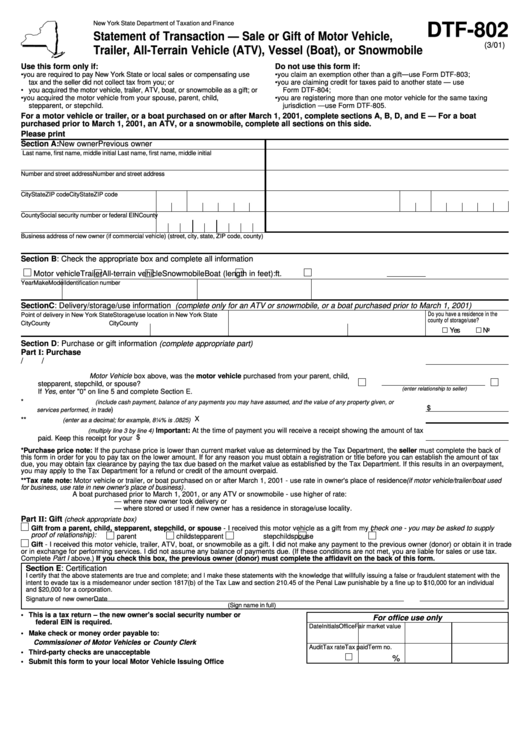

New York State Department of Taxation and Finance

DTF-802

Statement of Transaction — Sale or Gift of Motor Vehicle,

(3/01)

Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

Use this form only if:

Do not use this form if:

• you are required to pay New York State or local sales or compensating use

• you claim an exemption other than a gift—use Form DTF-803;

tax and the seller did not collect tax from you; or

• you are claiming credit for taxes paid to another state — use

• you acquired the motor vehicle, trailer, ATV, boat, or snowmobile as a gift; or

Form DTF-804;

• you acquired the motor vehicle from your spouse, parent, child,

• you are registering more than one motor vehicle for the same taxing

stepparent, or stepchild.

jurisdiction —use Form DTF-805.

For a motor vehicle or trailer, or a boat purchased on or after March 1, 2001, complete sections A, B, D, and E — For a boat

purchased prior to March 1, 2001, an ATV, or a snowmobile, complete all sections on this side.

Please print

Section A:

New owner

Previous owner

Last name, first name, middle initial

Last name, first name, middle initial

Number and street address

Number and street address

City

State

ZIP code

City

State

ZIP code

County

Social security number or federal EIN

County

Business address of new owner (if commercial vehicle) (street, city, state, ZIP code, county)

Section B: Check the appropriate box and complete all information

Motor vehicle

Trailer

All-terrain vehicle

Snowmobile

Boat (length in feet):

ft.

Year

Make

Model

Identification number

Section C: Delivery/storage/use information (complete only for an ATV or snowmobile, or a boat purchased prior to March 1, 2001)

Do you have a residence in the

Point of delivery in New York State

Storage/use location in New York State

county of storage/use?

City

County

City

County

Yes

No

Section D: Purchase or gift information (complete appropriate part)

Part I: Purchase

/

/

1. Date of purchase ...............................................................................................................................................................................

2. If you checked the Motor Vehicle box above, was the motor vehicle purchased from your parent, child,

stepparent, stepchild, or spouse? ..............................................................................................................

Yes

No

(enter relationship to seller)

If Yes, enter "0" on line 5 and complete Section E.

3. Total purchase price*

(include cash payment, balance of any payments you may have assumed, and the value of any property given, or

) ........................................................................................................................................................................ $

services performed, in trade

X

4. Tax rate**

(enter as a decimal; for example, 8¼% is .0825) ......................................................................................................................................

5. Sales/use tax due

Important: At the time of payment you will receive a receipt showing the amount of tax

(multiply line 3 by line 4)

paid. Keep this receipt for your records. ........................................................................................................................................ $

*Purchase price note: If the purchase price is lower than current market value as determined by the Tax Department, the seller must complete the back of

this form in order for you to pay tax on the lower amount. If for any reason you must obtain a registration or title before you can establish the amount of tax

due, you may obtain tax clearance by paying the tax due based on the market value as established by the Tax Department. If this results in an overpayment,

you may apply to the Tax Department for a refund or credit of the amount overpaid.

**Tax rate note: Motor vehicle or trailer, or boat purchased on or after March 1, 2001 - use rate in owner's place of residence (if motor vehicle/trailer/boat used

for business, use rate in new owner's place of business) .

A boat purchased prior to March 1, 2001, or any ATV or snowmobile - use higher of rate:

— where new owner took delivery or

— where stored or used if new owner has a residence in storage/use locality.

Part II: Gift

(check appropriate box)

Gift from a parent, child, stepparent, stepchild, or spouse - I received this motor vehicle as a gift from my ( check one - you may be asked to supply

proof of relationship):

parent

child

stepparent

stepchild

spouse

Gift - I received this motor vehicle, trailer, ATV, boat, or snowmobile as a gift. I did not make any payment to the previous owner (donor) or obtain it in trade

or in exchange for performing services. I did not assume any balance of payments due. (If these conditions are not met, you are liable for sales or use tax.

Complete Part I above.) If you check this box, the previous owner (donor) must complete the affidavit on the back of this form.

Section E: Certification

I certify that the above statements are true and complete; and I make these statements with the knowledge that willfully issuing a false or fraudulent statement with the

intent to evade tax is a misdemeanor under section 1817(b) of the Tax Law and section 210.45 of the Penal Law punishable by a fine up to $10,000 for an individual

and $20,000 for a corporation.

Signature of new owner

Date

(Sign name in full)

• This is a tax return – the new owner's social security number or

For office use only

federal EIN is required.

Date

Initials

Office

Fair market value

• Make check or money order payable to:

Commissioner of Motor Vehicles or County Clerk

Audit

Tax rate

Tax paid

Term no.

• Third-party checks are unacceptable

%

• Submit this form to your local Motor Vehicle Issuing Office

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2