Form Dtf-803 - Claim For Sales And Use Tax Exemption Title/registration Motor Vehicle, Trailer, All-Terrain Vehicle (Atv), Vessel (Boat), Or Snowmobile

ADVERTISEMENT

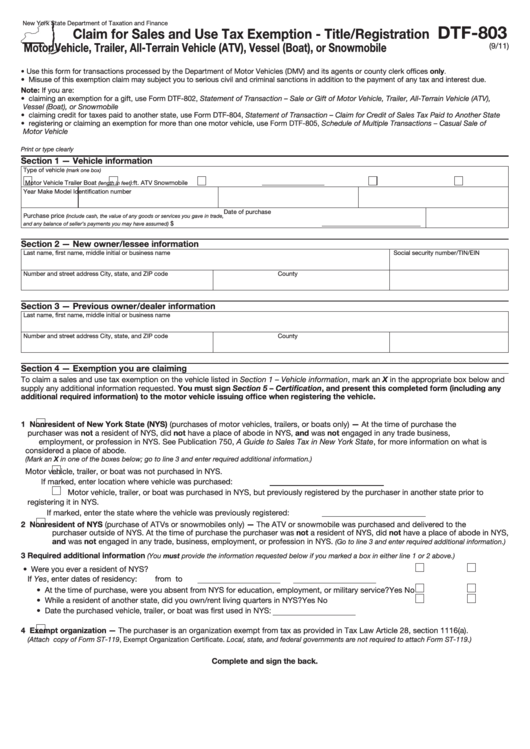

New York State Department of Taxation and Finance

DTF-803

Claim for Sales and Use Tax Exemption - Title/Registration

Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

(9/11)

Use this form for transactions processed by the Department of Motor Vehicles (DMV) and its agents or county clerk offices only.

•

• Misuse of this exemption claim may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due.

Note: If you are:

• claiming an exemption for a gift, use Form DTF-802, Statement of Transaction – Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV),

Vessel (Boat), or Snowmobile

• claiming credit for taxes paid to another state, use Form DTF-804, Statement of Transaction – Claim for Credit of Sales Tax Paid to Another State

• registering or claiming an exemption for more than one motor vehicle, use Form DTF-805, Schedule of Multiple Transactions – Casual Sale of

Motor Vehicle

Print or type clearly

Section 1 — Vehicle information

Type of vehicle

(mark one box)

Motor Vehicle

Trailer

Boat

)

ft.

ATV

Snowmobile

(length in feet

:

Year

Make

Model

Identification number

Date of purchase

Purchase price

(include cash, the value of any goods or services you gave in trade,

........................................................................................ $

and any balance of seller’s payments you may have assumed)

Section 2 — New owner/lessee information

Last name, first name, middle initial or business name

Social security number/TIN/EIN

Number and street address

City, state, and ZIP code

County

Section 3 — Previous owner/dealer information

Last name, first name, middle initial or business name

Number and street address

City, state, and ZIP code

County

Section 4 — Exemption you are claiming

To claim a sales and use tax exemption on the vehicle listed in Section 1 – Vehicle information, mark an X in the appropriate box below and

supply any additional information requested. You must sign Section 5 – Certification, and present this completed form (including any

additional required information) to the motor vehicle issuing office when registering the vehicle.

1

Nonresident of New York State (NYS) (purchases of motor vehicles, trailers, or boats only) — At the time of purchase the

purchaser was not a resident of NYS, did not have a place of abode in NYS, and was not engaged in any trade business,

employment, or profession in NYS. See Publication 750, A Guide to Sales Tax in New York State, for more information on what is

considered a place of abode.

(Mark an X in one of the boxes below; go to line 3 and enter required additional information.)

Motor vehicle, trailer, or boat was not purchased in NYS.

If marked, enter location where vehicle was purchased:

Motor vehicle, trailer, or boat was purchased in NYS, but previously registered by the purchaser in another state prior to

registering it in NYS.

If marked, enter the state where the vehicle was previously registered:

2

Nonresident of NYS (purchase of ATVs or snowmobiles only) — The ATV or snowmobile was purchased and delivered to the

purchaser outside of NYS. At the time of purchase the purchaser was not a resident of NYS, did not have a place of abode in NYS,

and was not engaged in any trade, business, employment, or profession in NYS.

(Go to line 3 and enter required additional information.)

3

Required additional information

(You must provide the information requested below if you marked a box in either line 1 or 2 above.)

• Were you ever a resident of NYS? ....................................................................................................................

Yes

No

If Yes, enter dates of residency:

from

to

• At the time of purchase, were you absent from NYS for education, employment, or military service? ...........

Yes

No

• While a resident of another state, did you own/rent living quarters in NYS? ...................................................

Yes

No

• Date the purchased vehicle, trailer, or boat was first used in NYS:

4

Exempt organization — The purchaser is an organization exempt from tax as provided in Tax Law Article 28, section 1116(a).

(Attach copy of Form ST-119, Exempt Organization Certificate. Local, state, and federal governments are not required to attach Form ST-119.)

Complete and sign the back.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2