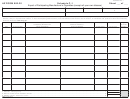

Schedule E - Part II, Subpart A

Roll-Your-Own Tobacco

Purchased, Acquired, or Shipped Into Connecticut During the Month

Distributor’s name _________________________________________________________________ Connecticut Tax Registration Number _____________________________________

Distributor’s address ______________________________________________________________ Month of ______________________________________________________________

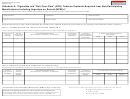

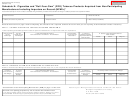

Part II—Roll-Your-Own Tobacco Products Not Purchased Directly From a Participating Manufacturer

Subpart A—Roll-Your-Own Tobacco Manufactured by a Participating Manufacturer but Not Purchased Directly From the Participating Manufacturer

Report in Subpart A the total weight of roll-your-own tobacco you purchased (or had shipped to you in Connecticut) during the month and that was manufactured by a participating manufacturer, but that

was not purchased directly from the participating manufacturer; the name, address, and FEIN of the person from whom you purchased the roll-your-own tobacco (Supplier); and the brand families of the

roll-your-own tobacco. Also report in Subpart A the name, address, and FEIN of the participating manufacturer. Complete all columns. Attach additional sheets if necessary. Because you may only lawfully

purchase and sell roll-your-own tobacco in brand families listed in the Connecticut Tobacco Directory, check the most recent update of the Connecticut Tobacco Directory and any email notifications from

DRS before purchasing and selling any roll-your-own tobacco. See Informational Publication 2006(31), Licensed Tobacco Products Distributor’s Guide to Connecticut Tobacco Products Tax Laws and

Other Tobacco Products-Related Laws, for more information. Complete all columns. Attach additional sheets if necessary.

Participating manufacturer’s

Roll-your-own tobacco

Supplier’s name, address, and FEIN

Net weight of each

Total weight

Quantity

name, address, and FEIN

brand family

Line 1. Subtotal for this page ........................................................................................................................................................................................

1

Line 2. Total from attached Schedule E - Part II, Subpart A, Additional Sheet(s). Number of additional sheet(s) __________________. ..................

2

Line 3. Total weight of roll-your-own tobacco: Add Line 1 and Line 2. Enter total on Part I, Line 4. .............................................................................

3

Schedule E - Part II, Subpart A (Rev. 10/08 )

Page 3 of 6

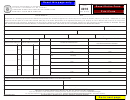

1

1 2

2 3

3 4

4 5

5 6

6