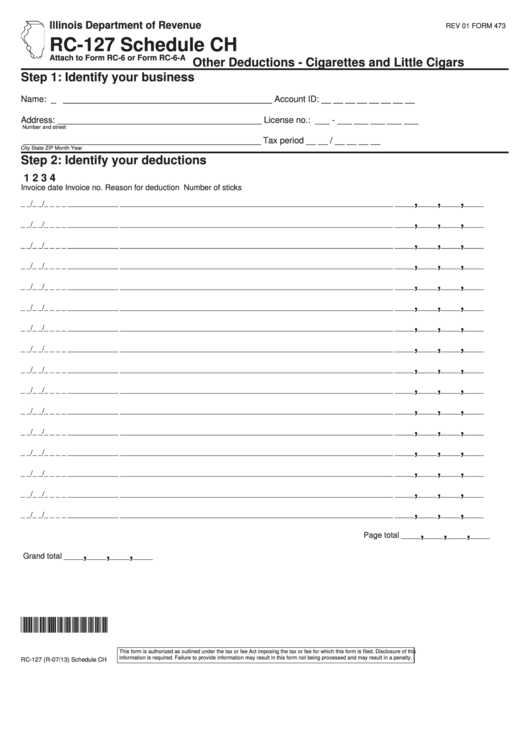

Illinois Department of Revenue

REV 01 FORM 473

RC-127

Schedule CH

Attach to Form RC-6 or Form RC-6-A

Other Deductions - Cigarettes and Little Cigars

Step 1: Identify your business

Name: _ _ ___________________________________________ Account ID: __ __ __ __ __ __ __ __

Address: _ __________________________________________ License no.: ___ - ___ ___ ___ ___ ___

Number and street

_ _________________________________________________ Tax period __ __ / __ __ __ __

City

State

ZIP

Month

Year

Step 2: Identify your deductions

1

2

3

4

Invoice date

Invoice no.

Reason for deduction

Number of sticks

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

_____________

______________________________________________________________________

_____

_____

_____

_____

,

,

,

Page total

_____

_____

_____

_____

,

,

,

Grand total

_____

_____

_____

_____

*347311110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

RC-127 (R-07/13) Schedule CH

1

1