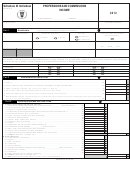

Schedule Nr - Nonresident Computation Of Fiduciary Income - 2012 Page 2

ADVERTISEMENT

27

27

Write the amount from Column C, Line 26.

00

Step 4: Figure your Illinois additions and subtractions

A

B

Form IL-1041

In Column A, write the total amounts from your Form IL-1041, Column B.

Fiduciary Share

Illinois Portion

You must read the instructions for Column B to properly complete this step.

28

28a

28b

Federal net operating loss deduction (Form IL-1041, Line 2)

00

00

29

29a

29b

ESBT taxable income (Form IL-1041, Line 3)

00

00

30

30a

30b

Exemption claimed on U.S. Form 1041, Line 20 (Form IL-1041, Line 4)

00

00

31

31a

31b

Illinois income and replacement tax deducted (Form IL-1041, Line 5b)

00

00

32

32a

32b

State, municipal, and other interest income (Form IL-1041, Line 6b)

00

00

33

33a

33b

Illinois Special Depreciation addition (Form IL-1041, Line 7b)

00

00

34

34a

34b

Related-Party Expenses additions (Form IL-1041, Line 8b)

00

00

35

35a

35b

Distributive share of additions (Form IL-1041, Line 9b)

00

00

36

36a

36b

Other additions (Form IL-1041, Line 10b)

00

00

37

37

Add Column B, Lines 27 through 36. This is the Illinois portion of your total income.

00

38

38a

38b

August 1, 1969 valuation limitation amount (Form IL-1041, Line 13b)

00

00

39

39a

39b

Payments from certain retirement plans (Form IL-1041, Line 14b)

00

00

40

Interest income from U.S. Treasury and other exempt

40a

40b

federal obligations (Form IL-1041, Line 15b)

00

00

41

41a

41b

Retirement payments to retired partners (Form IL-1041, Line 16b)

00

00

42

Enterprise Zone or River Edge Redevelopment Zone

42a

42b

Dividend subtraction (Form IL-1041, Line 17b)

00

00

43

43a

43b

High Impact Business Dividend subtraction (Form IL-1041, Line 18b)

00

00

44

44a

44b

00

00

Contributions to certain job training projects (Form IL-1041, Line 19b)

45

45a

45b

Illinois Special Depreciation subtraction (Form IL-1041, Line 20b)

00

00

46

46a

46b

Related-Party Expenses subtraction (Form IL-1041, Line 21b)

00

00

47

47a

47b

Distributive share of subtractions (Form IL-1041, Line 22b)

00

00

48

48a

48b

ESBT loss amount (Form IL-1041, Line 23b)

00

00

49

49a

49b

Other subtractions (Form IL-1041, Line 24b)

00

00

50

50

Add Column B, Lines 38 through 49. This is the total of your Illinois subtractions.

00

Step 5: Figure your standard exemption

51

Illinois base income or net loss. Subtract Line 50 from Line 37.

51

Write this amount on your Form IL-1041, Line 27.

00

If Line 51 is zero or a negative number, skip Lines 52 and 53, and write “0” on Line 54.

52

52

Write the base income from Form IL-1041, Line 26.

00

If Line 52 is zero, or a negative number, skip Line 53 and write $1,000 on Line 54.

53

53

Divide Line 51 by Line 52. This figure cannot be greater than “1.”

54

Standard exemption. Multiply Line 53 by $1,000. Short-year filers, see instructions.

54

Write this amount on your Form IL-1041, Line 31.

00

Step 6: Figure your business income apportionment factor

1

1

Total sales everywhere. This amount cannot be negative.

00

2

2

Total sales inside Illinois. This amount cannot be negative.

00

3

3

Divide Line 2 by Line 1. (Carry to six decimal places.) This is your apportionment factor.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

IL-1041Schedule NR back (R-12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2